Abercrombie & Fitch 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

68

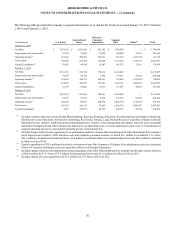

15. GILLY HICKS RESTRUCTURING

As previously announced, on November 1, 2013, A&F’s Board of Directors approved the closure of the Company’s 24 stand-alone

Gilly Hicks stores. The Company substantially completed the store closures as planned by the end of the first quarter of Fiscal

2014. The Company continues to offer Gilly Hicks products through the Hollister direct-to-consumer channel.

As a result of exiting the Gilly Hicks branded stores, the Company currently estimates that it will incur aggregate pre-tax charges

of approximately $91.2 million, of which $8.4 million in charges, primarily related to lease terminations and asset impairment,

was recognized during Fiscal 2014 and $81.5 million was recognized during Fiscal 2013.

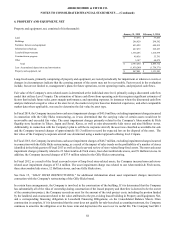

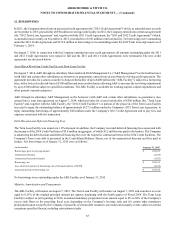

Below is a summary of the aggregate pre-tax charges incurred through January 31, 2015 related to the closure of the Gilly Hicks

branded stores (in thousands):

Lease terminations and store closure costs $ 48,665

Asset impairment 40,036

Other 1,230

Total charges (1) $ 89,931

(1) As of January 31, 2015, the Company incurred aggregate pre-tax charges related to restructuring plans for the Gilly Hicks brand of $50.4

million for the U.S. Stores segment and $39.5 million for the International Stores segment.

The remaining charges, primarily lease-related, including the net present value of payments related to lease terminations, potential

sub-lease losses and other lease-related costs of approximately $1.3 million, are expected to be recognized over the remaining

lease terms. These estimates are based on a number of significant assumptions and could change materially.

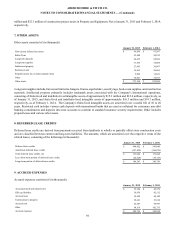

Costs associated with exit or disposal activities are recorded when the liability is incurred. Below is a roll forward of the liabilities

recognized on the Consolidated Balance Sheet as of January 31, 2015, related to the closure of the Gilly Hicks stores (in thousands):

Accrued liability as of February 1, 2014 $ 42,507

Costs incurred 11,631

Cash payments (48,141)

Accrued liability as of January 31, 2015 $ 5,997

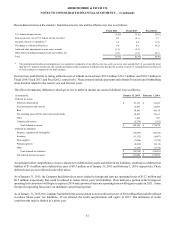

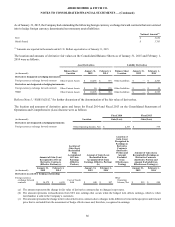

16. RETIREMENT BENEFITS

The Company maintains the Abercrombie & Fitch Co. Savings & Retirement Plan, a qualified plan. All U.S. associates are eligible

to participate in this plan if they are at least 21 years of age and have completed a year of employment with 1,000 or more hours

of service. In addition, the Company maintains the Abercrombie & Fitch Co. Nonqualified Savings and Supplemental Retirement,

composed of two sub-plans (Plan I and Plan II). Plan I contains contributions made through December 31, 2004, while Plan II

contains contributions made on and after January 1, 2005. Participation in these plans is based on service and compensation. The

Company’s contributions are based on a percentage of associates’ eligible annual compensation. The cost of the Company’s

contributions to these plans was $13.8 million, $18.3 million and $21.1 million for Fiscal 2014, Fiscal 2013 and Fiscal 2012,

respectively.

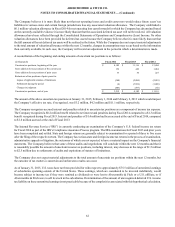

Effective February 2, 2003, the Company established a SERP to provide additional retirement income to its former CEO. On

December 8, 2014, the former CEO, Michael S. Jeffries, retired from his position as Chief Executive Officer. Mr. Jeffries'

employment with the Company terminated on December 31, 2014. In connection with his Employment Agreement, the former

CEO will receive a monthly benefit which accumulates annually to 50% of his final average compensation (as defined in the SERP)

for life. The final average compensation used for the calculation was based on actual compensation, base salary and cash incentive

compensation, averaged over the last 36 consecutive full calendar months ended before the former CEO’s retirement. The Company

recorded income of $1.0 million and $4.4 million, and expense of $3.9 million for Fiscal 2014, Fiscal 2013 and Fiscal 2012,

respectively, associated with the SERP.