Abercrombie & Fitch 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

The Company may continue to repurchase shares of its Common Stock and would anticipate funding these cash requirements

utilizing free cash flow generated from operations.

The Company is not dependent on dividends from its foreign subsidiaries to fund its U.S. operations or make distributions to

A&F's stockholders. Unremitted earnings from foreign subsidiaries, which are considered to be invested indefinitely, would become

subject to U.S. income tax if they were remitted as dividends or were lent to A&F or a U.S. affiliate. Although the Company has

no intent to repatriate cash held in Europe and Asia, the Company has the ability to repatriate current Europe and Asia cash balances

without the occurrence of a taxable dividend in the United States.

Off-Balance Sheet Arrangements

The Company uses in the ordinary course of business stand-by letters of credit under the existing ABL Facility. The Company had

$9.2 million in stand-by letters of credit outstanding as of January 31, 2015. The Company has no other off-balance sheet

arrangements.

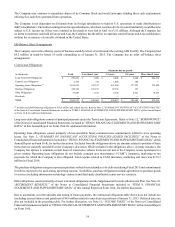

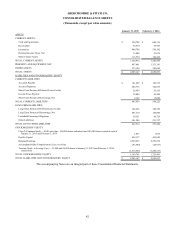

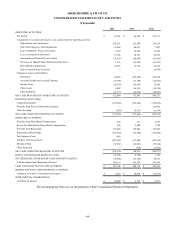

Contractual Obligations

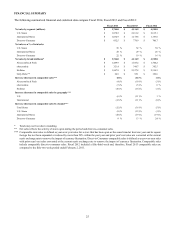

Payments due by period

(in thousands) Total Less than 1 year 1-3 years 3-5 years More than 5 years

Long-Term Debt Obligations $ 299,250 $ 3,000 $ 6,000 $ 6,000 $ 284,250

Capital Lease Obligatons 2,792 734 1,468 590 —

Operating Lease Obligations (1) 2,016,639 412,317 651,669 377,225 575,428

Purchase Obligations 254,742 225,213 29,362 167 —

Other Obligations 31,849 1,338 2,328 8,627 19,556

Dividends ———— —

Totals $ 2,605,272 $ 642,602 $ 690,827 $ 392,609 $ 879,234

(1) Includes leasehold financing obligations of $50.5 million and related interest. Refer to Note 2, "SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES,"

of the Notes to Consolidated Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this Annual Report

on Form 10-K for additional information.

Long-term debt obligations consist of principal payments under the Term Loan Agreement. Refer to Note 12, "BORROWINGS,"

of the Notes to Consolidated Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY

DATA” of this Annual Report on Form 10-K for additional information.

Operating lease obligations consist primarily of non-cancelable future minimum lease commitments related to store operating

leases. See Note 2, “SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES--LEASED FACILITIES,” of the Notes to

Consolidated Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this

Annual Report on Form 10-K, for further discussion. Excluded from the obligations above are amounts related to portions of lease

terms that are currently cancelable at the Company's discretion. While included in the obligations above, in many instances, the

Company has options to terminate certain leases if stated sales volume levels are not met or the Company ceases operations in a

given country. Operating lease obligations do not include common area maintenance (“CAM”), insurance, marketing or tax

payments for which the Company is also obligated. Total expense related to CAM, insurance, marketing and taxes was $172.3

million in Fiscal 2014.

The purchase obligations category represents purchase orders for merchandise to be delivered during Fiscal 2015 and commitments

for fabric expected to be used during upcoming seasons. In addition, purchase obligations include agreements to purchase goods

or services including information technology contracts and third-party distribution center service contracts.

Other obligations consist primarily of asset retirement obligations and the Supplemental Executive Retirement Plan. See Note 16,

“RETIREMENT BENEFITS,” of the Notes to Consolidated Financial Statements included in “ITEM 8. FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA” of this Annual Report on Form 10-K, for further discussion.

Due to uncertainty as to the amounts and timing of future payments, the contractual obligations table above does not include tax

(including accrued interest and penalties) of $4.6 million related to uncertain tax positions at January 31, 2015. Deferred taxes are

also not included in the preceding table. For further discussion, see Note 11, “INCOME TAXES,” of the Notes to Consolidated

Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this Annual Report

on Form 10-K.