Abercrombie & Fitch 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

72

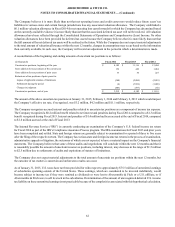

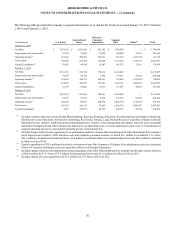

18. QUARTERLY FINANCIAL DATA (UNAUDITED)

Summarized unaudited quarterly financial results for Fiscal 2014 and Fiscal 2013 follows (in thousands, except per share amounts):

Fiscal Quarter 2014(10) First(2) Second(3) Third(4) Fourth(5)

Net sales $ 822,428 $ 890,605 $ 911,453 $ 1,119,544

Gross profit $ 511,659 $ 552,956 $ 567,070 $ 681,885

Net income (loss) $ (23,671) $ 12,877 $ 18,227 $ 44,388

Net income (loss) per diluted share(1) $ (0.32) $ 0.17 $ 0.25 $ 0.63

Fiscal Quarter 2013(10) First(6) Second(7) Third(8) Fourth(9)

Net sales $ 838,769 $ 945,698 $ 1,033,293 $ 1,299,137

Gross profit $ 553,166 $ 604,122 $ 651,040 $ 767,107

Net income (loss) $ (7,203) $ 11,370 $ (15,644) $ 66,106

Net income (loss) per diluted share(1) $ (0.09) $ 0.14 $ (0.20) $ 0.85

(1) Net income (loss) per diluted share (Diluted EPS) was computed individually for each of the quarters presented using weighted average number of

shares outstanding during the quarter while Diluted EPS for the full year is computed using the average of the weighted average number of shares

outstanding each quarter; therefore, the sum of Diluted EPS for the quarters may not equal the total for the year.

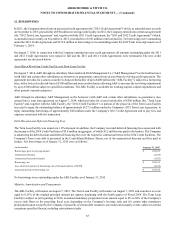

(2) The first quarter of Fiscal 2014 included pre-tax charges of $6.9 million related to certain corporate governance matters, $5.6 million related to the

restructuring of the Gilly Hicks brand, and $3.1 million related to the Company's profit improvement initiative. Net loss per diluted share included

$0.15 related to the charges. The thirteen weeks ended May 3, 2014 included correction of certain errors relating to prior periods. The out-of-period

correction of errors resulted in an increase to loss before taxes of $1.5 million, or $0.9 million after tax.

(3) The second quarter of Fiscal 2014 included pre-tax charges of $2.0 million related to the Company's profit improvement initiative and $0.4 million

related to the restructuring of the Gilly Hicks brand. Net income per diluted share included $0.02 related to the charges. The thirteen and twenty-six

weeks ended August 2, 2014 included the correction of certain errors relating to prior periods. The out-of-period correction of errors resulted in a

decrease to income before taxes of $1.4 million, or $0.9 million after tax, resulting in a $0.9 million to net income for the thirteen weeks ended August

2, 2014. The out-of-period correction of errors resulted in an increase to loss before taxes of $2.9 million, or $1.7 million after tax for the twenty-six

weeks ended August 2, 2014.

(4) The third quarter of Fiscal 2014 included pre-tax charges of $16.7 million for asset impairment, $2.3 million related to lease terminations and store

closures, $0.7 million related to the Company's profit improvement initiative and $0.6 million related to certain corporate governance matters. Net

income per diluted share included $0.17 related to the charges. The thirteen and thirty-nine weeks ended November 1, 2014 included the correction

of certain errors relating to prior periods. The out-of-period correction of errors resulted in a decrease to income before taxes of $0.6 million, or $0.4

million after tax, and an unrelated tax charge of $0.4 million, for a combined reduction to net income of $0.8 million for the thirteen weeks ended

November 1, 2014. The out-of-period correction of errors results in a decrease to income before taxes of $3.3 million, or $2.0 million after tax, and

an unrelated tax charge of $0.4 million, for a combined reduction to net income of $2.4 million for the thirty-nine weeks ended November 1, 2014.

