Abercrombie & Fitch 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

overall increase in total stockholder value of approximately $300 million. These SARs have an exercise price of $67.83 per share but are

currently underwater and have no intrinsic value.

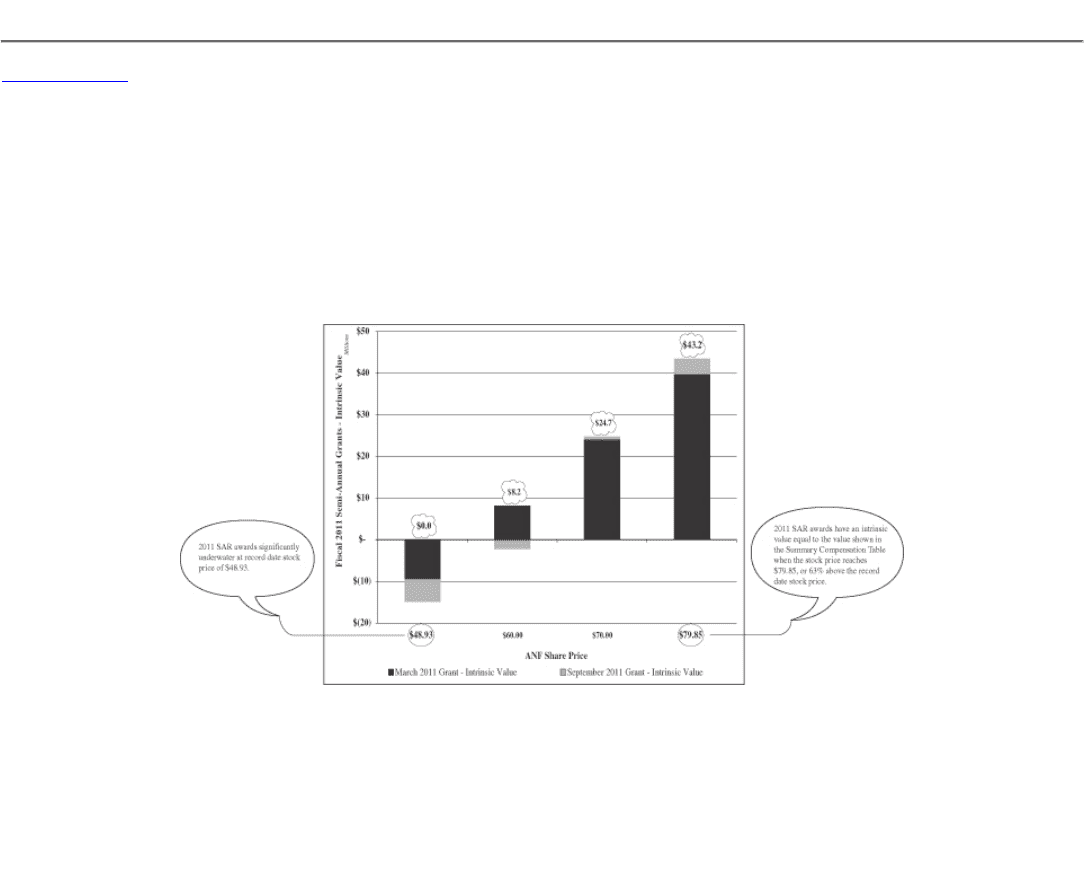

• The following table shows the intrinsic value of the SARs awarded in Fiscal 2011 based on various prices of our Common Stock. As reflected in

the table, in order for the SAR awards to have an intrinsic value equal to the grant date fair value reported in the "Fiscal 2011 Summary

Compensation Table," the price of the Company's Common Stock would need to be $79.85 or 63% above the record date stock price. At the

record date stock price, the awards are underwater by $14.9 million and, therefore, have no intrinsic value. In addition, equity awards granted to

the CEO are subject to time-based vesting requirements which must lapse before any value can be realized.

Intrinsic Value of Fiscal 2011 CEO Awards Versus Common Stock Price

• The CEO did not earn a semi-annual grant in March 2012 because the price of our Common Stock during the measurement period with respect to

the second half of Fiscal 2011 declined as compared to prior semi-annual periods.

• Since Fiscal 2008, the CEO has received no increase in the base salary set by his employment agreement.

• The CEO participated in the annual incentive compensation program for Fiscal 2011 on the same basis as other participants, earning an annual

cash incentive of 66% of the aggregate target on an annualized basis. Incentive payments were made at 165% of target for Spring 2011 when we

exceeded operating income goals, but no incentive payments were made for Fall 2011 since we did not meet our operating income goals. Please

see the section captioned "Annual Incentive Compensation Plan" beginning on page 49 of this Proxy Statement for more information.

6