Abercrombie & Fitch 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

60

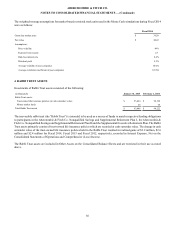

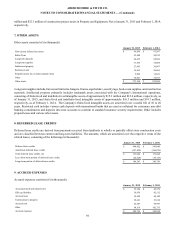

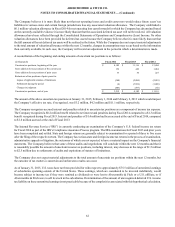

Accrued payroll and related costs include salaries, incentive compensation, benefits, withholdings and other payroll related costs.

Other accrued expenses include expenses incurred but not yet paid related to outside services associated with store and home

office operations.

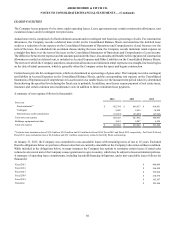

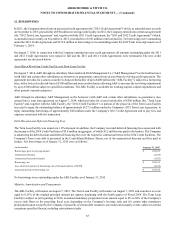

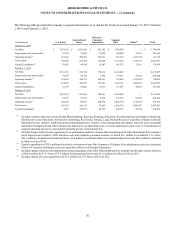

10. OTHER LIABILITIES

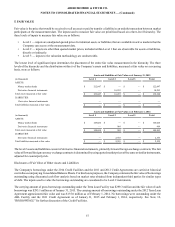

Other liabilities consisted of (in thousands):

January 31, 2015 February 1, 2014

Accrued straight-line rent $ 99,108 $ 114,001

Deferred compensation 56,244 87,385

Uncertain tax positions, including interest and penalties 4,572 5,777

Other 21,362 24,594

Other liabilities $ 181,286 $ 231,757

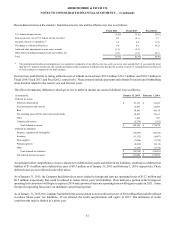

Deferred compensation includes the Supplemental Executive Retirement Plan (the “SERP”), the Abercrombie & Fitch Co. Savings

and Retirement Plan and the Abercrombie & Fitch Nonqualified Savings and Supplemental Retirement Plan, all further discussed

in Note 16, “RETIREMENT BENEFITS,” as well as deferred Board of Directors compensation and other accrued retirement

benefits.

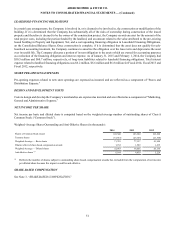

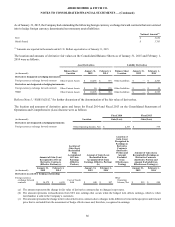

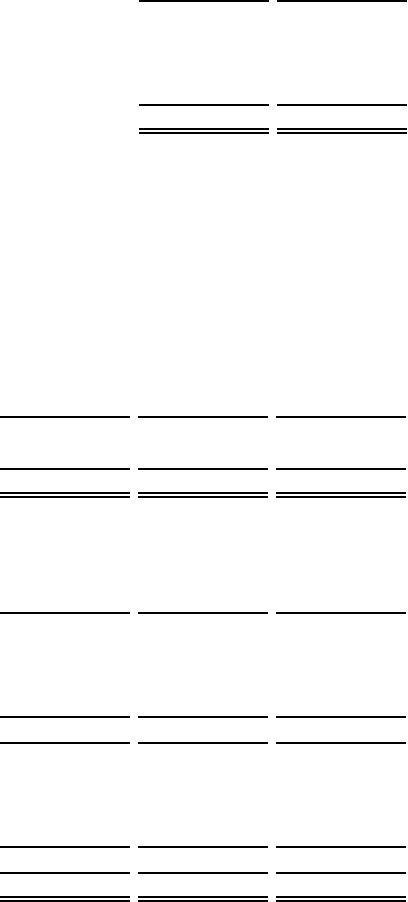

11. INCOME TAXES

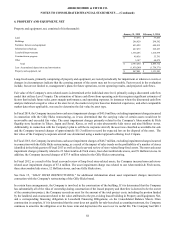

Income before taxes was comprised of:

(in thousands) Fiscal 2014 Fiscal 2013 Fiscal 2012

Domestic $ 100,115 $ 37,325 $ 302,589

Foreign (961) 35,952 64,356

Total $ 99,154 $ 73,277 $ 366,945

Domestic income above includes intercompany charges to foreign affiliates for management fees, cost-sharing, royalties, including

those related to international direct-to-consumer operations and interest. The provision for tax expense consisted of:

(in thousands) Fiscal 2014 Fiscal 2013 Fiscal 2012

Current:

Federal $ 21,287 $ 52,579 $ 111,761

State 1,944 (4,988) 15,323

Foreign 28,614 17,851 17,984

$ 51,845 $ 65,442 $ 145,068

Deferred:

Federal $ 8,971 $ (36,732) $ (10,456)

State 1,783 (4,606) 458

Foreign (15,266) (5,455) (5,136)

$ (4,512) $ (46,793) $ (15,134)

Total provision $ 47,333 $ 18,649 $ 129,934