Advance Auto Parts 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

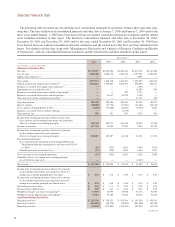

Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations(continued)

QuarterlyFinancialResults(unaudited)(inthousands,exceptpersharedata)

16Weeks

Ended

4/24/2004

12Weeks

Ended

7/17/2004

12Weeks

Ended

10/9/2004

12Weeks

Ended

1/1/2005

16Weeks

Ended

4/19/2003

12Weeks

Ended

7/12/2003

12Weeks

Ended

10/4/2003

13Weeks

Ended

1/3/2004

Netsales............................................. $1,122,918 $908,412 $890,161 $848,806 $1,005,968 $827,348 $839,101 $821,279

Grossprofit........................................ 520,898 422,302 416,515 393,656 463,989 379,474 386,928 374,127

Netincome......................................... $ 51,291 $ 53,235 $ 51,393 $ 32,069 $ 5,041 $ 43,458 $ 45,164 $ 31,272

Netincomepershare:

Basic............................................... $ 0.69 $ 0.71 $ 0.69 $ 0.44 $ 0.07 $ 0.60 $ 0.61 $ 0.42

Diluted........................................... $ 0.68 $ 0.70 $ 0.68 $ 0.43 $ 0.07 $ 0.58 $ 0.60 $ 0.41

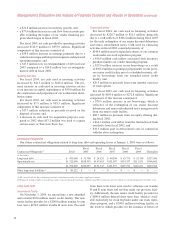

LiquidityandCapitalResources

OverviewofLiquidity

Ourprimarycashrequirementsincludethepurchaseof

inventory,capitalexpenditures,repurchasingsharesunder

ourstockrepurchaseprogramandcontractualobligations.

Wehavefinancedtheserequirementsprimarilythrougha

combination of cash generated from operations and bor-

rowingsunderourseniorcreditfacility.

AtJanuary1,2005,ourcashbalancewas$56.3million,

anincreaseof$44.8millioncomparedto2003.Ourcash

balanceincreasedprimarilyduetoourincreasedearnings

in 2004, as well as a decrease in cash used to repay or

redeemindebtednesscomparedto2003.In2003,weused

availablefundscombinedwithborrowingsunderoursenior

credit facility to redeem our senior discount debentures

andseniorsubordinatednotes.AtJanuary1,2005,wehad

outstanding indebtedness consisting of borrowings of

$470.0millionunderourseniorcreditfacility,anincrease

of $25.0 million from 2003. Additionally, we had $38.8

millioninlettersofcreditoutstanding,whichreducedour

availability under the revolving credit facility to $161.2

million.Ouravailabilityunderourrevolvingcreditfacility

increasedby$38.8millionfrom$122.4attheendoffiscal

2003duetotheincreaseinourrevolvingcreditfacilityfrom

$160.0 million to $200.0 million. This increase resulted

fromtherefinancingofourseniorcreditfacility,whichgives

usadditionalfundsforourprimarycashrequirements.

CapitalExpenditures

Ourprimarycapitalrequirementshavebeenthefunding

ofour continuedstore expansionprogram, includingnew

store openings and store acquisitions, store relocations

and remodels, inventory requirements, the construction

andupgradingofdistributioncenters,thedevelopmentand

implementation of proprietary information systems and

ourstrategicacquisitions.

Our capital expenditures were $179.8 million in 2004.

Theseamountsincludedcostsof$50.0millionforthecon-

struction and preparation of our northeastern distribution

center and additional amounts related to new store open-

ings, the upgrade of our information systems, remodels

andrelocationsofexistingstores,includingourcontinued

physical conversion of stores acquired in the Discount

acquisition to our Advance Auto Parts store format. In

2005, we anticipate that our capital expenditures will be

approximately$180.0millionto$200.0million.

Ournewstores,ifleased,requirecapitalexpendituresof

approximately$160,000perstoreandaninventoryinvest-

ment of approximately $170,000 per store, net of vendor

payables.Aportionoftheinventoryinvestmentisheldat

a distribution facility. Pre-opening expenses, consisting

primarily of store set-up costs and training of new store

team members, average approximately $20,000 per store

andareexpensedwhenincurred.

Ourfuturecapitalrequirementswilldependonthenum-

ber of new stores we open or acquire and the timing of

those openings or acquisitions within a given year. We

opened 125 new stores each year during 2004 and 2003.

Weanticipateaddingapproximately150to175newstores

during 2005 primarily through new store openings and

selectiveacquisitions.

VendorFinancingProgram

Historically,wehavenegotiatedextendedpaymentterms

fromsuppliersthathelpfinanceinventorygrowth,andwe

believethatwewillbeabletocontinuefinancingmuchof

our inventory growth through such extended payment

terms.Duringthefirstquarteroffiscal2004,weentered

intoashort-termfinancingprogramwithabank,allowing

us to extend our payment terms on certain merchandise

purchases.Underthisprogram,weissuenegotiableinstru-

ments to our vendors in lieu of a cash payment. Each

vendor is able to present the instrument to the bank for