Abercrombie & Fitch 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

49

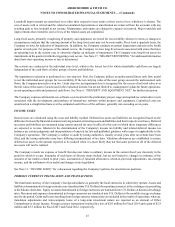

COST OF GOODS SOLD

Cost of goods sold primarily comprises cost incurred to ready inventory for sale, including product costs, freight, and import cost,

as well as provision for reserves for shrink and lower of cost or market. Gains and losses associated with foreign currency exchange

contracts related to hedging of inventory purchases are also recognized in cost of goods sold when the inventory being hedged is

sold.

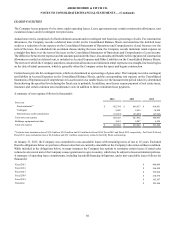

STORES AND DISTRIBUTION EXPENSE

Stores and distribution expense includes store payroll, store management, rent, utilities and other landlord expenses, depreciation

and amortization, repairs and maintenance and other store support functions, as well as Direct-to-Consumer expense and

Distribution Center (“DC”) expense.

Shipping and handling costs, including costs incurred to store, move and prepare merchandise for shipment, and costs incurred to

physically move merchandise to customers, associated with direct-to-consumer operations were $108.1 million, $93.4 million and

$78.6 million for Fiscal 2014, Fiscal 2013 and Fiscal 2012, respectively. Handling costs, including costs incurred to store, move

and prepare merchandise for shipment to stores were $52.2 million, $53.9 million and $59.4 million for Fiscal 2014, Fiscal 2013

and Fiscal 2012, respectively. These amounts are recorded in Stores and Distribution Expense in the Company's Consolidated

Statements of Operations and Comprehensive (Loss) Income. Costs incurred to physically move merchandise to stores is recorded

in Cost of Goods Sold in the Company's Consolidated Statements of Operations and Comprehensive (Loss) Income.

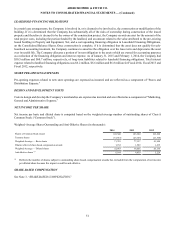

MARKETING, GENERAL & ADMINISTRATIVE EXPENSE

Marketing, general and administrative expense includes: photography and social media; store marketing; home office compensation,

except for those departments included in stores and distribution expense; information technology; outside services such as legal

and consulting; relocation; recruiting; samples and travel expenses.

RESTRUCTURING CHARGES

Restructuring charges consist of exit costs and other costs associated with the reorganization of the Company's operations, including

employee termination costs, lease contract termination costs, impairment of assets, and any other qualifying exit costs. Costs

associated with exit or disposal activities are recorded when the liability is incurred or when such costs are deemed probable and

estimable and represent the Company's best estimates.

OTHER OPERATING INCOME, NET

Other operating income, net included income of $10.2 million, $9.0 million and $4.8 million related to insurance recoveries for

Fiscal 2014, Fiscal 2013 and Fiscal 2012, respectively; $5.8 million, $8.8 million and $6.9 million for Fiscal 2014, Fiscal 2013

and Fiscal 2012, respectively, related to gift card balances whose likelihood of redemption has been determined remote and a loss

of $2.0 million in Fiscal 2014, and gains of $2.9 million and $3.3 million in Fiscal 2013 and Fiscal 2012, respectively, attributed

to foreign currency transactions. Other operating income, net for Fiscal 2012 also included a gain of $2.5 million related to the

net impact of changes in valuation related to other-than-temporary impairments associated with auction rate securities ("ARS").

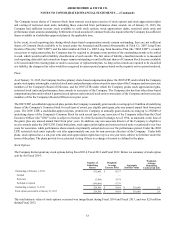

WEBSITE AND ADVERTISING COSTS

Advertising costs are comprised of in-store photography, e-mail distribution and other digital direct advertising, and other media

advertising. Beginning in Fiscal 2014, costs associated with cross-channel brand engagement campaigns and marketing events

have been classified as advertising costs. Accordingly, the advertising expense disclosures for Fiscal 2013 and Fiscal 2012 have

been revised to reflect this change. The production of in-store photography and signage are expensed when the marketing campaign

commences as a component of Marketing, General and Administrative Expense on the Consolidated Statements of Operations

and Comprehensive (Loss) Income. Website and other advertising costs related specifically to direct-to-consumer operations are

expensed as incurred as a component of Stores and Distribution Expense on the Consolidated Statements of Operations and

Comprehensive (Loss) Income. All other advertising costs are expensed as incurred as a component of Marketing, General and

Administrative Expense on the Consolidated Statements of Operations and Comprehensive (Loss) Income. The Company

recognized $84.6 million, $68.1 million and $59.0 million in advertising expense in Fiscal 2014, Fiscal 2013 and Fiscal 2012,

respectively.