(5) The fourth quarter of Fiscal 2014 included pre-tax charges of $28.3 million for asset impairment, $5.2 million related to certain corporate governance

matters and CEO transition costs, $3.4 million related to lease terminations and store closures, $2.4 million related to the restructuring of the Gilly

Hicks brand and $0.7 million related to the Company's profit improvement initiative. Net income per diluted share included $0.52 related to the

charges. The thirteen and fifty-two weeks ended January 31, 2015 included the correction of certain errors relating to prior periods. The out-of-period

correction of errors resulted in a decrease to income before taxes and net income of $0.1 million for the thirteen weeks ended January 31, 2015. The

out-of-period correction of errors resulted in a decrease in income before taxes of $2.9 million, or $1.8 million after tax, and an unrelated tax charge

of $0.4 million, for a combined reduction to net income of $2.2 million for the fifty-two weeks ended January 31, 2015.

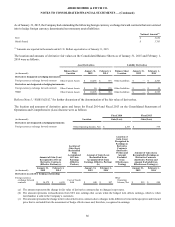

(6) The thirteen weeks ended May 4, 2013 included a reduction of pre-tax loss of $2.5 million and an unrelated tax charge of $1.2 million for the correction

of errors relating to prior periods. The effect of these corrections decreased net loss by $0.6 million for the thirteen week period ended May 4, 2013.

(7) The second quarter of Fiscal 2013 included pre-tax charges of $2.6 million related to the Company's profit improvement initiative. Earnings per diluted

share included $0.02 related to the charges. The thirteen week period ended August 3, 2013 included a reduction of pre-tax expense of $4.5 million

for the correction of errors related to prior periods; the twenty-six week period ended August 3, 2013 included a reduction of pre-tax expense of $5.5

million and an unrelated tax charges of $1.2 million for the correction of errors related to prior periods. The effect of these corrections increased net

income by $2.9 million and $2.5 million for the thirteen and twenty-six week periods ended August 3, 2013, respectively.

(8) The third quarter of Fiscal 2013 included pre-tax charges of $43.6 million for asset impairment, $44.7 million related to the restructuring of the Gilly

Hicks brand and $7.6 million related to the Company's profit improvement initiative. Earnings per diluted share included $0.72 related to the charges.

The thirteen week period ended November 2, 2013 included a reduction of pre-tax expense of $2.1 million and an unrelated tax benefit of $1.9 million

for the correction of errors related to prior periods; the thirty-nine week period ended November 2, 2013 included a reduction of pre-tax expense of

$6.3 million for the correction of errors related to prior periods. The effect of these corrections increased net income by $3.0 million and $4.7 million

for the thirteen and thirty-nine week periods ended November 2, 2013, respectively.

(9) The fourth quarter of Fiscal 2014 included pre-tax charges of $3.1 million for asset impairment, $36.8 million related to the restructuring of the Gilly

Hicks brand and $3.7 million related to the Company's profit improvement initiative. Earnings per diluted share included $0.38 related to the charges

and $0.11 for a tax true-up related to the restructuring, asset impairment and profit improvement charges primarily incurred in the third quarter of

Fiscal 2013, for the true-up of the estimated full year tax rate applied as of the third quarter to the full year Fiscal 2013 tax rate. The thirteen week

period ended February 1, 2014 included an increase in pre-tax expense of $6.5 million and an unrelated tax charge of $2.2 million for the correction

of errors related to prior periods. The effect of these corrections decrease net income by $6.2 million for the thirteen week period ended February 1,

2014; the fifty-two week period ended February 1, 2014 included a reduction of pre-tax expense of $2.6 million and an unrelated tax expense of $0.9

million.

(10) The Company does not believe these corrections were material to any current or prior interim or annual periods that were affected.