Abercrombie & Fitch 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

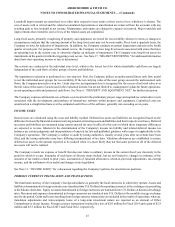

Policy Effect if Actual Results Differ from Assumptions

Property and Equipment

Long-lived assets, primarily comprising of property and

equipment, are tested for recoverability whenever events or

changes in circumstances indicate that the carrying amount of

the long-lived asset might not be recoverable. On at least a

quarterly basis, the Company reviews for indicators of

impairment. In addition, the Company conducts an annual

impairment analysis in the fourth quarter of each year. For the

purposes of the annual review, the Company reviews long-

lived assets associated with stores that have an operating loss

in the current year or otherwise display an indicator of

impairment.

Based on the impact of current sales trends, a number of

stores were tested for impairment during the third quarter. In

addition, the Company performed the annual review during

the fourth quarter. The stores that were tested and not

impaired had a net asset group value of $3.6 million and had

undiscounted cash flows which were in the range of 100% to

150% of their respective net asset values.

The Company’s impairment assessment requires management

to make assumptions and judgments related to factors used in

the evaluation for impairment, including, but not limited to,

management's expectations for future operations and

projected cash flows. The key assumptions used in the

Company's undiscounted future cash flow model include

sales, gross margin and, to a lesser extent, operating

expenses.

A 10% decrease in the sales assumption used to project future

cash flows in the fourth quarter of Fiscal 2014 impairment

test would have increased the impairment charge by

approximately $2.0 million.

Income Taxes

The provision for income taxes is determined using the asset

and liability approach. Tax laws often require items to be

included in tax filings at different times than the items are

being reflected in the financial statements. A current liability

is recognized for the estimated taxes payable for the current

year. Deferred taxes represent the future tax consequences

expected to occur when the reported amounts of assets and

liabilities are recovered or paid. Deferred taxes are adjusted

for enacted changes in tax rates and tax laws. Valuation

allowances are recorded to reduce deferred tax assets when it

is more likely than not that a tax benefit will not be realized.

The Company does not expect material changes in the

judgments, assumptions or interpretations used to calculate

the tax provision for Fiscal 2014. However, changes in these

assumptions may occur and should those changes be

significant, they could have a material impact on the

Company’s income tax provision.

A provision for U.S. income tax has not been recorded on

undistributed profits of non-U.S. subsidiaries that the

Company has determined to be indefinitely reinvested outside

the U.S. Determination of the amount of unrecognized

deferred U.S. income tax liability on these unremitted

earnings is not practicable because of the complexities

associated with this hypothetical calculation.

If the Company’s intention or U.S. and/or international tax

law changes in the future, there may be a material negative

impact on the provision for income taxes to record an

incremental tax liability in the period the change occurs.

The Company recognizes accrued interest and penalties

related to uncertain tax positions as a component of tax

expense upon settlement, law changes or expiration of statute

of limitations.

Of the total uncertain tax positions, it is reasonably possible

that $1.5 million to $2.5 million could change in the next 12

months due to audit settlements, expiration of statutes of

limitations or other resolution of uncertainties. Due to the

uncertain and complex application of tax laws and/or

regulations, it is possible that the ultimate resolution of audits

may result in amounts which could be different from this

estimate. In such case, the Company will record an

adjustment in the period in which such matters are effectively

settled.