Abercrombie & Fitch 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

52

RECENT ACCOUNTING PRONOUNCEMENTS

In July 2013, the Financial Accounting Standards Board ("FASB") issued Account Standards Update ("ASU") No. 2013-11,

"Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit

Carryforward Exists," which amends Accounting Standards Codification ("ASC") 740, "Income Taxes." The amendments provide

guidance on the financial statement presentation of an unrecognized tax benefit as either a reduction of a deferred tax asset or as

a liability, when a net operating loss carryforward, similar tax loss or a tax credit carryforward exists. The amendments were

effective at the beginning of Fiscal 2014. The adoption of this guidance did not have an impact on the Company's consolidated

financial statements.

In May 2014, FASB issued ASU No. 2014-09, "Revenue from Contracts with Customers," which supersedes the revenue recognition

requirements in "Revenue Recognition (Topic 605)." The new ASC guidance requires entities to recognize revenue in a way that

depicts the transfer of promised goods or services to customers in an amount that reflects the consideration which the entity expects

to be entitled to in exchange for those goods or services. This guidance is effective for the Company beginning Fiscal 2017, and

is to be applied retrospectively, with early application not permitted. The Company is currently evaluating the potential impact of

this standard.

In June 2014, FASB issued ASU No. 2014-12, "Accounting for Share-Based Payments When the Terms of an Award Provide That

a Performance Target Could Be Achieved after the Requisite Service Period," which amends ASC 718, "Compensation—Stock

Compensation." The amendment provides guidance on the treatment of share-based payments awards with a specific performance

target, requiring that a performance target that affects vesting and that could be achieved after the requisite service period be treated

as a performance condition. This guidance is effective for the Company at the beginning of Fiscal 2016 with early adoption

permitted. The adoption of this amendment is not expected to have a material impact on the Company's consolidated financial

statements.

In February 2015, FASB issued ASU No. 2015-02, "Consolidation (Topic 810): Amendments to the Consolidation Analysis."

These amendments provide guidance which change the analysis that a reporting entity must perform to determine whether it should

consolidate certain types of legal entities. This guidance is effective for the Company at the beginning of Fiscal 2017 with early

adoption permitted. The adoption of this amendment is not expected to have a material impact on the Company's consolidated

financial statements.

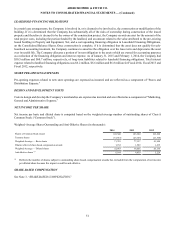

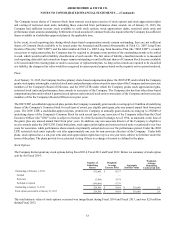

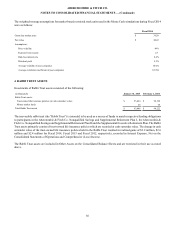

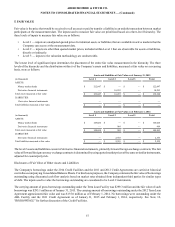

3. SHARE-BASED COMPENSATION

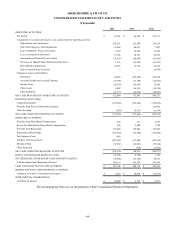

Financial Statement Impact

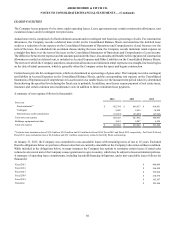

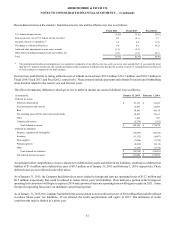

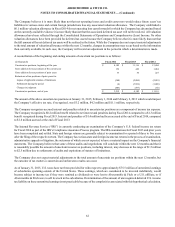

The Company recognized share-based compensation expense of $23.0 million, $53.5 million and $52.9 million for Fiscal 2014,

Fiscal 2013 and Fiscal 2012, respectively. The Company also recognized $8.6 million, $20.3 million and $20.1 million in tax

benefits related to share-based compensation for Fiscal 2014, Fiscal 2013 and Fiscal 2012, respectively.

The fair value of share-based compensation awards is recognized as compensation expense primarily on a straight-line basis over

the awards’ requisite service period, net of estimated forfeitures, with the exception of performance share awards. Performance

share award expense is primarily recognized in the performance period of the awards' requisite service period. For awards that are

expected to result in a tax deduction, a deferred tax asset is recorded in the period in which share-based compensation expense is

recognized. A current tax deduction arises upon the vesting of restricted stock units and performance share awards or the exercise

of stock options and stock appreciation rights and is principally measured at the award’s intrinsic value. If the tax deduction is

greater than the recorded deferred tax asset, the tax benefit associated with any excess deduction is considered an excess tax benefit

and is recognized as additional paid-in capital. If the tax deduction is less than the recorded deferred tax asset, the resulting

difference, or shortfall, is first charged to additional paid-in capital, to the extent of the windfall pool of excess tax benefits, with

any remainder recognized as tax expense. The Company’s windfall pool of excess tax benefits as of January 31, 2015, is sufficient

to fully absorb any shortfall which may develop associated with awards currently outstanding.

The Company adjusts share-based compensation expense on a quarterly basis for actual forfeitures and for changes to the estimate

of expected award forfeitures. The effect of adjusting the forfeiture rate is recognized in the period the forfeiture estimate is changed.

The effect of adjustments for forfeitures was $2.6 million, $2.3 million and $1.3 million for Fiscal 2014, Fiscal 2013 and Fiscal

2012, respectively.