Advance Auto Parts 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AdvanceAutoParts,Inc.andSubsidiaries

45

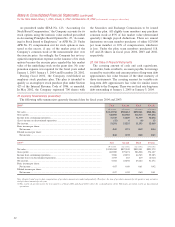

income tax reporting purposes. Net deferred income tax

balancesarecomprisedofthefollowing:

January1,

2005

January3,

2004

Deferredincometaxassets....................... $ 40,009 $ 38,441

Valuationallowance.................................. (1,029) (793)

Deferredincometaxliabilities................. (108,277) (100,989)

Netdeferredincometaxliabilities........... $ (69,297) $ (63,341)

AtJanuary1,2005andJanuary3,2004,theCompany

has cumulative net deferred income tax liabilities of

$69,297 and $63,341, respectively. The gross deferred

income tax assets also include state net operating loss

carryforwards,orNOLs,andstatetaxcreditcarryforwards

of approximately $3,720 and $6,695, respectively. These

NOLs and state tax credit carryforwards may be used to

reduce future taxable income and expire periodically

through fiscal year 2024. The Company believes it will

realize these tax benefits through a combination of the

reversaloftemporarydifferences,projectedfuturetaxable

income during the NOL carryforward periods and avail-

abletaxplanningstrategies.Duetouncertaintiesrelatedto

the realizationofcertain deferredtaxassetsforNOLsin

various jurisdictions, the Company recorded a valuation

allowanceof$1,029asofJanuary1,2005and$793asof

January3,2004.Theamountofdeferredincometaxassets

realizable,however,couldchangeinthenearfutureifesti-

matesoffuturetaxableincomearechanged.

Temporary differences which give rise to significant

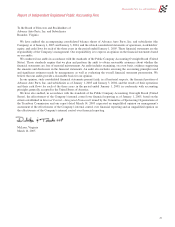

deferredincometaxassets(liabilities)areasfollows:

January1,

2005

January3,

2004

Currentdeferredincometaxliabilities

Inventorydifferences............................ $(57,127) $(51,604)

Accruedmedicalandworkers’

compensation..................................... 13,701 6,755

Accruedexpensesnotcurrently

deductiblefortax............................... 15,194 17,466

Netoperatinglosscarryforwards......... 2,152 3,567

Taxcreditcarryforwards....................... 419 —

Totalcurrentdeferredincome

taxliabilities...................................... $(25,661) $(23,816)

Long-termdeferredincometaxliabilities

Propertyandequipment........................ (52,605) (47,318)

Postretirementbenefitobligation.......... 6,975 6,931

Netoperatinglosscarryforwards......... 1,568 3,128

Taxcreditcarryforwards....................... —594

Valuationallowance.............................. (1,029) (793)

Other,net............................................... 1,455 (2,067)

Totallong-termdeferredincome

taxliabilities...................................... $(43,636) $(39,525)

These amounts are recorded in other current assets,

other current liabilities, other assets and other long-term

liabilities in the accompanying consolidated balance

sheets,asappropriate.

TheCompanycurrentlyhascertainyearsthatareopen

toauditbythe InternalRevenueService.In addition,the

Companyhascertainyearsthatareopenforauditbyvari-

ous state and foreign jurisdictions for income taxes and

sales,useandexcisetaxes.Inmanagement’sopinion,any

amounts assessed will not have a material effect on the

Company’sfinancialpositionorresultsofoperations.

15.LeaseCommitments

TheCompanyleasescertainstorelocations,distribution

centers, office space, equipment and vehicles, some of

which are with related parties. Initial terms for facility

leasesaretypically10to15years,followedbyadditional

terms containing renewal options at 5-year intervals, and

may include rent escalation clauses. The total amount of

theminimumrentisexpensedonastraight-linebasisover

theinitialtermoftheleaseunlessexternaleconomicfac-

tors exist such that renewals are reasonably assured, in

whichcasetheCompanywouldincludetherenewalperiod

in its amortization period. In addition to minimum fixed

rentals,someleasesprovideforcontingentfacilityrentals.

Contingentfacilityrentalsaredeterminedonthebasisofa

percentage of sales in excess of stipulated minimums for

certain store facilities as defined in the individual lease

agreements.MostoftheleasesprovidethattheCompany

pays taxes, maintenance, insurance and certain other

expenses applicable to the leased premises and include

optionstorenew.Managementexpectsthat,inthenormal

course of business, leases that expire will be renewed or

replacedbyotherleases.

AtJanuary1,2005,futureminimumleasepaymentsdue

under non-cancelable operating leases with lease terms

rangingfromoneyearthroughtheyear2024areasfollows:

Other(a)

Related

Parties(a) Total

2005........................................ $ 185,576 $ 2,779 $ 188,355

2006........................................ 165,274 2,344 167,618

2007........................................ 150,037 2,020 152,057

2008........................................ 132,420 1,937 134,357

2009........................................ 111,898 1,653 113,551

Thereafter............................... 562,348 3,714 566,062

$1,307,553 $14,447 $1,322,000

(a) TheOtherandRelatedPartiescolumnsincludestoresclosedasaresultofthe

Company’srestructuringplans.