Abercrombie & Fitch 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

61

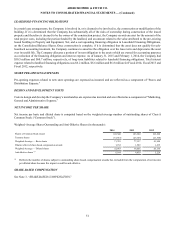

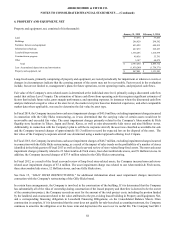

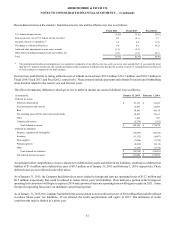

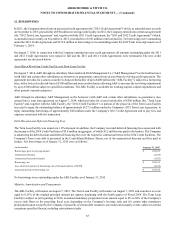

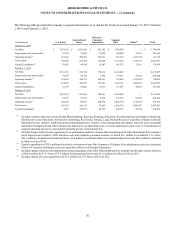

Reconciliation between the statutory federal income tax rate and the effective tax rate is as follows:

Fiscal 2014 Fiscal 2013 Fiscal 2012

U.S. Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of U.S. federal income tax effect 4.3 (4.1) 2.7

Taxation of non-U.S. operations (1) 5.4 2.0 (1.4)

Net change in valuation allowances 6.6 0.1 (0.2)

Audit and other adjustments to prior years' accruals (1.3) (5.6) —

Other items (including permanent items and credits), net (2.3) (1.9) (0.7)

Total 47.7% 25.5% 35.4%

(1) The jurisdictional location of earnings/losses is a significant component of our effective tax rate each year as tax rates outside the U.S. are generally lower

than the U.S. statutory income tax rate, and the rate impact of this component is influenced by the specific location of non-U.S. earnings/losses and the level

of such earnings as compared to our total earnings.

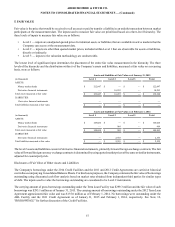

Income taxes paid directly to taxing authorities net of refunds received were $74.7 million, $116.3 million, and $122.5 million in

Fiscal 2014, Fiscal 2013, and Fiscal 2012, respectively. These amounts include payments and refunds for income and withholding

taxes incurred related to the current year and all prior years.

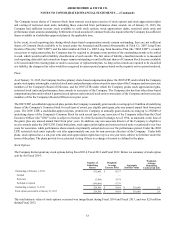

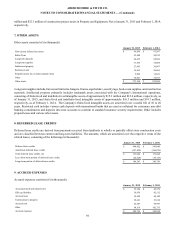

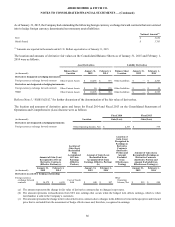

The effect of temporary differences which gives rise to deferred income tax assets (liabilities) were as follows:

(in thousands) January 31, 2015 February 1, 2014

Deferred tax assets:

Deferred compensation $ 83,157 $ 91,585

Accrued expenses and reserves 17,695 22,403

Rent 38,881 49,170

Net operating losses (NOL) and credit carryforwards 14,897 12,611

Other 1,403 307

Valuation allowances (6,730) (202)

Total deferred tax assets $ 149,303 $ 175,874

Deferred tax liabilities:

Property, equipment and intangibles (16,059) (36,266)

Inventory (11,332) (8,487)

Store supplies (7,046) (7,798)

Prepaid expenses (2,438) (2,116)

Other (1,424) (3,754)

Total deferred tax liabilities $ (38,299) $ (58,421)

Net deferred income tax assets $ 111,004 $ 117,453

Accumulated other comprehensive (loss) is shown net of deferred tax assets and deferred tax liabilities, resulting in a deferred tax

liability of $1.6 million and a deferred tax asset of $0.3 million as of January 31, 2015 and February 1, 2014, respectively. These

deferred taxes are not reflected in the table above.

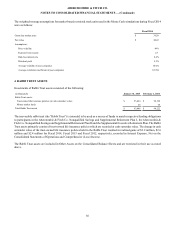

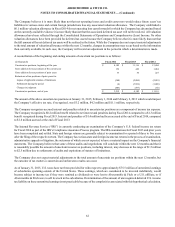

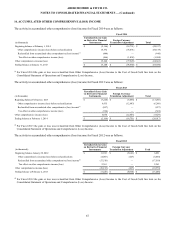

As of January 31, 2015, the Company had deferred tax assets related to foreign and state net operating losses of $12.7 million and

$0.2 million, respectively, that could be utilized to reduce future years’ tax liabilities. If not utilized, a portion of the foreign net

operating loss carryovers will begin to expire in 2016 and a portion of state net operating losses will begin to expire in 2021. Some

foreign net operating losses have an indefinite carryforward period.

As of January 31, 2015, the Company had deferred tax assets related to state credit carryovers of $2.0 million that could be utilized

to reduce future years’ tax liabilities. If not utilized, the credit carryforwards will expire in 2017. The utilization of credit

carryforwards may be limited in a given year.