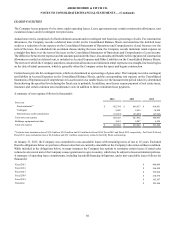

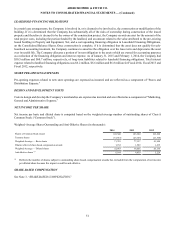

Abercrombie & Fitch 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

54

The grant date fair value of stock options that vested was insignificant during Fiscal 2014 and Fiscal 2013, and was $1.3 million

during Fiscal 2012.

As of January 31, 2015, all compensation cost related to currently outstanding stock options had been fully recognized.

Stock Appreciation Rights

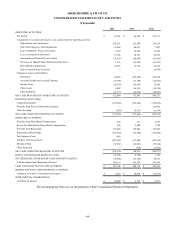

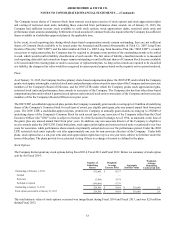

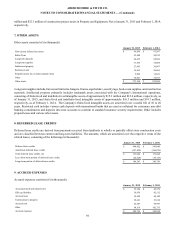

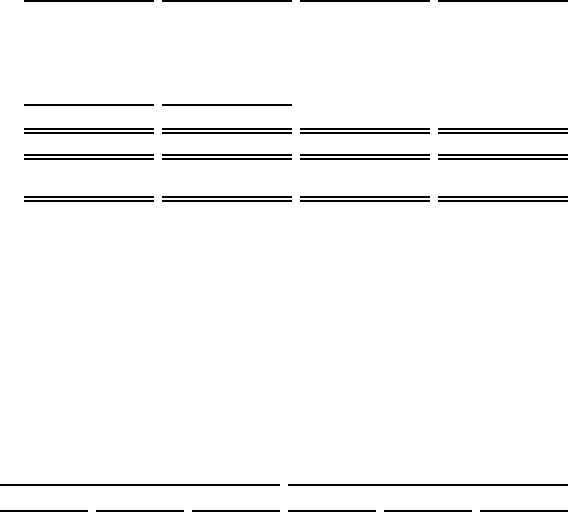

The following table summarizes stock appreciation rights activity for Fiscal 2014:

Number of

Underlying

Shares

Weighted-

Average

Exercise Price Aggregate

Intrinsic Value

Weighted-

Average

Remaining

Contractual Life

Outstanding at February 1, 2014 8,982,959 $ 40.76

Granted 512,216 36.31

Exercised (92,475) 26.92

Forfeited or expired (449,025) 48.03

Outstanding at January 31, 2015 8,953,675 $ 40.28 $ 5,099,000 2.6

Stock appreciation rights exercisable at January 31, 2015 8,152,634 $ 40.17 $ 5,099,000 2.0

Stock appreciation rights expected to become exercisable in the future as

of January 31, 2015 739,920 $ 41.69 $ — 8.6

The Company estimates the fair value of stock appreciation rights using the Black-Scholes option-pricing model, which requires

the Company to estimate the expected term of the stock appreciation rights and expected future stock price volatility over the

expected term. Estimates of expected terms, which represent the expected periods of time the Company believes stock appreciation

rights will be outstanding, are based on historical experience. Estimates of expected future stock price volatility are based on the

volatility of the Company's Common Stock price for the most recent historical period equal to the expected term of the stock

appreciation right, as appropriate. The Company calculates the volatility as the annualized standard deviation of the differences

in the natural logarithms of the weekly stock closing price, adjusted for stock splits and dividends. The weighted-average

assumptions used in the Black-Scholes option-pricing model for stock appreciation rights granted during Fiscal 2014, Fiscal 2013

and Fiscal 2012 were as follows:

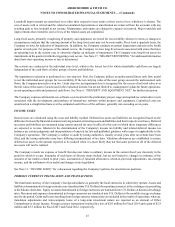

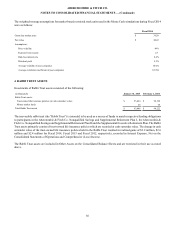

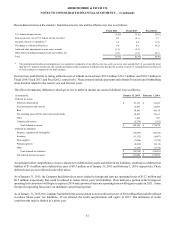

Executive Officers All Other Associates

2014 2013 2012 2014 2013 2012

Grant date market price $ 35.08 $ 46.57 $ 52.89 $ 37.05 $ 43.86 $ 51.31

Exercise price $ 35.49 $ 46.57 $ 52.89 $ 37.22 $ 43.86 $ 51.31

Fair value $ 12.85 $ 20.34 $ 23.53 $ 12.92 $ 16.17 $ 21.90

Assumptions:

Price volatility 49% 61% 56% 50% 53% 61%

Expected term (years) 4.9 4.7 5.0 4.1 4.1 4.1

Risk-free interest rate 1.6% 0.7% 1.3% 1.4% 0.7% 0.9%

Dividend yield 2.0% 1.8% 1.1% 1.9% 1.8% 1.2%

Compensation expense for stock appreciation rights is recognized on a straight-line basis over the awards' requisite service period,

net of forfeitures. As of January 31, 2015, there was $8.0 million of total unrecognized compensation cost, net of estimated

forfeitures, related to stock appreciation rights. The unrecognized compensation cost is expected to be recognized over a weighted-

average period of 16 months.

The total intrinsic value of stock appreciation rights exercised during Fiscal 2014, Fiscal 2013 and Fiscal 2012 was $1.5 million,

$8.5 million and $0.9 million, respectively. The grant date fair value of stock appreciation rights that vested during Fiscal 2014,

Fiscal 2013 and Fiscal 2012 was $7.4 million, $83.7 million and $24.1 million, respectively.