Abercrombie & Fitch 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

firm from the Company and its subsidiaries. The SEC Rules specify the types of non-audit services that an independent registered public accounting firm may

not provide to its audit client and establish the Audit Committee's responsibility for administration of the engagement of the independent registered public

accounting firm.

Annually, the Company's management and the independent registered public accounting firm jointly submit to the Audit Committee an Audit and Non-

Audit Services Matrix (the "Matrix") specifying the categories of audit services and permitted non-audit services of which management may wish to avail

itself. The Audit Committee reviews the Matrix and either approves or rejects specific categories of services. Management and the independent registered

public accounting firm then revise the Matrix to include only those categories of services approved by the Audit Committee. The specific services within

those categories must be pre-approved as described below.

Annually, the Company's management and the independent registered public accounting firm jointly submit to the Audit Committee an Annual Pre-

Approval Request (the "Pre-Approval Request") listing all known and/or anticipated audit services and permitted non-audit services for the upcoming fiscal

year. The Pre-Approval Request lists these specific services by category in accordance with the Matrix, describes them in reasonable detail and includes an

estimated budget (or budgeted range) of fees.

The Audit Committee reviews the Pre-Approval Request with both the Company's management and the independent registered public accounting firm.

A final list of annual pre-approved services and budgeted fees is then prepared and distributed by management to appropriate Company personnel and by the

independent registered public accounting firm to the partners who provide services to the Company and its subsidiaries. The pre-approval of non-audit

services contained in the Pre-Approval Request is merely an authorization for management potentially to use the independent registered public accounting

firm for the approved services and allowable services. Management has the discretion to engage either the independent registered public accounting firm or

another provider for each listed non-audit service. The Audit Committee, in concert with management, has the responsibility to set the terms of the

engagement, negotiate the fees (within the approved budget range) and execute the letters of engagement.

During the course of each fiscal year, there may be additional non-audit services that are identified by the Company's management as desired but which

were not included in the annual Pre-Approval Request. The Audit Committee designates two members with the authority to pre-approve interim requests for

additional non-audit services. Prior to engaging the independent registered public accounting firm for such additional non-audit services, the Company's

management submits a request for approval of the non-audit services to the designated Audit Committee members who will approve or deny the request and

so notify management. These interim pre-approval procedures may be used only for non-audit services that are less than $100,000. Requests for additional

non-audit services greater than $100,000 must be approved by the full Audit Committee. At each subsequent Audit Committee meeting, the designated Audit

Committee members are to report any interim non-audit service pre-approvals since the last Audit Committee meeting.

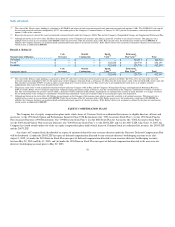

Fees of Independent Registered Public Accounting Firm

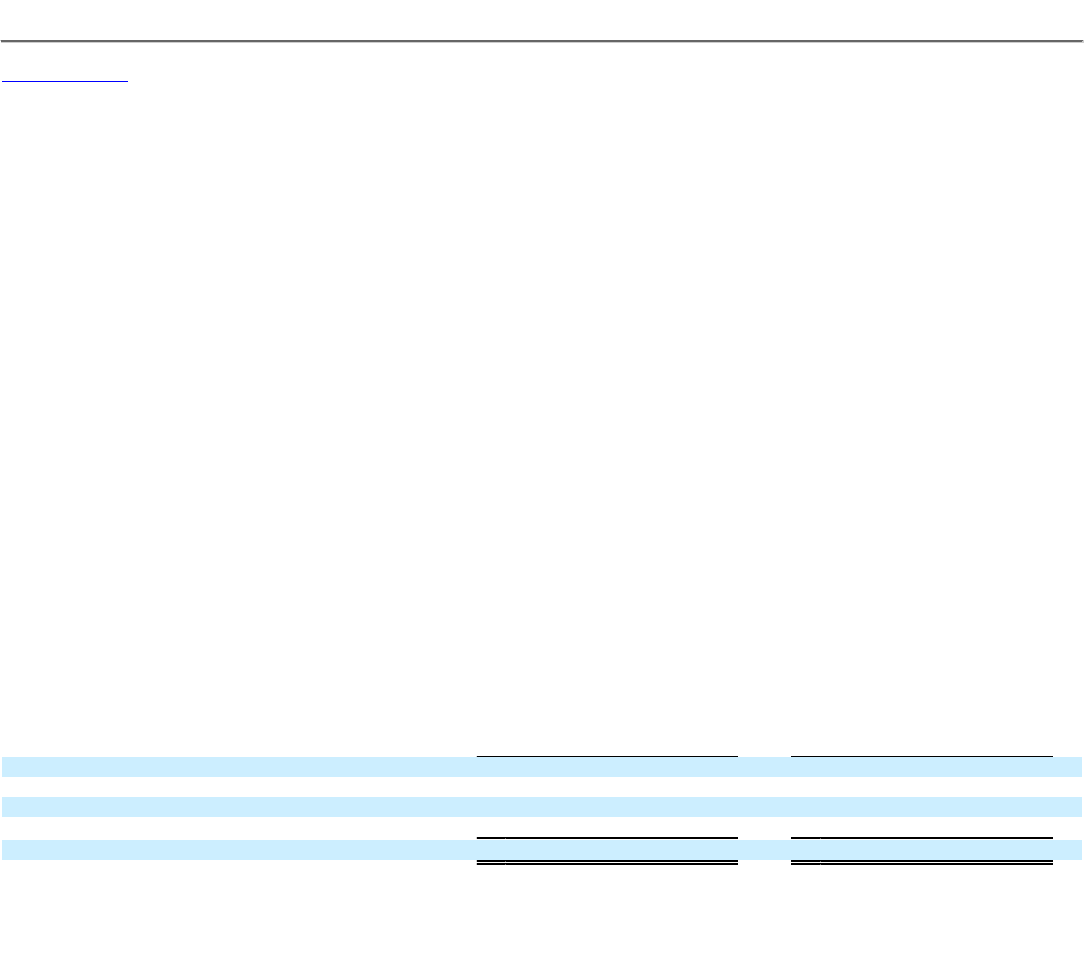

Fees billed for services rendered by PwC for each of Fiscal 2011 and Fiscal 2010 were as follows:

2011 2010

Audit Fees $ 1,487,631 $ 1,222,778

Audit-Related Fees 32,800 5,000

Tax Fees 75,300 —

All Other Fees — —

Total $ 1,595,731 $ 1,227,778

Audit Fees represent fees for professional services rendered by PwC in connection with the audit of the Company's annual consolidated financial

statements and reviews of the unaudited interim consolidated financial statements included in the Company's Quarterly Reports on Form 10-Q.

73