Advance Auto Parts 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AdvanceAutoParts,Inc.andSubsidiaries

23

payment at an agreed upon discount rate. At January 1,

2005, $56.9millionwaspayabletothe bank byusunder

thisprogram.Thisprogramwillallowustofurtherreduce

our working capital invested in current inventory levels

andfinancefutureinventorygrowth.Additionally,ournew

senior credit facility allows us to increase our capacity

under this program from $100 million to $150 million

during2005.

StockRepurchaseProgram

During the third quarter of fiscal 2004, our Board of

Directorsauthorizedastockrepurchaseprogramofupto

$200.0millionofourcommonstockplusrelatedexpenses.

The program will allow us to repurchase our common

stockontheopenmarketorinprivatelynegotiatedtrans-

actionsfromtimetotimeinaccordancewiththerequire-

mentsoftheSecuritiesandExchangeCommission.Asof

January1,2005,wehadrepurchasedatotalof3.7million

shares of common stock at an aggregate cost of $146.2

million,or $39.52pershare.At January1,2005, wehad

$53.8 million, excluding related expenses, available for

future stock repurchases under the stock repurchase pro-

gram.AsofMarch9,2005,wehadrepurchasedanaddi-

tional1.0millionsharesofcommonstockatanaggregate

costof$43.0million.

DeferredCompensationandPostretirementPlans

We maintain two deferred compensation plans. Our

ongoing plan was established in 2003 as an unqualified

deferredcompensationplanestablishedforcertainofour

keyteammembers.Thisplanprovidesforaminimumand

maximum deferral percentage of the team member base

salary and bonus, as determined by our Retirement Plan

Committee. We fund the plan liability by remitting the

teammember’sdeferraltoaRabbiTrustwherethesedefer-

rals are invested in trading securities. Accordingly, all

gainsandlossesontheseunderlyinginvestmentsareheld

intheRabbiTrusttofundthedeferredcompensationlia-

bility.AtJanuary1,2005,theliabilityrelatedtothisplan

was$1.8million,allofwhichiscurrent.Wealsomaintain

anunfundeddeferredcompensationplanestablishedprior

tothe1998Westernmergerforcertainkeyteammembers

ofWestern.TheplanwasfrozenatthedateoftheWestern

merger. At January 1, 2005, the total liability for the

Western plan was $1.6 million, of which $0.3 million is

recorded as a current liability. The classification for the

Westerndeferredcompensationplanisdeterminedbypay-

ment terms elected by plan participants, which can be

changedupon12months’notice.

Weprovidecertainhealthcareandlifeinsurancebene-

fitsforeligibleretiredteammembersthroughourpost-

retirement plan. At January 1, 2005, our accrued benefit

costrelatedtothisplanwas$17.4million.Theplanhasno

assetsandisfundedonacashbasisasbenefitsarepaid/

incurred.Thediscountratethatweutilizefordetermining

our postretirement benefit obligation is actuarially deter-

mined. Thediscountrate utilized at January1,2005 and

January 4, 2004 was 5.75% and 6.25%, respectively. We

reserve the right to change or terminate the benefits or

contributions at any time. We also continue to evaluate

ways in which we can better manage these benefits and

control costs. Any changes in the plan or revisions to

assumptions that affect the amount of expected future

benefits may have a significant impact on the amount of

thereportedobligationandannualexpense.Effectivesec-

ondquarteroffiscal2004,weamendedthePlantoexclude

outpatient prescription drug benefits to Medicare-eligible

retirees effective January 1, 2006. Due to this negative

plan amendment, our accumulated postretirement benefit

obligation was reduced by $7.6 million, resulting in an

unrecognized negative prior service cost in the same

amount. The unrecognized negative prior service cost is

beingamortizedovertheestimatedremaininglifeexpec-

tancyoftheplanparticipantsof13years.

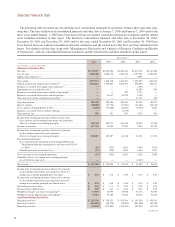

AnalysisofCashFlows

FiscalYear

2004 2003 2002

(inmillions)

Cashflowsfromoperating

activities..................................... $ 263.7 $ 355.9 $243.0

Cashflowsfrominvesting

activities..................................... (166.8) (85.5) (78.0)

Cashflowsfromfinancing

activities..................................... (52.1) (272.8) (169.2)

Netincrease(decrease)incash

andcashequivalents.................. $ 44.8 $ (2.4) $ (4.2)

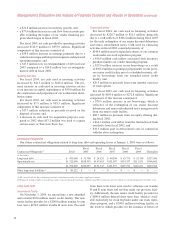

OperatingActivities

Forfiscal 2004, net cashprovidedbyoperatingactivi-

tiesdecreased$92.2millionto$263.7million.Significant

componentsofthisdecreaseconsistedof:

• a$63.1millionincreaseinearningsfromfiscal2003;

• a $47.2 million reduction in deferred income tax pro-

vision,primarilyreflectiveof(1)thereductioninoper-

ating loss carryforwards from prior years and (2) the

impactofthelossonextinguishmentofdebtfrom

fiscal2003;