Abercrombie & Fitch 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Compensation Committee administers the Incentive Plan in a manner such that payments under the Incentive Plan qualify as "performance-based

compensation" under Section 162(m) of the Internal Revenue Code.

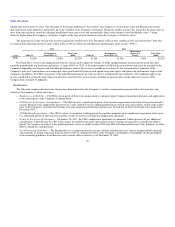

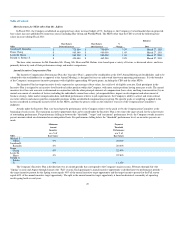

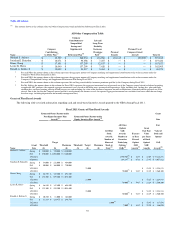

The Incentive Plan rewards participants for the achievement of seasonal financial performance goals. Consistent with Fiscal 2010, for Fiscal 2011, the

Company performance measure for both the Spring and Fall seasons was operating income. The metrics and actual results for each period were as follows:

Spring 2011 Metric ($000s)

Below Threshold Threshold Target Maximum Actual

% Payout 0% 25% 100% 200% 165%

Operating Income $ 0 $ 10,894 $ 40,931 $ 110,000 $ 85,919

Fall 2011 Metric ($000s)

Below Threshold Threshold Target Maximum Actual(1)

% Payout 0% 25% 100% 200% 0%

Operating Income $ 0 $ 321,593 $ 401,991 $ 462,290 $ 227,684

(1) Actual operating income is adjusted to add back impairment charges of $68.0 million, store closure and lease exit charges of $19.0 million, asset write-down charges of $14.6 million, legal

settlement charges of $10.0 million and ARS charges of $13.4 million consistent with the Incentive Plan provisions and with the basis on which the performance goals were set.

The Incentive Plan gives the Compensation Committee members discretion to adjust cash incentive payouts downward based on their business

judgment. However, the Compensation Committee may not adjust cash incentive payouts upward under the terms of the Incentive Plan. No such discretionary

adjustments were made for Fiscal 2011.

Long-Term Incentive Program for NEOs other than the CEO

Long-term incentives are used to balance the short-term focus of the annual Incentive Plan by tying a significant portion of total compensation to

performance achieved over multi-year periods. Under the 2005 LTIP, which was approved by stockholders at the 2005 Annual Meeting of Stockholders, and

the 2007 LTIP, which was approved by stockholders at the 2007 Annual Meeting of Stockholders and amended and restated with the approval of stockholders

at the 2011 Annual Meeting of Stockholders, the Compensation Committee may grant a variety of long-term incentive vehicles, including stock options,

SARs, restricted stock units, and performance shares. For NEOs other than the CEO, the Company has relied since 2008 on a combination of performance-

based restricted stock units and SARs. The combination of the types of awards provides a balance between retention (through performance-based restricted

stock units) and long-term stock price appreciation (through SARs).

Target long-term incentive award levels are expressed as a fixed number of shares that does not change frequently. Factors that influence how the target

number of shares is established include the individual's current base salary, job responsibilities, impact on development and achievement of business strategy,

labor market compensation data, individual performance relative to job requirements, the Company's ability to attract and retain critical associates and salaries

paid for comparable positions within an identified compensation peer group. Before the Compensation Committee approves the equity grants in total, the

Committee reviews the overall dilution represented by the awards to ensure that the overall share usage is consistent with competitive practice.

Beginning with awards made to Executive Vice Presidents who were NEOs on the Fiscal 2008 grant date, the Company added a performance

component to the vesting schedule for restricted stock units. Performance-based restricted stock units granted in Fiscal 2011 to Executive Vice Presidents will

vest 25% a year provided the Company's adjusted non-GAAP net income is positive for the year. If this performance hurdle is not met, the restricted stock

units will not vest in accordance with the vesting schedule for that year. The Executive Vice Presidents have the opportunity to earn back this unvested

portion of the award if the profitability requirement is met in subsequent years. The Compensation Committee retains the right to adjust equity vesting

schedules for specific circumstances.

50