Abercrombie & Fitch 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

56

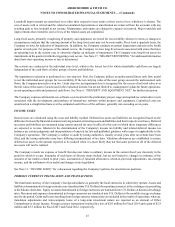

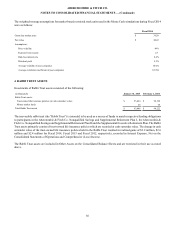

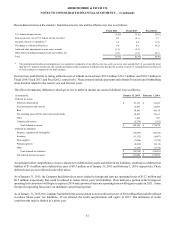

The weighted-average assumptions for market-based restricted stock units used in the Monte Carlo simulations during Fiscal 2014

were as follows:

Fiscal 2014

Grant date market price $ 36.20

Fair value $ 40.42

Assumptions:

Price volatility 49%

Expected term (years) 2.7

Risk-free interest rate 0.8%

Dividend yield 2.2%

Average volatility of peer companies 36.0%

Average correlation coefficient of peer companies 0.3704

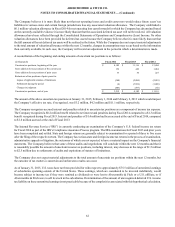

4. RABBI TRUST ASSETS

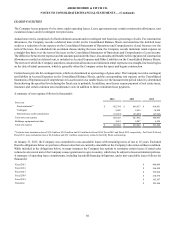

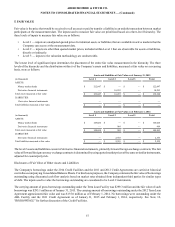

Investments of Rabbi Trust assets consisted of the following:

(in thousands) January 31, 2015 February 1, 2014

Rabbi Trust assets:

Trust-owned life insurance policies (at cash surrender value) $ 93,424 $ 90,198

Money market funds 24 24

Total Rabbi Trust assets $ 93,448 $ 90,222

The irrevocable rabbi trust (the “Rabbi Trust”) is intended to be used as a source of funds to match respective funding obligations

to participants in the Abercrombie & Fitch Co. Nonqualified Savings and Supplemental Retirement Plan I, the Abercrombie &

Fitch Co. Nonqualified Savings and Supplemental Retirement Plan II and the Supplemental Executive Retirement Plan. The Rabbi

Trust assets primarily consist of trust-owned life insurance policies which are recorded at cash surrender value. The change in cash

surrender value of the trust-owned life insurance policies held in the Rabbi Trust resulted in realized gains of $3.2 million, $2.6

million and $2.4 million for Fiscal 2014, Fiscal 2013 and Fiscal 2012, respectively, recorded in Interest Expense, Net on the

Consolidated Statements of Operations and Comprehensive (Loss) Income.

The Rabbi Trust assets are included in Other Assets on the Consolidated Balance Sheets and are restricted in their use as noted

above.