Advance Auto Parts 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

thegrant-datefairvalueoftheaward(withlimitedexcep-

tions).Thatcostwillberecognizedovertheperiodduring

which an employee is required to provide service in

exchange for the award (usually the vesting period). The

grant-datefairvalueofemployeeshareoptionsandsimilar

instrumentswillbeestimatedusingoption-pricingmodels.

Ifanequityawardismodifiedafterthegrantdate,incre-

mentalcompensationcostwillberecognizedinanamount

equaltotheexcessofthefairvalueofthemodifiedaward

overthefairvalueoftheoriginalawardimmediatelybefore

themodification.

TheCompanyisrequiredtoapplySFASNo.123Rtoall

awardsgranted,modifiedorsettledasofthebeginningof

the first interim or annual reporting period that begins

after June 15, 2005. The statement also requires the

Company to use either the modified-prospective method

or modified-retrospective method. Under the modified-

prospective method, the Company must recognize com-

pensation cost for all awards subsequent to adopting the

standardandfortheunvestedportionofpreviouslygranted

awards outstanding upon adoption. Under the modified-

retrospectivemethod,theCompanymustrestateitsprevi-

ouslyissuedfinancialstatementstorecognizetheamounts

itpreviouslycalculatedandreportedonaproformabasis,

as if the prior standard had been adopted. Under both

methods, the statement permits the use of either the

straight-lineoranacceleratedmethodtoamortizethecost

as an expense for awards with graded vesting. The stan-

dardpermitsandencouragesearlyadoption.

TheCompanyhascommenceditsanalysisoftheimpact

of SFAS No. 123R, but has not yet decided: (1) whether

to elect early adoption, (2) the early adoption date, if

elected,(3)theuseofthemodified-prospectiveormodified-

retrospectivemethod,and(4)theelectiontouse straight-

lineoranacceleratedmethod.Accordingly,theCompany

hasnotdeterminedtheimpact thatthe adoptionofSFAS

No.123Rwillhaveonthefinancialpositionorresultsof

operations.

Reclassifications

Certain items in the fiscal 2003 financial statements

have been reclassified to conform with the fiscal 2004

presentation.

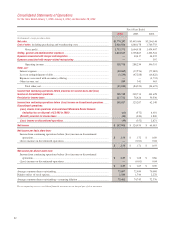

3.DiscontinuedOperations

On December 19, 2003, the Company discontinued

the supply of merchandise to its Wholesale Distribution

Network, or Wholesale. Wholesale consisted of indepen-

dentlyownedandoperateddealerlocations,forwhichthe

Company supplied merchandise inventory. This compo-

nentoftheCompany’sbusinessoperatedintheCompany’s

previouslyreportedwholesalesegment.TheCompanyhas

accountedforthediscontinuanceofthewholesalesegment

in accordance with SFAS No. 144, “Accounting for the

Impairment or Disposal of Long-Lived Assets.” The

Companyhasclassifiedtheseoperatingresultsasdiscon-

tinuedoperationsintheaccompanyingconsolidatedstate-

mentsofoperations forthefiscal yearsendedJanuary3,

2004andDecember28,2002.Forthefiscalyearsended

January 3,2004 andDecember28, 2002, Wholesalehad

revenuesof$52,486and$83,743,respectively.AtJanuary3,

2004,Wholesaleassetswerenotsignificanttotheaccom-

panying consolidated balance sheets. For the fiscal year

endedJanuary1,2005,theoperatingresultsrelatedtothe

discontinuedwholesalebusinesswereminimalasaresult

ofrecognizinganestimateofexitcostsinfiscal2003.

Thediscontinuedwholesalesegment,excludingcertain

allocatedandteammemberbenefitexpenses,represented

theentireresultsofoperationspreviouslyreportedinthat

segment.Theseexcludedexpensesrepresented$2,361and

$3,272 of allocated and team member benefit expenses

forfiscal2003and2002,respectively,thatremainacom-

ponent of income from continuing operations and have

thereforebeenexcludedfromdiscontinuedoperations.The

Company has allocated corporate interest expenses

incurred under the Company’s senior credit facility and

subordinated notes. The allocated interest complies with

the provisions of EITF 87-24, “Allocation of Interest to

DiscontinuedOperations,”andisreportedindiscontinued

operationsontheaccompanyingstatementsofoperations.

Theseamountswere$484and$1,126forfiscal2003and

2002,respectively.Thelossonthediscontinuedoperations

ofWholesaleforfiscal2003included$2,693ofexitcosts

asfollows:

Severancecosts......................................................................... $1,183

Warrantyallowances................................................................ 1,656

Other......................................................................................... (146)

Totalexitcosts.......................................................................... $2,693

NotestoConsolidatedFinancialStatements(continued)

FortheYearsEndedJanuary1,2005,January3,2004,andDecember28,2002(inthousands,exceptpersharedata)