Abercrombie & Fitch 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

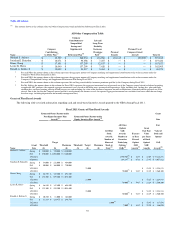

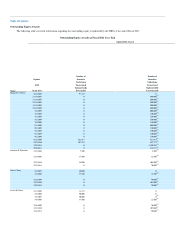

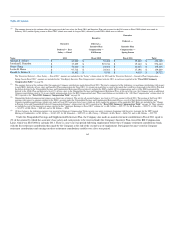

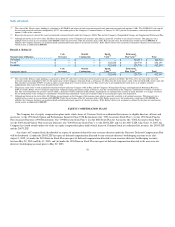

Potential Payments Upon Termination or Change in Control

The following tables describe the approximate payments that would be made to the NEOs pursuant to an employment agreement (in the case of

Mr. Jeffries) or other plans or individual award agreements in the event of the NEOs' termination of employment under the circumstances described below,

assuming such termination took place on January 28, 2012, the last day of Fiscal 2011. The table captioned "Outstanding Equity Awards at Fiscal 2011

Year-End" beginning on page 61 contains more information regarding the vested stock options and SARs held by the NEOs as of the end of Fiscal 2011.

Jeffries Agreement – Termination Provisions

Under the Jeffries Agreement, described above under the section captioned "Employment Agreement with Mr. Jeffries" beginning on page 58, if

Mr. Jeffries' employment is terminated by the Company for "Cause" (defined below) or by Mr. Jeffries other than for "Good Reason" (defined below) prior to

a "Change of Control" (defined below) of the Company, Mr. Jeffries will be entitled to the following: (i) any compensation earned but not yet paid; (ii) any

amounts which had been previously deferred (including any interest earned or credited thereon); (iii) reimbursement of any and all reasonable expenses

incurred in connection with Mr. Jeffries' duties and responsibilities under the Jeffries Agreement; and (iv) other or additional benefits and entitlements in

accordance with the applicable plans, programs and arrangements of the Company (collectively, the "Accrued Compensation"). In addition, pursuant to the

Jeffries Agreement's clawback features, the Retention Grant and any unvested Semi-Annual Grants will be immediately forfeited.

Under the Jeffries Agreement, if Mr. Jeffries' employment is terminated by the Company without Cause and other than due to death or disability or

Mr. Jeffries leaves for Good Reason prior to a Change of Control of the Company, he will receive his Accrued Compensation and continue to receive his then

current base salary and medical, dental and other associate welfare benefits for two years after the termination date. Mr. Jeffries will also receive an additional

payment (the "pro-rata bonus") equal to 60% of his base salary prorated for the portion of the half-year period in which such termination occurs that he was

employed by the Company to the extent that such pro-rata bonus is not payable as a part of the Accrued Compensation. The Retention Grant will be subject to

pro-rata vesting acceleration (based on the portion of the term that he was employed by the Company, but with a minimum of two years' worth of vesting) and

each outstanding Semi-Annual Grant will immediately become fully vested. The Company will also continue to pay the premiums on Mr. Jeffries' term life

insurance policy until the later of February 1, 2014 or the last day of his welfare benefits coverage.

If Mr. Jeffries' employment is terminated by the Company without Cause or he leaves for Good Reason within two years after a Change of Control, he

will be entitled to the same severance benefits as those payable prior to a Change of Control, except that (i) his two years of base salary will be paid in a lump

sum rather than ratably over the two years after the termination date and (ii) the Retention Grant will immediately become fully vested.

If Mr. Jeffries' employment is terminated due to his death, his estate or his beneficiaries will be entitled to receive the Accrued Compensation and the

pro-rata bonus with respect to the fiscal period in which the termination occurred to the extent such pro-rata bonus is not payable as part of the Accrued

Compensation. The Retention Grant will be subject to pro-rata vesting acceleration (based on the portion of the term that he was employed by the Company)

and each outstanding Semi-Annual Grant will immediately become fully vested. The Company will also provide any assistance necessary to facilitate the

payment of the term life insurance proceeds to Mr. Jeffries' beneficiaries.

If Mr. Jeffries' employment is terminated due to his Disability, as defined in the Jeffries Agreement, he will be entitled to receive the Accrued

Compensation and will continue to receive 100% of his then current base salary for 24 months and 80% of his base salary for the third 12 months following

the termination date (reduced by any long-term disability insurance payments he may receive) and medical, dental and other associated welfare benefits

during that time period. The Retention Grant will be subject to pro-rata vesting acceleration (based on the portion of the term that he was employed by the

Company) and each outstanding Semi-Annual Grant will immediately become fully vested. The Company will also continue to pay the premiums on

Mr. Jeffries' term life insurance policy until the later of February 1, 2014 or the last day of his welfare benefits coverage.

66