Abercrombie & Fitch 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

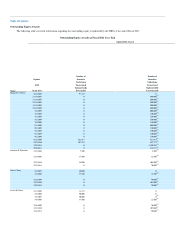

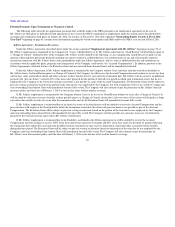

(1) Equity value is calculated using the fiscal year end closing price of $47.23 per share of Common Stock. As of January 28, 2012, Mr. Jeffries's total outstanding value for all equity awards

was equal to $84,700,545. This includes $9,481,927 of value in equity awards which were vested at fiscal year end. This vested value is not included in the table above as it could be

realized independently from each of the events described in the table.

For termination as a result of death or disability, the $49,040,591 includes the value of any outstanding Semi-Annual Grants ($8,616,018), plus a pro-rated amount of the Retention Grant

based on the period from the effective date of the Jeffries Agreement through the date of death or disability ($40,424,573).

For termination with "Good Reason" or "Not for Cause" not subject to a change of control, the $49,040,591 includes the value of any outstanding Semi-Annual Grants ($8,616,018), and a

pro-rated amount of the Retention Grant based on the period from the effective date of the Jeffries Agreement through the date of termination with a minimum pro-ration of two years

($40,424,573).

For termination with "Good Reason" or "Not for Cause" subject to a change of control, the $75,218,618 includes the value of any outstanding Semi-Annual Grants ($8,616,018), plus the

full value of the Retention Grant from the effective date of the Jeffries Agreement through the end date of the Jeffries Agreement ($66,602,600).

(2) Represents the present value of the vested accumulated retirement benefit under the Company's 401(k) Plan and the Company's Nonqualified Savings and Supplemental Retirement Plan

of $11,628,921 and, with the exception of "Severance For Cause" or "Death", the present value of the vested accumulated retirement benefit under the SERP of $14,583,619.

(3) Under the Jeffries Agreement, the Company maintains term life insurance coverage on the life of Mr. Jeffries in the amount of $10,000,000, the proceeds of which will be payable to the

beneficiary or beneficiaries designated by Mr. Jeffries.

Although not shown in the above table, Mr. Jeffries also participates in the Company's life insurance plan which is generally available to all salaried associates. The life insurance plan

pays out a multiple of base salary up to a maximum of $2,000,000. Under the provisions of the life insurance plan, if Mr. Jeffries passed away, his beneficiaries would receive $2,000,000.

In addition, the Company maintains an accidental death and dismemberment plan for all salaried associates. If Mr. Jeffries' death were accidental as defined by the plan, his beneficiaries

would receive an additional $2,000,000.

The Jeffries Agreement requires the Company to pay a pro-rata bonus for the respective fiscal period equal to 60% of base salary pro-rated for the number of days in the bonus period

worked, to the extent such pro-rata bonus is not payable as part of the Accrued Compensation.

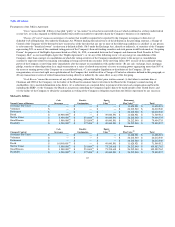

(4) The Jeffries Agreement calls for the payment of Mr. Jeffries' base salary (currently $1,500,000) for two years after his termination and payment of incentive compensation accrued for the

period. The Jeffries Agreement requires the Company to pay a "pro-rata bonus" for the respective fiscal period equal to 60% of Mr. Jeffries' base salary pro-rated for the number of days

in the bonus period worked.

(5) The Jeffries Agreement calls for the continuation of Mr. Jeffries' medical, dental and other associate welfare benefits for two years after his termination. This includes the continuation of

the $10,000,000 life insurance coverage until the later of February 1, 2014 or the last day of Mr. Jeffries' welfare benefits coverage.

(6) The Jeffries Agreement calls for the payment of Mr. Jeffries' base salary (currently $1,500,000) for the first two years and 80% of his base salary (currently $1,200,000) for the next year.

(7) The Jeffries Agreement calls for the continuation of 100% of Mr. Jeffries' medical, dental and other associate welfare benefits for three years after his termination due to disability. This

includes the continuation of the $10,000,000 life insurance coverage until the later of February 1, 2014 or the last day of Mr. Jeffries' welfare benefits coverage.

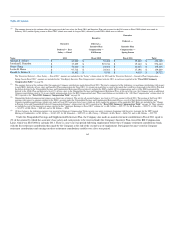

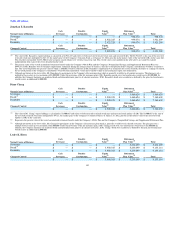

Other NEOs

For the other NEOs, there are no employment contracts that provide severance either in the usual course of business or upon a change of control. Each

NEO would receive the value of his or her accrued benefits under the Company's 401(k) Plan and the Company's Nonqualified Savings and Supplemental

Retirement Plan in the event of any termination of employment (e.g., death, disability, termination by the Company with or without cause or voluntary

termination by the NEO). However, the Company may choose to enter into a severance agreement with an NEO as consideration for entering into restrictive

covenants related to prospective employers.

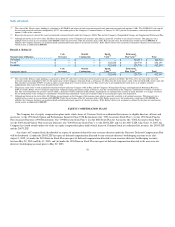

In the case of severance after a Change of Control or termination due to death or disability, in addition to the benefits under the plans mentioned in the

preceding paragraph, the vesting of all outstanding SARs, stock options, and restricted stock units held by the NEO would accelerate. This provision applies

to all associates participating in the Company's equity compensation plans.

68