Advance Auto Parts 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

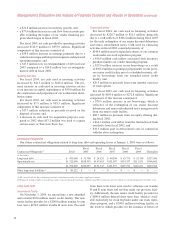

Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations(continued)

The tablebelow presents principal cashflows andrelated weighted-averageinterestratesonour long-term debtout-

standingatJanuary1,2005,byexpectedmaturitydates.Additionally,thetableincludesthenotionalamountsofourdebt

hedgedandtheimpactoftheanticipatedaveragepayandreceiveratesofourinterestrateswapsthroughtheirmaturity

dates.Expectedmaturitydatesapproximatecontractterms.Weighted-averagevariableratesarebasedonimpliedforward

ratesintheyieldcurveatJanuary1,2005,asadjustedbythelimitationsoftheswapagreement.Theimpactofourthree

interestrateswapagreementsenteredintoinMarch2005arenotreflectedinthetablebelow.Impliedforwardratesshould

notbeconsideredapredictorofactualfutureinterestrates.

Fiscal

2005

Fiscal

2006

Fiscal

2007

Fiscal

2008

Fiscal

2009 Thereafter Total

FairMarket

Liability

(dollarsinthousands)

Long-termdebt:

Variablerate............................... $31,700 $24,525 $40,200 $63,375 $52,700 $257,500 $470,000 —

Weighted-averageinterestrate... 4.7% 5.4% 5.7% 6.1% 6.4% 6.7% 5.8% —

Interestrateswap:

Variabletofixed......................... $125,000 $75,000 $ — $ — $ — $ — $125,000 $814

Averagepayrate......................... — — — — — — — —

Averagereceiverate................... 0.5% 0.3% — — — — 0.5% —

Forward-LookingStatements

Certain statements in this report are “forward-looking

statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, which are usually identified by

the use ofwordssuchas“will,”“anticipates,”“believes,”

“estimates,” “expects,” “projects,” “forecasts,” “plans,”

“intends,”“should”orsimilarexpressions.Weintendthose

forward-lookingstatementstobecoveredbythesafehar-

borprovisionsforforward-lookingstatementscontainedin

the Private Securities Litigation Reform Act of 1995 and

are included in this statement for purposes of complying

withthesesafeharborprovisions.

Theseforward-lookingstatementsreflectcurrentviews

aboutourplans,strategiesandprospects,whicharebased

on the information currently available and on current

assumptions.

Although we believe that our plans, intentions and

expectationsasreflectedinorsuggestedbythoseforward-

looking statements are reasonable, we can give no assur-

ance that the plans, intentions or expectations will be

achieved. Listed below and discussed elsewhere in this

reportaresomeimportantrisks,uncertaintiesandcontin-

gencieswhichcouldcauseouractualresults,performance

orachievementstobemateriallydifferentfromtheforward-

lookingstatementsmadeinthisreport.Theserisks,uncer-

taintiesandcontingencies include, butare not limited to,

thefollowing:

• theimplementationofourbusinessstrategiesandgoals;

• ourabilitytoexpandourbusiness;

• integrationofanyfutureacquisitions;

• adecreaseinoveralldemandforourproducts;

• theoccurrenceofnaturaldisastersand/orextendedperi-

odsofinclementweather;

• deteriorationingeneraleconomicconditions;

• ourabilitytoattractandretainqualifiedteammembers;

• competitivepricingandothercompetitivepressures;

• ourrelationshipswithourvendors;

• ourinvolvementasadefendantinlitigationorincurrence

ofjudgments,finesorlegalcosts;

• adherence to the restrictions and covenants imposed

underourcreditfacility;and

• other statements that are not of historical fact made

throughoutthisreport,includinginthesectionsentitled

“Management’s Discussion and Analysis of Financial

ConditionandResultsofOperations”and“RiskFactors”

found in our Form 10-K filed on March 17, 2005 with

theSecuritiesandExchangeCommission.

Weassumenoobligationstoupdatepubliclyanyforward-

lookingstatements,whetherasaresultofnewinformation,

future events or otherwise.In evaluating forward-looking

statements,youshouldconsidertheserisksanduncertain-

ties, together with the other risks described from time to

time in our other reports and documents filed with the

SecuritiesandExchangeCommission,andyoushouldnot

placeunduerelianceonthosestatements.