Abercrombie & Fitch 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

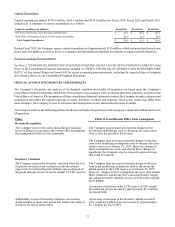

Interest Rate Risks

On August 7, 2014, the Company entered into new credit agreements and all amounts outstanding under the Company's previously

existing term loan facility and revolving credit facility were repaid in full. The Company has approximately $299.3 million in

gross borrowings outstanding under its new term loan facility (the "Term Loan Facility") and no borrowings outstanding under

its new senior secured revolving credit facility (the "ABL Facility" and, together with the Term Loan Facility, the "2014 Credit

Facilities"). The 2014 Credit Facilities carry interest rates that are tied to LIBOR or an alternate base rate plus a margin. The

interest rate on the Term Loan Facility has a 100 basis point LIBOR floor, and assuming no changes in the Company's financial

structure as it stands, an increase in market interest rates of 100 basis points would not have a material effect on annual interest

expense. This hypothetical analysis for Fiscal 2014 may differ from the actual change in interest expense due to various conditions

which may result in changes in interest rates under the Company's 2014 Credit Facilities.

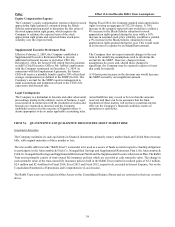

Foreign Exchange Rate Risk

A&F’s international subsidiaries generally operate with functional currencies other than the U.S. Dollar. The Company’s

Consolidated Financial Statements are presented in U.S. Dollars. Therefore, the Company must translate revenues, expenses,

assets and liabilities from functional currencies into U.S. Dollars at exchange rates in effect during or at the end of the reporting

period. The fluctuation in the value of the U.S. Dollar against other currencies affects the reported amounts of revenues, expenses,

assets and liabilities. The potential impact of currency fluctuation increases as international expansion increases.

A&F and its subsidiaries have exposure to changes in currency exchange rates associated with foreign currency transactions and

forecasted foreign currency transactions, including the sale of inventory between subsidiaries and foreign denominated assets and

liabilities. Such transactions are denominated primarily in U.S. Dollars, Australian Dollars, British Pounds, Canadian Dollars,

Chinese Yuan, Danish Kroner, Euros, Hong Kong Dollars, Japanese Yen, Kuwaiti Dinars, New Taiwan Dollars, Polish Zloty,

Singapore Dollars, South Korean Won, Swedish Kronor, Swiss Francs and UAE Dirhams. The Company has established a program

that primarily utilizes foreign currency forward contracts to partially offset the risks associated with the effects of certain foreign

currency transactions and forecasted transactions. Under this program, increases or decreases in foreign currency exposures are

partially offset by gains or losses on forward contracts, to mitigate the impact of foreign currency gains or losses. The Company

does not use forward contracts to engage in currency speculation. All outstanding foreign currency forward contracts are recorded

at fair value at the end of each fiscal period.

The fair value of outstanding foreign currency exchange forward contracts included in Other Current Assets was $10.3 million

and $1.0 million as of January 31, 2015 and February 1, 2014, respectively. The fair value of outstanding foreign currency exchange

forward contracts included in Other Liabilities was insignificant as of January 31, 2015, and $2.6 million as of February 1, 2014.

Foreign currency exchange forward contracts are sensitive to changes in foreign currency exchange rates. The Company assessed

the risk of loss in fair values from the effect of a hypothetical 10% devaluation of the U.S. Dollar against the exchange rates for

foreign currencies under contract. The results would decrease derivative contract fair values by approximately $7.9 million. As

the Company's foreign currency exchange forward contracts are primarily designated as cash flow hedges of forecasted transactions,

the hypothetical change in fair value would be largely offset by the net change in the fair values of the underlying hedged items.