Abercrombie & Fitch 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

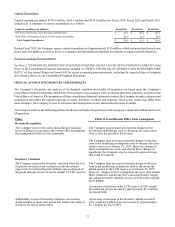

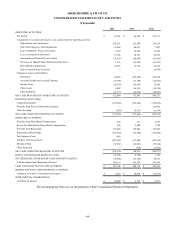

Capital Expenditures

Capital expenditures totaled $174.6 million, $163.9 million and $339.9 million for Fiscal 2014, Fiscal 2013 and Fiscal 2012,

respectively. A summary of capital expenditures is as follows:

Capital Expenditures (in millions) Fiscal 2014 Fiscal 2013 Fiscal 2012

New Store Construction, Store Refreshes and Remodels $ 86.3 $ 101.4 $ 245.3

Home Office, Distribution Centers and Information Technology 88.3 62.5 94.6

Total Capital Expenditures $ 174.6 $ 163.9 $ 339.9

During Fiscal 2015, the Company expects capital expenditures of approximately $150 million, which are prioritized toward new

stores and store updates, as well as direct-to-consumer and information technology investments to support growth initiatives.

Recent Accounting Pronouncements

See Note 2, "SUMMARY OF SIGNIFICANT ACCOUTING POLICIES - RECENT ACCOUNTING PRONOUNCEMENTS" of the

Notes to the Consolidated Financial Statements included in "ITEM 8. FINANCIAL STATEMENT AND SUPPLEMENTARY

DATA," of this Annual Report on Form 10-K for recent accounting pronouncements, including the expected dates of adoption

and estimate effects on our Consolidated Financial Statements.

CRITCAL ACCOUNTING POLICIES AND ESTIMATES

The Company’s discussion and analysis of its financial condition and results of operations are based upon the Company’s

consolidated financial statements which have been prepared in accordance with accounting principles generally accepted in the

United States of America. The preparation of these consolidated financial statements requires the Company to make estimates and

assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. Since actual results may differ from

those estimates, the Company revises its estimates and assumptions as new information becomes available.

The Company believes the following policies are the most critical to the portrayal of the Company’s financial condition and results

of operations.

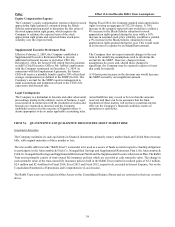

Policy Effect if Actual Results Differ from Assumptions

Revenue Recognition

The Company reserves for sales returns through estimates

based on historical experience and various other assumptions

that management believes to be reasonable.

The Company has not made any material changes in the

accounting methodology used to determine the sales return

reserve over the past three fiscal years.

The Company does not expect material changes in the near

term to the underlying assumptions used to measure the sales

return reserve as of January 31, 2015. However, changes in

these assumptions do occur, and, should those changes be

significant, the Company may be exposed to gains or losses

that could be material.

Inventory Valuation

The Company reduces the inventory valuation when the cost

of specific inventory items on hand exceeds the amount

expected to be realized from the ultimate sale or disposal of

the goods through a lower of cost or market ("LCM") reserve.

The Company does not expect material changes in the near

term to the underlying assumptions used to determine the

shrink reserve or the LCM reserve as of January 31, 2015.

However, changes in these assumptions do occur, and, should

those changes be significant, they could significantly impact

the ending inventory valuation at cost, as well as the resulting

gross margin.

An increase or decrease in the LCM reserve of 10% would

have affected pre-tax income by approximately $1.3 million

for Fiscal 2014.

Additionally, as part of inventory valuation, an inventory

shrink estimate is made each period that reduces the value of

inventory for lost or stolen items.

An increase or decrease in the inventory shrink accrual of

10% would have affected pre-tax income by approximately

$1.1 million for Fiscal 2014.