Abercrombie & Fitch 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

64

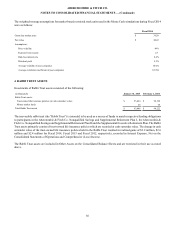

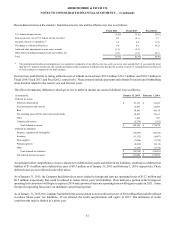

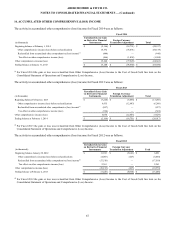

A summary of future minimum payments under the Term Loan facility is as follows (in thousands):

Fiscal 2015 $ 3,000

Fiscal 2016 $ 3,000

Fiscal 2017 $ 3,000

Fiscal 2018 $ 3,000

Fiscal 2019 $ 3,000

Thereafter $ 284,250

Guarantees and Security

All obligations under the 2014 Credit Facilities are unconditionally guaranteed by A&F and certain of its subsidiaries. The ABL

Facility is secured by a first-priority security interest in certain working capital of the borrowers and guarantors consisting of

inventory, accounts receivable and certain other assets. The Term Loan Facility is secured by a second-priority security interest in

the same collateral, with certain exceptions. The Term Loan Facility is also secured by a first-priority security interest in certain

property and assets of the borrowers and guarantors, including certain fixed assets, intellectual property, stock of subsidiaries and

certain after-acquired material real property. The ABL Facility is secured by a second-priority security interest in the same collateral.

Interest and Fees

Amounts borrowed under the ABL Facility bear interest, at the Company's option, at either an adjusted LIBOR rate plus a margin

of 1.25% to 1.75% per annum, or an alternate base rate plus a margin of 0.25% to 0.75% per annum. The initial applicable margins

with respect to LIBOR loans and base rate loans, including swing line loans, under the ABL Facility are 1.50% and 0.50% per

annum, respectively, and are subject to adjustment each fiscal quarter beginning January 31, 2015, based on average historical

excess availability during the preceding quarter. The Company is also required to pay a fee of 0.25% per annum on undrawn

commitments under the ABL Facility. Customary agency fees and letter of credit fees are also payable in respect of the ABL

Facility.

At the Company's option, borrowings under the Term Loan Facility will bear interest at either (a) an adjusted LIBOR rate no lower

than 1.00% plus a margin of 3.75% per annum or (b) an alternate base rate plus a margin of 2.75% per annum. Customary agency

fees are also payable in respect of the Term Loan Facility.

The interest rate on borrowings under the Term Loan Facility was 4.75% as of January 31, 2015.

Representations, Warranties and Covenants

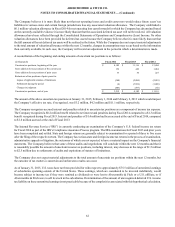

The 2014 Credit Facilities contain various representations, warranties and restrictive covenants that, among other things and subject

to specified exceptions, restrict the ability of A&F and its subsidiaries to incur indebtedness (including guarantees), grant liens,

make investments, pay dividends or distributions with respect to capital stock, make prepayments on other indebtedness, engage

in mergers, dispose of certain assets or change the nature of their business. In addition, excess availability equal to the greater of

10% of the loan cap or $30 million must be maintained under the ABL Facility. The 2014 Credit Facilities do not otherwise contain

financial maintenance covenants.

The Company was in compliance with the covenants under the 2014 Credit Facilities as of January 31, 2015.

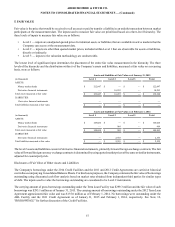

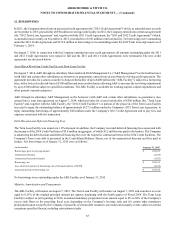

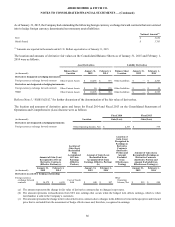

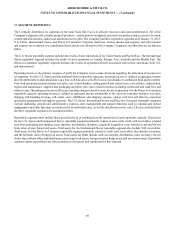

13. DERIVATIVES

The Company is exposed to risks associated with changes in foreign currency exchange rates and uses derivatives, primarily

forward contracts, to manage the financial impacts of these exposures. The Company does not use forward contracts to engage in

currency speculation and does not enter into derivative financial instruments for trading purposes.

In order to qualify for hedge accounting treatment, a derivative must be considered highly effective at offsetting changes in either

the hedged item’s cash flows or fair value. Additionally, the hedge relationship must be documented to include the risk management

objective and strategy, the hedging instrument, the hedged item, the risk exposure, and how hedge effectiveness will be assessed