Abercrombie & Fitch 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

48

DERIVATIVES

See Note 13, “DERIVATIVES.”

CONTINGENCIES

The Company is a defendant in lawsuits and other adversary proceedings arising in the ordinary course of business. Legal costs

incurred in connection with the resolution of claims and lawsuits are generally expensed as incurred, and the Company establishes

reserves for the outcome of litigation where it deems appropriate to do so under applicable accounting rules. The Company’s

assessment of the current exposure could change in the event of the discovery of additional facts with respect to legal matters

pending against the Company or determinations by judges, juries, administrative agencies or other finders of fact that are not in

accordance with the Company’s evaluation of claims. Actual liabilities may exceed the amounts reserved, and there can be no

assurance that final resolution of these matters will not have a material adverse effect on the Company’s financial condition, results

of operations or cash flows. The Company has established accruals for certain matters where losses are deemed probable and

reasonably estimable. There are other claims and legal proceedings pending against the Company for which accruals have not

been established.

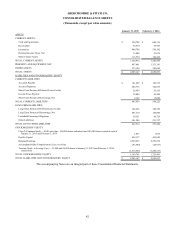

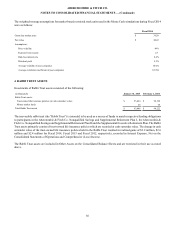

STOCKHOLDERS’ EQUITY

At January 31, 2015 and February 1, 2014, there were 150.0 million shares of A&F’s Class A Common Stock, $0.01 par value,

authorized, of which 69.4 million and 76.4 million were outstanding at January 31, 2015 and February 1, 2014, respectively, and

106.4 million shares of Class B Common Stock, $0.01 par value, authorized, none of which were outstanding at January 31, 2015

and February 1, 2014.

Holders of Class A Common Stock generally have identical rights to holders of Class B Common Stock, except holders of Class A

Common Stock are entitled to one vote per share while holders of Class B Common Stock are entitled to three votes per share on

all matters submitted to a vote of stockholders.

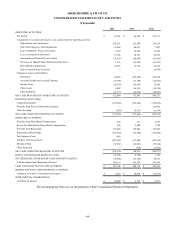

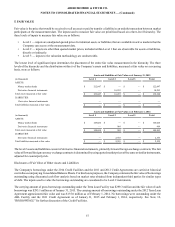

REVENUE RECOGNITION

The Company recognizes store sales at the time the customer takes possession of the merchandise. Direct-to-consumer sales are

recorded based on an estimated date for customer receipt of merchandise, which is based on shipping terms and historical delivery

transit times. Amounts relating to shipping and handling billed to customers in a sale transaction are classified as Net Sales and

the related direct shipping and handling costs are classified as Stores and Distribution Expense in the Company's Consolidated

Statements of Operations and Comprehensive (Loss) Income. Sales are recorded net of an allowance for estimated returns, associate

discounts, and promotions and other similar customer incentives. The Company estimates reserves for sales returns based on

historical experience. The sales return reserve was $9.5 million, $8.0 million and $9.3 million at January 31, 2015, February 1,

2014 and February 2, 2013, respectively.

The Company sells gift cards in its stores and through direct-to-consumer operations. The Company accounts for gift cards sold

to customers by recognizing a liability at the time of sale. Gift cards sold to customers do not expire or lose value over periods of

inactivity. The liability remains on the Company’s books until the Company recognizes income from gift cards. Income from gift

cards is recognized at the earlier of redemption by the customer (recognized as Net Sales) or when the Company determines that

the likelihood of redemption is remote, referred to as gift card breakage (recognized as Other Operating Income). The Company

determines the probability of the gift card being redeemed to be remote based on historical redemption patterns. The gift card

liability was $36.9 million and $42.5 million at January 31, 2015 and February 1, 2014, respectively.

The Company is not required by law to escheat the value of unredeemed gift cards to the states in which it operates. The Company

recognized in Other Operating Income gift card breakage of $5.8 million, $8.8 million and $6.9 million for Fiscal 2014, Fiscal

2013 and Fiscal 2012, respectively.

The Company does not include tax amounts collected as part of the sales transaction in its net sales results.