Advance Auto Parts 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AdvanceAutoParts,Inc.andSubsidiaries

41

Depreciationoflandimprovements,buildings,furniture,

fixturesandequipment, andvehiclesisprovidedoverthe

estimatedusefullives,whichrangefrom2to40years,of

the respective assets using the straight-line method.

Amortization of building and leasehold improvements is

providedovertheshorteroftheoriginalusefullivesofthe

respectiveassetsorthetermoftheleaseusingthestraight-

linemethod.Thetermoftheleaseisgenerallytheinitial

term of the lease unless external economic factors exist

such that renewals are reasonably assured, in which case

the renewal period would be included in the lease term

for purposes of establishing an amortization period. At

January 1, 2005, construction in progress primarily con-

sistedofconstruction-relatedcostsfortheCompany’snew

Northeast distribution center. Depreciation and amortiza-

tionexpensewas$104,877,$100,737and$94,090forthe

fiscalyearsended2004,2003and2002,respectively.

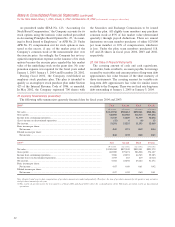

Propertyandequipmentconsistsofthefollowing:

Original

UsefulLives

January1,

2005

January3,

2004

Landandland

improvements............ 0–10years $ 187,624 $ 177,088

Buildings........................ 40years 240,447 214,919

Buildingandleasehold

improvements............ 10–40years 133,415 110,974

Furniture,fixtures

andequipment........... 3–12years 632,312 553,759

Vehicles.......................... 2–10years 32,963 36,338

Construction

inprogress................. 29,936 10,420

Other.............................. 4,335 4,231

1,261,032 1,107,729

Less:Accumulated

depreciationand

amortization............... (474,820) (395,027)

Propertyand

equipment,net........... $ 786,212 $ 712,702

TheCompanycapitalizedapproximately$4,625,$5,423

and $2,888 incurred for the development of internal use

computer software in accordance with the American

Institute of Certified Public Accountant’s Statement of

Position 98-1, “Accounting for the Cost of Computer

SoftwareDevelopedorObtainedforInternalUse”during

fiscal 2004, fiscal 2003 and fiscal 2002, respectively.

These costs are included in the furniture, fixtures and

equipment category above and are depreciated on the

straight-linemethodoverthreetosevenyears.

8.AssetsHeldforSale

The Company applies SFAS No. 144, “Accounting for

theImpairmentorDisposalofLong-LivedAssets,”which

requires that long-lived assets and certain identifiable

intangibleassetstobedisposedofbereportedatthelower

ofthe carryingamount orthe fairmarketvalue lesssel-

ling costs. At January 1, 2005 and January 3, 2004, the

Company’sassetsheldforsalewere$18,298and$20,191,

respectively, primarily consisting of closed stores as a

resultoftheDiscountintegrationandtwocloseddistribu-

tioncenters.

9.OtherAssets

AsofJanuary1,2005andJanuary3,2004,otherassets

includedeferreddebtissuancecostsof$3,297and$3,987,

respectively (net of accumulated amortization of $1,935

and$1,793,respectively),relatingtotheCompany’ssenior

credit facility. Such costs are being amortized over the

termoftherelateddebt.InNovember2004,theCompany

wrote off$1,090 in deferreddebtissuancecosts included

in other assets as a result of refinancing its senior credit

facility. In April 2003, the Company redeemed all of its

outstandingseniorsubordinatednotesandseniordiscount

debentures.Accordingly,theCompanywroteoff$9,822in

deferreddebtissuancecostincludedinotherassets.

