Abercrombie & Fitch 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

51

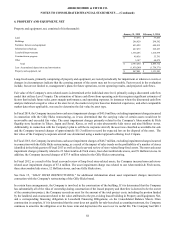

LEASEHOLD FINANCING OBLIGATIONS

In certain lease arrangements, the Company is involved in, or is deemed to be involved in, the construction or modification of the

building. If it is determined that the Company has substantially all of the risks of ownership during construction of the leased

property and therefore is deemed to be the owner of the construction project, the Company records an asset for the amount of the

total project costs, including the portion funded by the landlord, and an amount related to the value attributed to the pre-existing

leased building in Property and Equipment, Net, and a corresponding financing obligation in Leasehold Financing Obligations,

on the Consolidated Balance Sheets. Once construction is complete, if it is determined that the asset does not qualify for sale-

leaseback accounting treatment, the Company continues to amortize the obligation over the lease term and depreciates the asset

over its useful life. The Company allocates a portion of its rent obligation to the assets which are owned for accounting purposes

as a reduction of the financing obligation and interest expense. As of January 31, 2015 and February 1, 2014, the Company had

$50.5 million and $60.7 million, respectively, of long-term liabilities related to leasehold financing obligations. Total interest

expense related to landlord financing obligations was $6.2 million, $6.6 million and $6.8 million for Fiscal 2014, Fiscal 2013 and

Fiscal 2012, respectively.

STORE PRE-OPENING EXPENSES

Pre-opening expenses related to new store openings are expensed as incurred and are reflected as a component of "Stores and

Distribution Expense."

DESIGN AND DEVELOPMENT COSTS

Costs to design and develop the Company’s merchandise are expensed as incurred and are reflected as a component of “Marketing,

General and Administrative Expense.”

NET INCOME PER SHARE

Net income per basic and diluted share is computed based on the weighted-average number of outstanding shares of Class A

Common Stock (“Common Stock”).

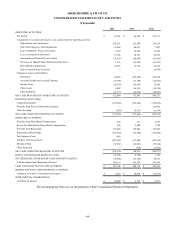

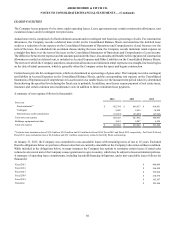

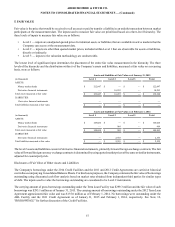

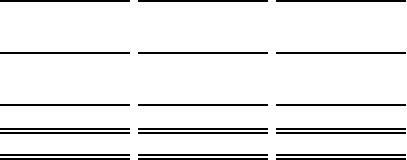

Weighted-Average Shares Outstanding and Anti-Dilutive Shares (in thousands):

2014 2013 2012

Shares of Common Stock issued 103,300 103,300 103,300

Treasury shares (31,515) (26,143) (21,360)

Weighted-Average — Basic shares 71,785 77,157 81,940

Dilutive effect of share-based compensation awards 1,152 1,509 1,235

Weighted-Average — Diluted shares 72,937 78,666 83,175

Anti-dilutive shares (1) 6,144 4,630 5,228

(1) Reflects the number of shares subject to outstanding share-based compensation awards but excluded from the computation of net income

per diluted share because the impact would be anti-dilutive.

SHARE-BASED COMPENSATION

See Note 3, “SHARE-BASED COMPENSATION.”