Abercrombie & Fitch 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

62

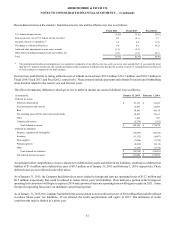

The Company believes it is more likely than not that net operating losses and credit carryovers would reduce future years’ tax

liabilities in various states and certain foreign jurisdictions less any associated valuation allowance. The Company established a

$6.1 million valuation allowance in Fiscal 2014 for net operating loss carryforwards for which the Company has determined based

on the currently available evidence it is more likely than not that the associated deferred tax asset will not be realized. All valuation

allowances have been reflected through the Consolidated Statements of Operations and Comprehensive (Loss) Income. No other

valuation allowances have been provided for deferred tax assets because the Company believes that it is more likely than not that

the full amount of the net deferred tax assets will be realized in the future. While the Company does not expect material adjustments

to the total amount of valuation allowance within the next 12 months, changes in assumptions may occur based on the information

then currently available. In such case, the Company will record an adjustment in the period in which a determination is made.

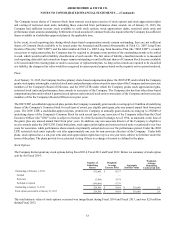

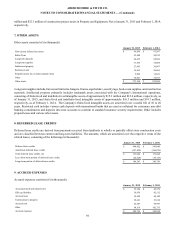

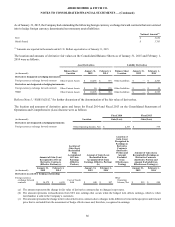

A reconciliation of the beginning and ending amounts of uncertain tax positions is as follows:

(in thousands) Fiscal 2014 Fiscal 2013 Fiscal 2012

Uncertain tax positions, beginning of the year $ 4,182 $ 11,116 $ 13,404

Gross addition for tax positions of the current year 152 449 1,084

Gross addition for tax positions of prior years 33 30 227

Reductions of tax positions of prior years for:

Lapses of applicable statutes of limitations (348) (2,880) (2,053)

Settlements during the period (4) (3,936) (1,480)

Changes in judgment (803) (597) (66)

Uncertain tax positions, end of year $ 3,212 $ 4,182 $ 11,116

The amount of the above uncertain tax positions at January 31, 2015, February 1, 2014 and February 2, 2013 which would impact

the Company’s effective tax rate, if recognized, was $3.2 million, $4.2 million and $11.1 million, respectively.

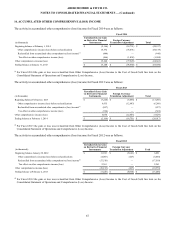

The Company recognizes accrued interest and penalties related to uncertain tax positions as a component of income tax expense.

The Company recognized a $0.2 million benefit related to net interest and penalties during Fiscal 2014 compared to a $1.3 million

benefit recognized during Fiscal 2013. Interest and penalties of $1.4 million had been accrued at the end of Fiscal 2014, compared

to $1.6 million accrued at the end of Fiscal 2013.

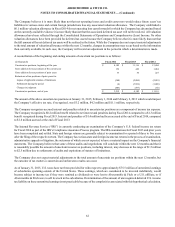

The Internal Revenue Service (“IRS”) is currently conducting an examination of the Company’s U.S. federal income tax return

for Fiscal 2014 as part of the IRS’s Compliance Assurance Process program. The IRS examinations for Fiscal 2013 and prior years

have been completed and settled. State and foreign returns are generally subject to examination for a period of three to five years

after the filing of the respective return. The Company has various state and foreign income tax returns in the process of examination,

administrative appeals or litigation, the outcomes of which are not expected to have a material impact on the Company's financial

statements. The Company believes that some of these audits and negotiations will conclude within the next 12 months and that it

is reasonably possible the amount of uncertain income tax positions, including interest, may decrease in the range of $1.5 million

to $2.5 million due to settlements of audits and expirations of statutes of limitations.

The Company does not expect material adjustments to the total amount of uncertain tax positions within the next 12 months, but

the outcome of tax matters is uncertain and unforeseen results can occur.

As of January 31, 2015, U.S. taxes have not been provided for with respect to approximately $75.5 million of unremitted earnings

of subsidiaries operating outside of the United States. These earnings, which are considered to be invested indefinitely, would

become subject to income tax if they were remitted as dividends or were lent to Abercrombie & Fitch or a U.S. affiliate, or if

Abercrombie & Fitch were to sell its stock in the subsidiaries. Determination of the amount of unrecognized deferred U.S. income

tax liability on these unremitted earnings is not practicable because of the complexities associated with this hypothetical calculation.