Abercrombie & Fitch 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

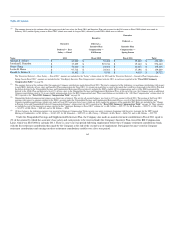

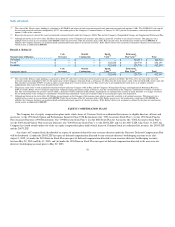

Audit-Related Fees for each of Fiscal 2011 and Fiscal 2010 represent fees relating to accounting research.

Tax Fees for Fiscal 2011 represent fees relating to customs and tax compliance matters.

All of the services rendered by PwC to the Company and its subsidiaries during Fiscal 2011 and Fiscal 2010 were pre-approved by the Audit

Committee.

PROPOSAL 3 — RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As noted above, PwC served as the Company's independent registered public accounting firm during Fiscal 2011 and, in that capacity, rendered a report

on the Company's consolidated financial statements as of and for the fiscal year ended January 28, 2012 and internal control over financial reporting as of

January 28, 2012. Subject to ratification by the stockholders, the Audit Committee of the Board has unanimously reappointed PwC as the independent

registered public accounting firm to audit the Company's consolidated financial statements and internal control over financial reporting for the current fiscal

year. Although the Company's governing documents do not require the submission of PwC's appointment to stockholders for ratification, the Company

believes it is desirable to do so. If the appointment of PwC is not ratified, the Audit Committee of the Board will reconsider the appointment.

Representatives of PwC are expected to be present at the Annual Meeting. They will be available to respond to appropriate questions and may make a

statement if they so desire.

THE AUDIT COMMITTEE AND THE BOARD UNANIMOUSLY RECOMMEND THAT YOU VOTE "FOR" THE RATIFICATION OF THE

APPOINTMENT OF PwC.

Required Vote

The ratification of the appointment of PwC as the Company's independent registered public accounting firm for the fiscal year ending February 2, 2013

requires the affirmative vote of a majority in voting interest of the stockholders present in person or by proxy and voting thereon. Abstentions will not be

treated as votes cast.

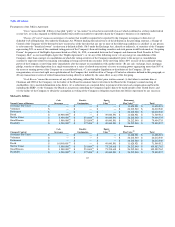

PROPOSAL 4 — RE-APPROVAL OF THE ABERCROMBIE & FITCH CO. INCENTIVE COMPENSATION PERFORMANCE PLAN

At the Annual Meeting, the Company's stockholders will be requested to consider and act upon a proposal to re-approve the Abercrombie & Fitch Co.

Incentive Compensation Performance Plan (the "Incentive Plan").

On March 3, 1997, the Board adopted the Incentive Plan, subject to approval by the Company's stockholders who in turn approved the Incentive Plan

on May 20, 1997. The Incentive Plan was then re-approved by stockholders on May 23, 2002 and June 13, 2007. The Incentive Plan has not been amended

since the approval by stockholders in 2007 and is being submitted to stockholders for re-approval solely to satisfy certain requirements under Section 162(m)

of the Internal Revenue Code ("Section 162(m)"); however, there can be no guarantee that amounts payable under the Incentive Plan will be treated as

qualified "performance-based compensation" under Section 162(m).

Pursuant to the Incentive Plan, selected key associates are eligible to participate in the Incentive Plan, including the named executive officers. The

purpose of the Incentive Plan is to give the Company a competitive advantage in attracting, retaining and motivating key associates and to provide the

Company with the ability to provide incentive compensation that is linked to financial measures. In addition, the Incentive Plan is intended to permit the

payment of bonuses that may qualify as "performance-based compensation" within the meaning of Section 162(m).

74