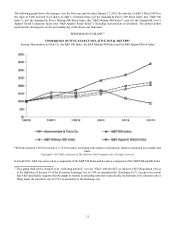

Abercrombie & Fitch 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS.

OVERVIEW

The Company is a specialty retailer that operates stores in North America, Europe, Asia, Australia and the Middle East and direct-

to-consumer operations in North America, Europe and Asia that service its brands throughout the world. The Company sells casual

sportswear apparel, including knit tops and woven shirts, graphic t-shirts, fleece, jeans and woven pants, shorts, sweaters, and

outerwear; personal care products; and accessories for men, women and kids under the Abercrombie & Fitch, abercrombie kids

and Hollister brands. The Company also sells bras, underwear, personal care products, sleepwear and at-home products for girls

through Hollister under the Gilly Hicks brand.

The Company’s fiscal year ends on the Saturday closest to January 31, typically resulting in a fifty-two week year, but occasionally

giving rise to an additional week, resulting in a fifty-three week year as was the case for Fiscal 2012. A store is included in

comparable sales when it has been open as the same brand at least one year and its square footage has not been expanded or reduced

by more than 20% within the past year. Additionally, beginning with Fiscal 2012, comparable direct-to-consumer sales were

included in comparable sales. Direct-to-Consumer comparable sales is computed using net sales in current and prior years converted

at the current year's exchange rate to remove the impact of currency fluctuation.

For purposes of this “ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS,” the fifty-two week period ended January 31, 2015 is compared to the fifty-two week period ended

February 1, 2014 and the fifty-two week period ended February 1, 2014 is compared to the fifty-three week period ended February 2,

2013.

On December 8, 2014, Michael S. Jeffries retired from his position as Chief Executive Officer and resigned as a Director of the

Company, effective immediately. The Company's Board of Directors did not appoint an Interim Chief Executive Officer, but

appointed Arthur C. Martinez, the Non-Executive Chairman of the Board, to serve as Executive Chairman of the Board and

appointed Jonathan E. Ramsden, the Company's Chief Operating Officer, to serve as Interim Principal Executive Officer. The

Company's Board of Directors also formed an Office of the Chairman, whose members are Arthur C. Martinez, Jonathan E.

Ramsden, Christos E. Angelides, Brand President of Abercrombie & Fitch and abercrombie kids, and Fran Horowitz, Brand

President of Hollister, until a new Chief Executive Officer is appointed.

Mr. Jeffries' employment with the Company terminated on December 31, 2014. In connection with his retirement, Mr. Jeffries

entered into a Retirement Agreement with the Company, providing him compensation as if his employment had been terminated

without cause pursuant to his Employment Agreement dated December 9, 2013. As a result and in addition to any benefits Mr.

Jeffries is entitled to upon retirement, as set forth in the Company's most recent definitive proxy statement on Schedule 14A, filed

with the SEC on May 13, 2014, Mr. Jeffries will also receive payments of approximately $5.5 million in cash and benefits

continuation, and the Company incurred a pre-tax charge of approximately $4.7 million in the fourth quarter of Fiscal 2014.

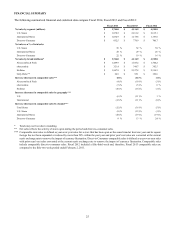

The Company had net sales of $3.744 billion for Fiscal 2014, a decrease of 9% from net sales of $4.117 billion for Fiscal 2013.

For Fiscal 2014, U.S. Stores net sales decreased 13% to $1.879 billion, International Stores net sales decreased 12% to $1.033

billion and Direct-to-Consumer net sales, including shipping and handling revenue, increased 7% to $832.5 million.

Operating income was $113.5 million for Fiscal 2014, compared to operating income of $80.8 million for Fiscal 2013. For Fiscal

2014, operating income for U.S. Stores increased 34% to $261.4 million, International Stores decreased 18% to $204.3 million

and Direct-to-Consumer decreased 9% to $269.6 million. Operating loss not attributable to a segment decreased 6% to $621.8

million.

Net income was $51.8 million and net income per diluted share was $0.71 in Fiscal 2014 compared to net income of $54.6 million

and net income per diluted share of $0.69 in Fiscal 2013.

Excluding certain charges detailed in the GAAP to non-GAAP financial measures reconciliation below, the Company reported

adjusted non-GAAP operating income of $191.7 million, net income of $112.3 million and net income per diluted shares of $1.54

for Fiscal 2014, compared to adjusted non-GAAP operating income of $222.9 million, net income of $150.6 million and net income

per diluted share of $1.91 for Fiscal 2013.

The Company believes that the non-GAAP financial measures discussed above are useful to investors as they provide the ability

to measure the Company's operating performance and compare it against that of prior periods without reference to the impact of

charges related to asset impairment, store closures, restructuring of the Gilly Hicks brand, CEO transition costs, the Company's