Advance Auto Parts 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

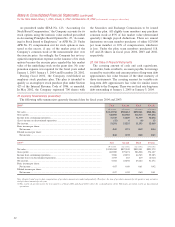

NotestoConsolidatedFinancialStatements(continued)

FortheYearsEndedJanuary1,2005,January3,2004,andDecember28,2002(inthousands,exceptpersharedata)

Other financial information related to the Plan was

determinedbytheCompany’sindependentactuaries.The

measurementdateusedbytheactuarieswasOctober31of

eachfiscalyear.Thefollowingprovidesareconciliationof

theaccruedbenefitobligationincludedinotherlong-term

liabilities in the accompanying consolidated balance

sheets, recorded and the funded status of the Plan as of

January1,2005andJanuary3,2004:

2004 2003

Changeinbenefitobligation:

Benefitobligationatbeginning

oftheyear.............................................. $22,750 $23,002

Servicecost................................................ 25

Interestcost................................................ 1,004 1,485

Benefitspaid.............................................. (1,239) (3,336)

Planamendment........................................ (7,557) —

Actuarial(gain)loss.................................. (335) 1,594

Benefitobligationatendoftheyear......... 14,625 22,750

Changeinplanassets:

Fairvalueofplanassetsatbeginning

oftheyear.............................................. ——

Employercontributions............................. 1,239 3,336

Participantcontributions........................... 2,485 1,779

Benefitspaid.............................................. (3,724) (5,115)

Fairvalueofplanassetsatendofyear.... ——

Reconciliationoffundedstatus:

Fundedstatus............................................. (14,625) (22,750)

Unrecognizedtransitionobligation.......... —9

Unrecognizedpriorservicecost............... (7,112) —

Unrecognizedactuarialloss...................... 4,371 5,362

Accruedpostretirementbenefitcost............. $(17,366) $(17,379)

Netperiodicpostretirementbenefitcostisasfollows:

2004 2003 2002

Servicecost.......................................... $ 2 $ 5 $ 473

Interestcost.......................................... 1,004 1,485 1,239

Amortizationofthetransition

obligation......................................... —1 58

Amortizationoftheprior

servicecost...................................... (436) — —

Amortizationofrecognized

netlosses(gains)............................. 250 146 (89)

$ 820 $1,637 $1,681

The health care cost trend rate was assumed to be

14.0% for 2005, 12.5% for 2006, 11.5% for 2007, 10.0%

for2008,9.5%for2009,8.5%for2010and5.0%to8.0%

for 2011 and thereafter. If the health care cost were

increased1%forallfutureyearstheaccumulatedpost-

retirement benefit obligation would have increased by

$1,247asofJanuary1,2005.Theeffectofthischangeon

thecombinedserviceandinterestcostwouldhavebeenan

increase of $102 for 2004. If the health care cost were

decreased 1% for all future years the accumulated post-

retirement benefit obligation would have decreased by

$1,318asofJanuary1,2005.Theeffectofthischangeon

thecombinedserviceandinterestcostwouldhavebeena

decreaseof$121for2004.

The postretirement benefit obligation and net periodic

postretirement benefit cost were computed using the fol-

lowingweighted-averagediscountratesas determined by

theCompany’sactuariesforeachapplicableyear:

2004 2003

Weighted-averagediscountrate.............................. 5.75% 6.25%

TheCompanyexpectsplancontributionstocompletely

offset benefits paid. The following table summarizes the

Company’sexpectedbenefitpayments(netofretireecon-

tributions)tobepaidforeachofthefollowingfiscalyears:

Amount

2005........................................................................................... $1,340

2006........................................................................................... 1,050

2007........................................................................................... 1,145

2008........................................................................................... 1,160

2009........................................................................................... 1,191

2010–2014................................................................................. 5,101

TheCompanyreservestherighttochangeorterminate

the benefits or contributions at any time. The Company

alsocontinuestoevaluatewaysinwhichitcanbetterman-

age these benefits and control costs. Any changes in the

Planorrevisionstoassumptionsthataffecttheamountof

expectedfuturebenefitsmayhaveasignificantimpacton

theamountofthereportedobligation,annualexpenseand

projectedbenefitpayments.

19.EquityCompensation

During fiscal 2004, the Company established the

AdvanceAutoParts,Inc.2004Long-TermIncentivePlan,

or the LTIP, which was approved at its 2004 Annual

MeetingofStockholders.TheLTIPwascreatedtoenable

theCompanytocontinuetoattractandretainteammem-

bersofexceptionalmanagerialtalentuponwhom,inlarge

measure, its sustained progress, growth and profitability

depends.TheLTIPreplacestheCompany’sprevioussenior

executive stock option plan and executive stock option

plan.Thestockoptionsthatremainedavailableforfuture

grant under these predecessor plans became available

undertheLTIPandthusnostockoptionswillbeavailable

forgrantunderthoseplans.Thestockoptionsauthorized

tobegrantedarenon-qualifiedstockoptionsandterminate

ontheseventhanniversaryofthegrantdate.Additionally,