Abercrombie & Fitch 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

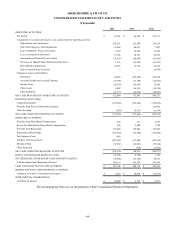

A&F has historically paid quarterly dividends on its Common Stock. There are no amounts included in the above table related to

dividends due to the fact that dividends are subject to determination and approval by A&F's Board of Directors.

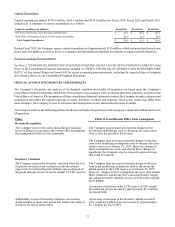

Gilly Hicks Restructuring

As previously announced, on November 1, 2013, A&F’s Board of Directors approved the closure of the Company’s 24 stand-

alone Gilly Hicks stores. The Company substantially completed the store closures as planned by the end of the first quarter of

Fiscal 2014. The Company continues to offer Gilly Hicks products through the Hollister direct-to-consumer channel.

As a result of exiting the Gilly Hicks branded stores, the Company currently estimates that it will incur aggregate pre-tax charges

of approximately $91.2 million, of which $8.4 million in charges, primarily related to lease terminations and asset impairment,

was recognized during Fiscal 2014 and $81.5 million was recognized during Fiscal 2013.

Below is a summary of the aggregate pre-tax charges incurred through January 31, 2015 related to the closure of the Gilly Hicks

branded stores (in thousands):

Lease terminations and store closure costs $ 48,665

Asset impairment 40,036

Other 1,230

Total charges (1) $ 89,931

(1) As of January 31, 2015, the Company incurred aggregate pre-tax charges related to restructuring plans for the Gilly Hicks brand of $50.4

million for the U.S. Stores segment and $39.5 million for the International Stores segment.

The remaining charges, primarily lease-related, including the net present value of payments related to lease terminations, potential

sub-lease losses and other lease-related costs of approximately $1.3 million, are expected to be recognized over the remaining

lease terms. These estimates are based on a number of significant assumptions and could change materially.

Costs associated with exit or disposal activities are recorded when the liability is incurred. Below is a roll forward of the liabilities

recognized on the Consolidated Balance Sheet as of January 31, 2015, related to the closure of the Gilly Hicks stores (in thousands):

Accrued liability as of February 1, 2014 $ 42,507

Costs incurred 11,631

Cash payments (48,141)

Accrued liability as of January 31, 2015 $ 5,997