Abercrombie & Fitch 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Loan Facility were used to repay the outstanding balance of approximately $127.5 million under the Company's 2012 term loan

agreement, to repay outstanding borrowings of approximately $60 million under the Company's 2011 credit agreement and to pay

fees and expenses associated with the transaction.

Maturity, Amortization, Prepayments and Interest

The ABL Facility will mature on August 7, 2019. The Term Loan Facility will mature on August 7, 2021 and amortizes at a rate

equal to 0.25% of the original principal amount per quarter, beginning with the fourth quarter of Fiscal 2014. The Term Loan

Facility is subject to (a) beginning in 2016, an annual mandatory prepayment in an amount equal to 0% to 50% of the Company's

excess cash flows in the preceding fiscal year, depending on the Company's leverage ratio and (b) certain other mandatory

prepayments upon receipt by the Company of proceeds of certain debt issuances, asset sales and casualty events, subject to certain

exceptions specified therein, including reinvestment rights. The interest rate on borrowings under the Term Loan Facility was

4.75% as of January 31, 2015. The gross amount outstanding under the Term Loan Facility was $299.3 million as of January 31,

2015.

The Company's credit facilities are described in Note 12, "BORROWINGS" of the Notes to the Consolidated Financial Statements

included in "ITEM 8. FINANCIAL STATEMENT AND SUPPLEMENTARY DATA," of this Annual Report on Form 10-K.

Operating Activities

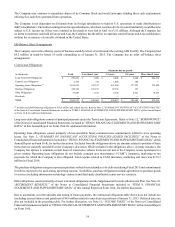

Net cash provided by operating activities was $312.5 million for Fiscal 2014 compared to $175.5 million for Fiscal 2013 and

$684.2 million for Fiscal 2012. The increase in net cash provided by operating activities from Fiscal 2013 was primarily driven

by changes in inventory and accounts payable and accrued expenses. The decrease in net cash provided by operating activities in

Fiscal 2013 from Fiscal 2012 was primarily driven by lower net income, adjusted for non-cash items, including asset impairment

charges, and changes in inventory and income taxes.

Investing Activities

Cash outflows for investing activities in Fiscal 2014, Fiscal 2013 and Fiscal 2012 were used primarily for capital expenditures

related to new stores, store refreshes and remodels, information technology, distribution center and other home office projects.

Financing Activities

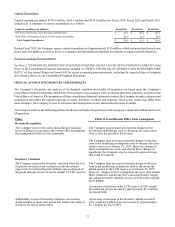

For Fiscal 2014, cash outflows for financing activities consisted primarily of the repurchase of A&F's Common Stock of $285.0

million, the repayment of borrowings of $195.8 million and the payment of dividends of $57.4 million. For Fiscal 2013, cash

outflows for financing activities consisted primarily of the repurchase of A&F's Common Stock of $115.8 million, the payment

of dividends of $61.9 million and the repayment of borrowings of $15.0 million. For Fiscal 2012, cash outflows for financing

activities consisted primarily of the repurchase of A&F’s Common Stock of $321.7 million, the repayment of borrowings of $135.0

million and the payment of dividends of $57.6 million. For Fiscal 2014, Fiscal 2013, and Fiscal 2012, cash inflows from financing

activities consisted primarily of proceeds from borrowings of $357.0 million, $150.0 million and $135.0 million, respectively.

During Fiscal 2014, A&F repurchased approximately 7.3 million shares of A&F’s Common Stock, of which approximately 3.5

million shares with a market value of approximately $135.0 million were purchased in the open market and approximately 3.8

million shares with an aggregate cost of $150.0 million were purchased pursuant to an accelerated share repurchase agreement.

During Fiscal 2013, A&F repurchased approximately 2.4 million shares of A&F's Common Stock in the open market with a market

value of $115.8 million. During Fiscal 2012, A&F repurchased approximately 7.5 million shares of A&F’s Common Stock in the

open market with a market value of $321.7 million. Repurchase of A&F's Common Stock were made pursuant to the A&F Board

of Directors' authorizations.

As of January 31, 2015, A&F had approximately 9.0 million remaining shares available for repurchase as part of the A&F Board

of Directors’ previously approved authorization.

Future Cash Requirements and Sources of Cash

Over the next 12 months, the Company’s primary cash requirements will be to fund operating activities, including the acquisition

of inventory, and obligations related to compensation, leases, taxes and other operating activities, as well as to fund capital

expenditures and quarterly dividends to stockholders subject to approval by the Company's Board of Directors. The Company has

availability under the ABL Facility as a source of additional funding.