Advance Auto Parts 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AdvanceAutoParts,Inc.andSubsidiaries

27

In November 2004, the FASB issued SFAS No. 151,

“InventoryCosts.”ThenewstatementamendsAccounting

ResearchBulletinNo.43,Chapter4,“InventoryPricing,”

to clarify the accounting for abnormal amounts of idle

facilityexpense,freight,handlingcostsandwastedmate-

rial.Thisstatementrequiresthatthoseitemsberecognized

as current-period charges and requires that allocation of

fixed production overheads to the cost of conversion be

based onthe normalcapacity oftheproductionfacilities.

Thisstatementiseffectiveforfiscalyearsbeginningafter

June15,2005.Wedonotexpecttheadoptionofthisstate-

menttohaveamaterialimpactonourfinancialcondition

orresultsofoperations.

In December 2004, the FASB issued SFAS No. 123

(revised2004),“Share-BasedPayment,”orSFASNo.123R.

SFAS No. 123R replaces SFASNo.123, “Accountingfor

Stock-BasedCompensation”andsupersedesAPBOpinion

No.25,“AccountingforStockIssuedtoEmployees,”and

subsequently issued stock option related guidance. This

statement establishes standards for the accounting for

transactionsinwhichanentityexchangesitsequityinstru-

ments for goods or services, primarily on accounting for

transactionsinwhichanentityobtainsemployeeservices

in share-based payment transactions. It also addresses

transactionsinwhichanentityincursliabilitiesinexchange

forgoodsorservicesthatarebasedonthefairvalueofthe

entity’s equity instruments or that may be settled by the

issuance of those equity instruments. Entities will be

requiredtomeasurethecostofemployeeservicesreceived

in exchangeforanawardofequity instruments basedon

thegrant-datefairvalueoftheaward(withlimitedexcep-

tions).Thatcostwillberecognizedovertheperiodduring

which an employee is required to provide service in

exchange for the award (usually the vesting period). The

grant-datefairvalueofemployeeshareoptionsandsimilar

instrumentswillbeestimatedusingoption-pricingmodels.

Ifanequityawardismodifiedafterthegrantdate,incre-

mentalcompensationcostwillberecognizedinanamount

equaltotheexcessofthefairvalueofthemodifiedaward

overthefairvalueoftheoriginalawardimmediatelybefore

themodification.

WearerequiredtoapplySFASNo.123Rtoallawards

granted,modifiedorsettledasofthebeginningofthefirst

interimorannualreportingperiodthatbeginsafterJune15,

2005. We are also required to use either the modified-

prospective method or modified-retrospective method.

Under the modified-prospective method, we must recog-

nizecompensationcostforallawardssubsequenttoadopt-

ingthestandardandfortheunvestedportionofpreviously

granted awards outstanding upon adoption. Under the

modified-retrospectivemethod,wemustrestateourprevi-

ouslyissuedfinancialstatementstorecognizetheamounts

wepreviouslycalculatedandreportedonaproformabasis,

as if the prior standard had been adopted. Under both

methods,wearepermittedtouseeitherthestraightlineor

anacceleratedmethodtoamortizethecostasanexpense

forawardswithgradedvesting.Thestandardpermitsand

encouragesearlyadoption.

WehavecommencedouranalysisoftheimpactofSFAS

No. 123R,buthave not yetdecided:(1) whether weelect

to early adopt, (2) if we elect to early adopt, what date

we would do so, (3) whether we will use the modified-

prospective or modified-retrospective method, and (4)

whetherwewillelecttousestraight-lineoranaccelerated

method.Accordingly,we havenotdeterminedtheimpact

thattheadoptionofSFASNo.123Rwillhaveonourfinan-

cialpositionorresultsofoperations.

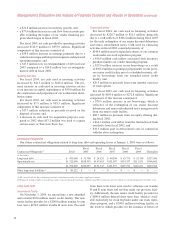

QuantitativeandQualitativeDisclosuresAboutMarketRisks

We are exposed to cash f low risk due to changes in

interestrateswithrespecttoourlong-termdebt.Ourlong-

termdebtcurrentlyconsistsofborrowingsunderasenior

creditfacilityandisprimarilyvulnerabletomovementsin

theLIBORrate.Whilewecannotpredicttheimpactinter-

estratemovementswillhaveonourdebt,exposuretorate

changesismanagedthroughtheuseofhedgingactivities.

Ourfutureexposure tointerestrateriskincreasedduring

2004duetotheexpirationofour$150.0millionzero-cost

collarduringNovember2004.

In March2003,weenteredinto twointerestrateswap

agreements on an aggregate of $125 million of our debt

underourcreditfacility.Thefirstswapallowsustofixour

LIBOR rate at 2.269% on $75.0 million of variable rate

debtforatermof36months,expiringinthefirstquarter

of fiscal 2006. The second swap allows us to fix our

LIBOR rate at 1.79% on $50.0 million of variable rate

debtforatermof24months,expiringinthefirstquarter

offiscal2005.

SubsequenttoJanuary1,2005andinanefforttoman-

ageourfutureinterestraterisk,weenteredintothefollow-

ingthreenewinterestrateswapagreementsonanaggregate

of$175millionofdebtunderourseniorcreditfacility.The

detailfortheindividualswapsisasfollows:

• Thefirst swap, beginninginMarch 2005,allows us to

fixourtotalinterestrateat4.153%on$50millionofour

debtforatermof48months;

• Thesecondswap,beginninginMarch2005,allowsusto

fixourtotalinterestrateat4.255%on$75millionofour

debtforatermof60months;and

• Thethirdswap,beginninginMarch2006,allowsusto

fixourtotal interestrateat4.6125%on$50millionof

ourdebtforatermof54months.