Abercrombie & Fitch 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

55

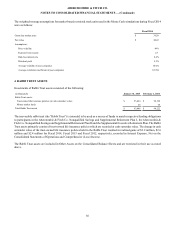

Restricted Stock Units

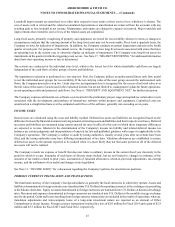

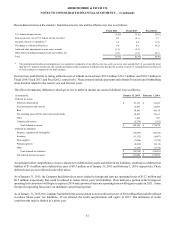

The following table summarizes the activity for restricted stock units for Fiscal 2014:

Service-based Restricted Stock

Units Performance-based Restricted

Stock Units Market-based Restricted Stock

Units

Number of

Underlying

Shares

Weighted-

Average Grant

Date Fair Value

Number of

Underlying

Shares

Weighted-

Average Grant

Date Fair Value

Number of

Underlying

Shares

Weighted-

Average Grant

Date Fair Value

Unvested at February 1, 2014 1,162,825 $ 47.15 263,754 $ 40.93 — $ —

Granted 1,019,363 32.45 177,006 26.61 88,500 42.44

Adjustments for performance

achievement relative to award target — — (98,483) 44.51 — —

Vested (355,796) 48.00 (10,002) 51.50 — —

Forfeited (260,120) 44.59 (126,855) 31.71 (52,126) 44.05

Unvested at January 31, 2015 1,566,272 $ 37.81 205,420 $ 32.05 36,374 $ 40.13

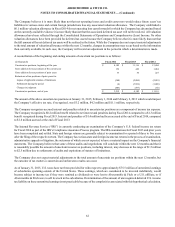

The fair value of both service-based and performance-based restricted stock units is calculated using the market price of the

underlying Common Stock on the date of grant reduced for anticipated dividend payments on unvested shares. In determining the

fair value, the Company does not take into account any performance-based vesting requirements. The performance-based vesting

requirements are taken into account in determining the number of awards expected to vest and the related expense. However, for

market-based restricted stock units, the fair value is calculated using a Monte Carlo simulation with the number of shares that

ultimately vest dependent on the Company's total stockholder return measured against the total stockholder return of a select group

of peer companies over a three-year period. For any award with performance-based or market-based vesting requirements, the

number of shares that ultimately vest can vary from 0% - 200% of target depending on the level of achievement of performance

criteria.

Service-based restricted stock units are expensed on a straight-line basis over the total requisite service period, net of forfeitures.

Performance-based restricted stock units are expensed on an accelerated attribution basis, net of forfeitures. Market-based restricted

stock units without graded vesting features are expensed on a straight-line basis over the requisite service period, net of forfeitures.

As of January 31, 2015, there was $33.6 million, $0.8 million, and $1.0 million of total unrecognized compensation cost, net of

estimated forfeitures, related to service-based, performance-based and market-based restricted stock units, respectively. The

unrecognized compensation cost is expected to be recognized over a weighted-average period of 16 months, 7 months, and 14

months for service-based, performance-based and market-based restricted stock units, respectively.

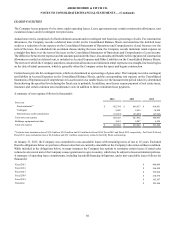

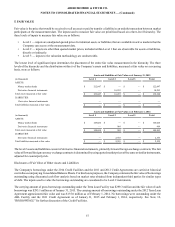

Additional information pertaining to restricted stock units for Fiscal 2014, Fiscal 2013 and Fiscal 2012 follows:

(in thousands) Fiscal 2014 Fiscal 2013 Fiscal 2012

Service-based Restricted Stock Units:

Total grant date fair value of awards granted $ 33,075 $ 23,192 $ 29,297

Total grant date fair value of awards vested 17,078 14,535 19,532

Performance-based Restricted Stock Units:

Total grant date fair value of awards granted $ 4,709 $ 10,814 $ 773

Total grant date fair value of awards vested 515 515 —

Market-based Restricted Stock Units:

Total grant date fair value of awards granted $ 3,756 $ — $ —

Total grant date fair value of awards vested — — —