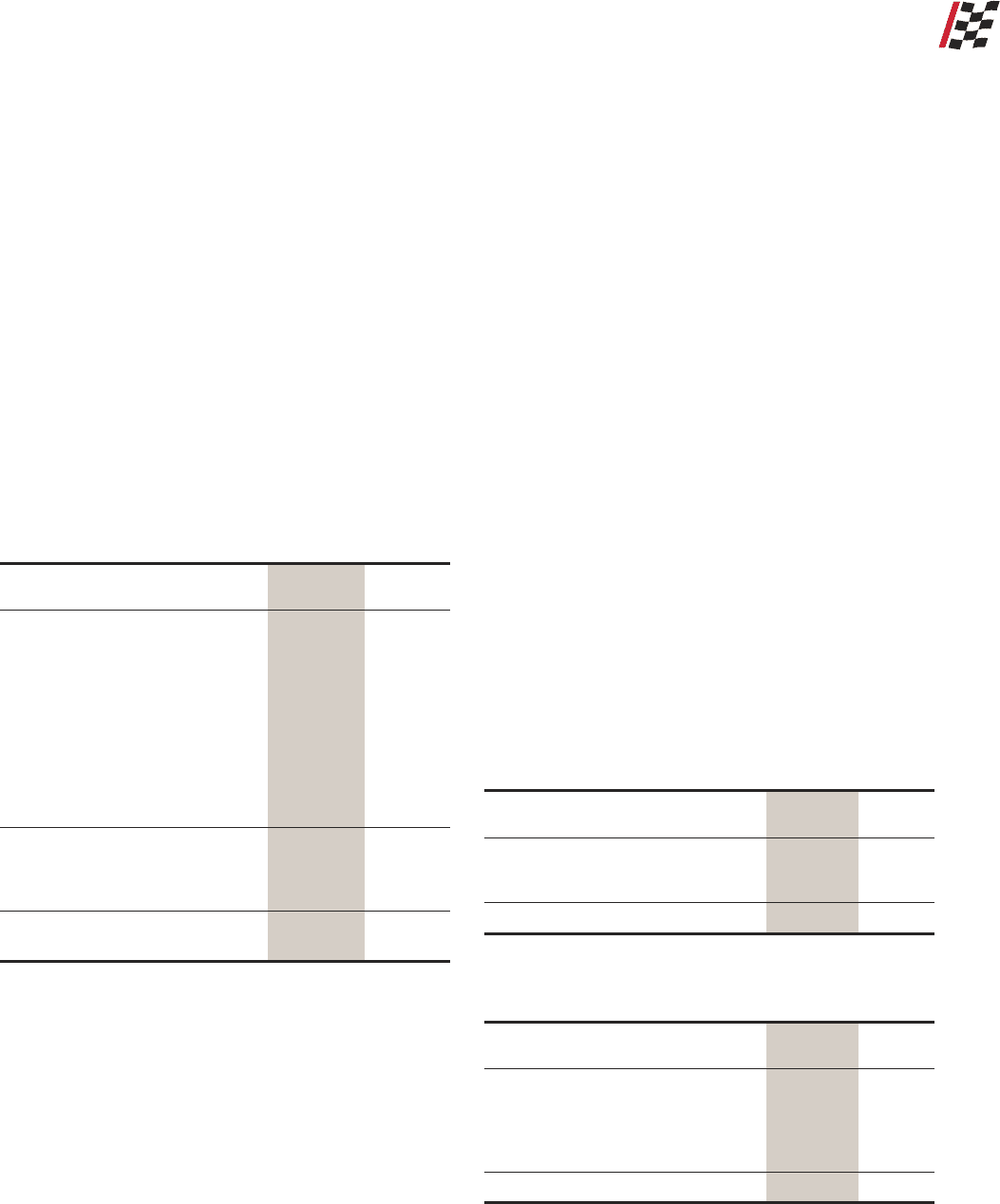

10.AccruedExpenses

Accruedexpensesconsistofthefollowing:

January1,

2005

January3,

2004

Payrollandrelatedbenefits....................... $ 81,305 $ 67,788

Warranty.................................................... 10,960 15,578

Other.......................................................... 106,214 90,452

Totalaccruedexpenses............................. $198,479 $173,818

11.OtherLong-termLiabilities

Otherlong-termliabilitiesconsistofthefollowing:

January1,

2005

January3,

2004

Employeebenefits..................................... $18,658 $19,162

Restructuringandclosed

storeliabilities....................................... 3,122 4,684

Deferredincometaxes.............................. 43,636 39,525

Other.......................................................... 14,806 11,731

Totalotherlong-termliabilities................ $80,222 $75,102