Abercrombie & Fitch 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

65

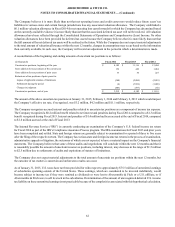

prospectively and retrospectively. The extent to which a hedging instrument has been, and is expected to continue to be, effective

at offsetting changes in fair value or cash flows is assessed and documented at least quarterly. Any hedge ineffectiveness is reported

in current period earnings and hedge accounting is discontinued if it is determined that the derivative is not highly effective.

For derivatives that either do not qualify for hedge accounting or are not designated as hedges, all changes in the fair value of the

derivative are recognized in earnings. For qualifying cash flow hedges, the effective portion of the change in the fair value of the

derivative is recorded as a component of Other Comprehensive (Loss) Income (“OCI”) and recognized in earnings when the

hedged cash flows affect earnings. The ineffective portion of the derivative gain or loss, as well as changes in the fair value of the

derivative’s time value are recognized in current period earnings. The effectiveness of the hedge is assessed based on changes in

the fair value attributable to changes in spot prices. The changes in the fair value of the derivative contract related to the changes

in the difference between the spot price and the forward price are excluded from the assessment of hedge effectiveness and are

also recognized in current period earnings. If the cash flow hedge relationship is terminated, the derivative gains or losses that are

deferred in OCI will be recognized in earnings when the hedged cash flows occur. However, for cash flow hedges that are terminated

because the forecasted transaction is not expected to occur in the original specified time period, or a two-month period thereafter,

the derivative gains or losses are immediately recognized in earnings.

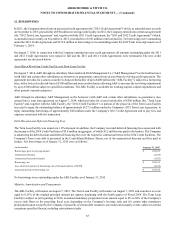

The Company uses derivative instruments, primarily forward contracts designated as cash flow hedges, to hedge the foreign

currency exposure associated with forecasted foreign-currency-denominated inter-company inventory sales to foreign subsidiaries

and the related settlement of the foreign-currency-denominated inter-company accounts receivable. Fluctuations in exchange rates

will either increase or decrease the Company’s inter-company equivalent cash flows and affect the Company’s U.S. dollar earnings.

Gains or losses on the foreign currency exchange forward contracts that are used to hedge these exposures are expected to partially

offset this variability. Foreign currency exchange forward contracts represent agreements to exchange the currency of one country

for the currency of another country at an agreed-upon settlement date. These forward contracts typically have a maximum term

of 12 months. The sale of the inventory to the Company’s customers will result in the reclassification of related derivative gains

and losses that are reported in Accumulated Other Comprehensive (Loss) Income. Substantially all of the unrealized gains or

losses related to designated cash flows hedges as of January 31, 2015 will be recognized in cost of goods sold over the next twelve

months.

The Company presents its derivative assets and derivative liabilities at their gross fair values on the Consolidated Balance Sheets.

However, our master netting and other similar arrangements allow net settlements under certain conditions.

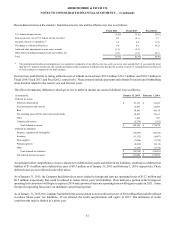

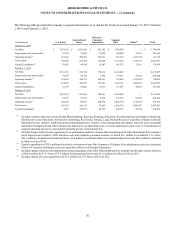

As of January 31, 2015, the Company had the following outstanding foreign currency exchange forward contracts that were entered

into to hedge either a portion, or all, of forecasted foreign-currency-denominated inter-company inventory sales, the resulting

settlement of the foreign-currency-denominated inter-company accounts receivable, or both:

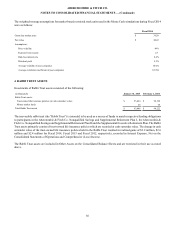

Notional Amount(1)

Euro $ 53,120

British Pound $ 18,345

Canadian Dollar $ 10,705

(1) Amounts are reported in thousands and in U.S. Dollars equivalent as of January 31, 2015.

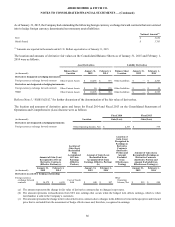

The Company also uses foreign currency exchange forward contracts to hedge certain foreign-currency-denominated net monetary

assets/liabilities. Examples of monetary assets/liabilities include cash balances, receivables and payables. Fluctuations in exchange

rates result in transaction gains/(losses) being recorded in earnings as U.S. GAAP requires that monetary assets/liabilities be

remeasured at the spot exchange rate at quarter-end or upon settlement. The Company has chosen not to apply hedge accounting

to these instruments because there are no differences in the timing of gain or loss recognition on the hedging instrument and the

hedged item.