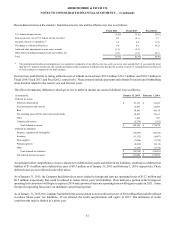

Abercrombie & Fitch 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

59

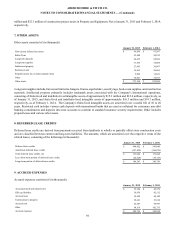

million and $52.3 million of construction project assets in Property and Equipment, Net at January 31, 2015 and February 1, 2014,

respectively.

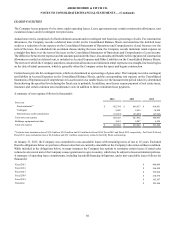

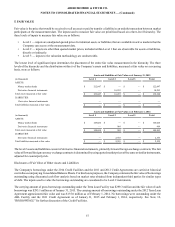

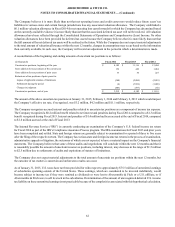

7. OTHER ASSETS

Other assets consisted of (in thousands):

January 31, 2015 February 1, 2014

Non-current deferred tax assets $ 96,999 $ 97,587

Rabbi Trust 93,448 90,222

Long-term deposits 64,415 68,886

Long-term supplies 31,565 36,008

Intellectual property 27,943 30,987

Restricted cash 14,835 26,686

Prepaid income tax on intercompany items 9,968 12,421

Other 34,021 36,293

Other assets $ 373,194 $ 399,090

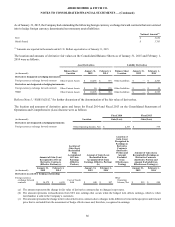

Long-term supplies include, but are not limited to, hangers, frames, sign holders, security tags, back-room supplies, and construction

materials. Intellectual property primarily includes trademark assets associated with the Company's International operations,

consisting of finite-lived and indefinite-lived intangible assets of approximately $15.3 million and $12.6 million, respectively, as

of January 31, 2015, and finite-lived and indefinite-lived intangible assets of approximately $16.3 million and $14.7 million,

respectively, as of February 1, 2014. The Company's finite-lived intangible assets are amortized over a useful life of 10 to 20

years. Restricted cash includes various cash deposits with international banks that are used as collateral for customary non-debt

banking commitments and deposits into trust accounts to conform to standard insurance security requirements. Other includes

prepaid leases and various other assets.

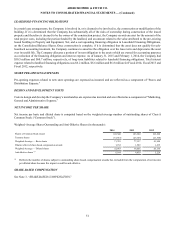

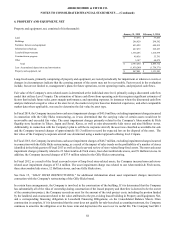

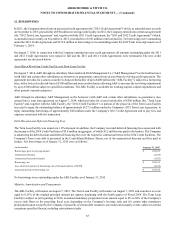

8. DEFERRED LEASE CREDITS

Deferred lease credits are derived from payments received from landlords to wholly or partially offset store construction costs

and are classified between current and long-term liabilities. The amounts, which are amortized over the respective terms of the

related leases, consisting of the following (in thousands):

January 31, 2015 February 1, 2014

Deferred lease credits $ 490,452 $ 543,040

Amortized deferred lease credits (357,430) (366,076)

Total deferred lease credits, net $ 133,022 $ 176,964

Less: short-term portion of deferred lease credits (26,629) (36,165)

Long-term portion of deferred lease credits $ 106,393 $ 140,799

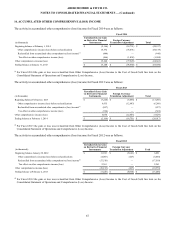

9. ACCRUED EXPENSES

Accrued expenses consisted of (in thousands):

January 31, 2015 February 1, 2014

Accrued payroll and related costs $ 56,384 $ 49,878

Gift card liability 36,936 42,512

Accrued taxes 34,629 44,100

Construction in progress 30,661 23,634

Accrued rent 25,607 59,997

Other 98,519 102,713

Accrued expenses $ 282,736 $ 322,834