Advance Auto Parts 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

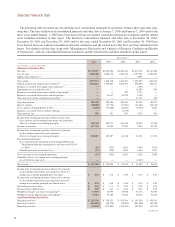

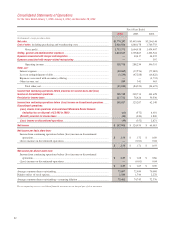

ResultsofOperations

Thefollowingtablesetsforthcertainofouroperatingdataexpressedasapercentageofnetsalesfortheperiodsindicated.

FiscalYearEnded

January1,

2005

January3,

2004

December28,

2002

Netsales....................................................................................................................................................... 100.0% 100.0% 100.0%

Costofsales................................................................................................................................................. 53.5 54.1 55.2

Grossprofit.............................................................................................................................................. 46.5 45.9 44.8

Selling,generalandadministrativeexpenses............................................................................................ 37.8 37.3 37.6

Expensesassociatedwithmergerandintegration..................................................................................... —0.3 1.1

Expensesassociatedwithmergerrelatedrestructuring............................................................................. —— 0.0

Operatingincome.................................................................................................................................... 8.7 8.3 6.1

Interestexpense........................................................................................................................................... (0.5) (1.1) (2.4)

Lossonextinguishmentofdebt.................................................................................................................. (0.1) (1.4) (0.5)

Expensesassociatedwithsecondaryoffering............................................................................................ —— (0.1)

Otherincome,net........................................................................................................................................ 0.0 0.0 0.0

Incometaxexpense..................................................................................................................................... 3.1 2.2 1.2

Incomefromcontinuingoperationsbeforediscontinuedoperations.................................................... 5.0 3.6 1.9

Discontinuedoperations:

(Loss)incomefromoperationsofdiscontinuedwholesaledistributionnetwork................................. (0.0) (0.0) 0.1

(Benefit)provisionforincometaxes...................................................................................................... (0.0) (0.0) 0.0

(Loss)incomeondiscontinuedoperations............................................................................................. (0.0) (0.0) 0.1

Netincome............................................................................................................................................... 5.0% 3.6% 2.0%

Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations(continued)

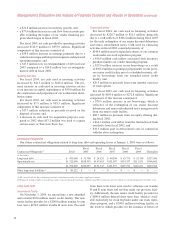

Fiscal2004ComparedtoFiscal2003

Netsalesfor2004were$3,770.3million,anincreaseof

$276.6million,or7.9%,overnetsalesfor2003.Excluding

theeffectofthe53rdweekfor2003ournetsalesincreased

$339.6million,or 9.9%,overnetsales for2003.Thenet

sales increase was due to an increase in the comparable

store sales of 6.1% and contributions from our 125 new

stores opened within the last year. The comparable store

sales increase was driven by increases in both customer

traffic and average ticket sales. Overall, we believe our

2010 store format, category management and enhanced

nationwide advertising program drove our growth in net

sales.Inaddition,webelieveourDIFMsaleshaveincreased

as a result of the continued execution of our commercial

deliveryprogramsinourexistingmarketsandourcontinued

focusonahighlevelofservicetoourDIFMcustomers.

Grossprofitfor2004was$1,753.4million,or46.5%of

netsales,ascomparedto$1,604.5million,or45.9%ofnet

sales,in2003.Theincreaseingrossprofitasapercentage

ofsalesreflectscontinuedbenefitsrealizedfromourcate-

gorymanagementinitiativesandreducedinventoryshrink-

age.In2005,weanticipateourgrossprofittocontinueto

improveasaresultofthebenefitsrealizedfromourcate-

gory management initiatives, including the expansion of

our private label brand and proprietary brands, and the

continuedexecutionofoursupplychaininitiatives.

Selling, general and administrative expenses increased

to$1,424.6million,or37.8%ofnetsales,for2004,from

$1,316.3 million, or 37.6% of net sales, for 2003. The

increaseinselling,generalandadministrativeexpensesas

apercentageofnetsalesin2004wasprimarilyaresultof

increasedexpensesassociatedwithourself-insurancepro-

grams, including the increased costs required to close

claims below our stop-loss limits and increased medical

costs for covered team members due to inflation in the

health care sector. Selling, general and administrative

expenses for 2003 included $10.4 million in merger and

integrationexpensesrelatedtotheintegrationofDiscount.

These integration expenses were related to, among other

things,overlappingadministrativefunctionsandstorecon-

version expenses. Excluding the merger and integration

expenses from 2003, selling, general and administrative

expenseswere37.3%ofnetsales.