Advance Auto Parts 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AdvanceAutoParts,Inc.andSubsidiaries

35

if any, of the market price of the Company’s common

stock at the measurement date over the exercise price.

Accordingly,theCompanyhasnotrecognizedcompensa-

tionexpenseon the issuance of its fixedoptions because

the exercise price equaled the fair market value of the

underlying stock on the grant date. In addition, the

Companyhasnotrecognizedcompensationexpenseforits

employeestockpurchaseplan since itisintendedto be a

plan that qualifies under Section 423 of the Internal

Revenue Code of 1986, as amended. The issuance of

deferred stock units results in compensation expense as

discussedintheEquityCompensationfootnote(Note19).

As required by SFAS No. 148, “Accounting for Stock-

Based Compensation—Transition and Disclosure an

amendment of FASB Statement No. 123,” the following

table reflects the impact on net income and earnings per

share as if the Company had adopted the fair method of

recognizingstock-basedcompensationcostsasprescribed

bySFASNo.123.

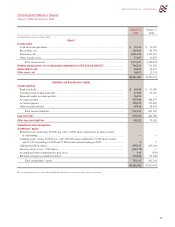

2004 2003 2002

Netincome,asreported.......... $187,988 $124,935 $65,019

Add:Totalstock-based

employeecompensation

expenseincludedin

reportednetincome,netof

relatedtaxeffects................ 304 — —

Deduct:Totalstock-based

employeecompensation

expensedeterminedunder

fairvaluebasedmethodfor

allawards,netofrelated

taxeffects............................ (5,977) (4,636) (1,894)

Proformanetincome.............. $182,315 $120,299 $63,125

Netincomepershare:

Basic,asreported................ $ 2.54 $ 1.71 $ 0.93

Basic,proforma.................. 2.47 1.65 0.90

Diluted,asreported............. 2.49 1.67 0.90

Diluted,proforma............... 2.41 1.61 0.87

Thefairvalueofeachstockoptionwasestimatedonthe

date of the grant using the Black-Scholes option-pricing

modelwiththefollowingweighted-averageassumptions:

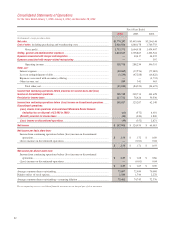

2004 2003 2002

Risk-freeinterestrate......................... 3.3% 3.1% 4.4%

Expecteddividendyield..................... —— —

Expectedstockpricevolatility.......... 34.3% 41.0% 17.0%

Expectedlifeofstockoptions............ 4years 4years 4years

Theweighted-averagefairvalueofstockoptionsgranted

duringfiscal2004,2003and2002usedincomputingpro

formacompensationexpensewas$12.42,$7.61and$8.20

pershare,respectively.

FinancedVendorAccountsPayable

During the first quarter on fiscal 2004, the Company

enteredashort-termfinancingprogramwithabankallow-

ingittoextenditspaymenttermsoncertainmerchandise

purchases. Under this program, the Company issues

negotiable instruments to vendors in lieu of a cash pay-

ment.Thevendorpresentstheinstrumenttothebankfor

payment at an agreed upon discount rate. The Company

recordsthisdiscountgivenbythevendortothevalueofits

inventoryuponthe Company’sissuanceofthenegotiable

instrumentandaccretesthisdiscounttotheresultingshort-

termpayabletothebankthroughinterestexpenseoverthe

extended term. At January 1, 2005, $56,896 was payable

to the bank by the Company under this program and is

included in the accompanying condensed consolidated

balancesheetsasFinancedVendorAccountsPayable.

LeaseAccounting

TheCompanyleasescertainstorelocations,distribution

centers, office space, equipment and vehicles, some of

which are with related parties. Initial terms for facility

leasesaretypically10to15years,followedbyadditional

terms containing renewal options at 5-year intervals, and

may include rent escalation clauses. The total amount of

theminimumrentisexpensedonastraight-linebasisover

theinitialtermoftheleaseunlessexternaleconomicfac-

tors exist such that renewals are reasonably assured, in

whichcasetheCompanywouldincludetherenewalperiod

in its amortizationperiod.Inthoseinstances therenewal

periodwouldbeincludedintheleasetermforpurposesof

establishing an amortization period and determining if

suchleasequalifiedasacapitaloroperatinglease.Inaddi-

tion to minimum fixed rentals, some leases provide for

contingent facility rentals. Contingent facility rentals are

determinedonthebasisofapercentageofsalesinexcess

of stipulated minimums for certain store facilities as

defined in the individual lease agreements. Most of the

leases providethattheCompany paytaxes,maintenance,

insurance and certain other expenses applicable to the

leasedpremisesandincludeoptionstorenew.Management

expectsthat,inthenormalcourseofbusiness,leasesthat

expirewillberenewedorreplacedbyotherleases.