Abercrombie & Fitch 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

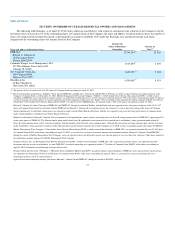

Long-Term Incentive Plans

A majority of incentive compensation-eligible associates (including executive officers and senior management) is eligible to participate in a common

set of long-term incentive plans — the 2005 Long-Term Incentive Plan (the "2005 LTIP") and the Amended and Restated 2007 Long-Term Incentive Plan

(the "2007 LTIP"). Together, the 2005 LTIP and the 2007 LTIP provide for the ability to award a mix of stock options, stock-settled SARs, restricted stock

and restricted stock units which serve to align the interests of associates and stockholders. In most cases, these awards vest over the four years subsequent to

grant, and provide a significant "hold" on associates, who would forfeit considerable value should they leave the Company prior to vesting. In addition,

beginning with awards made to Executive Vice Presidents who were named executive officers on the Fiscal 2008 grant date, the Company added a

performance component to the vesting schedule for restricted stock units.

For Fiscal 2012, the Company added performance shares to the mix of long-term incentives granted to Executive Vice Presidents with these awards

vesting only if earnings per share growth targets are achieved. Our CEO also recently agreed to amend his employment agreement to provide that 80% of the

total fair value of any semi-annual equity grants earned during the remaining term of his employment agreement will be awarded in the form of SARs and

20% will be awarded in the form of restricted stock units. The restricted stock units will be subject to the same target and threshold adjusted earnings per

share performance levels that apply to performance shares granted to our Executive Vice Presidents, as well as the time-based vesting requirements specified

in our CEO's employment agreement.

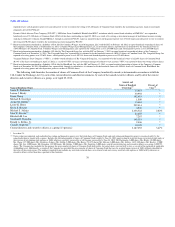

In "ITEM 1A. RISK FACTORS" of the Company's Annual Report on Form 10-K for Fiscal 2011, the Company states that "equity-based compensation

awarded under the employment agreement with our Chief Executive Officer could adversely impact our cash flows, financial position or results of operations

and could have a dilutive effect on our outstanding Common Stock." In connection with the semi-annual equity grants contemplated by our CEO's

employment agreement, the related compensation expense could significantly impact the Company's results of operations. In addition, the significant number

of shares of Common Stock which could be used to settle the Retention Grants granted under our CEO's employment agreement and any semi-annual equity

grants is uncertain and dependent on the future price of our Common Stock and our financial performance and would, if issued, have a dilutive effect with

respect to our outstanding shares of Common Stock, which may adversely affect the market price of our Common Stock. In the event that there are not

sufficient shares of Common Stock available to be issued under the 2007 LTIP, or under a successor or replacement plan, at the time these equity-based

awards are ultimately settled, the Company would be required to settle some portion of the awards in cash, which would have an adverse impact on our cash

flows from operations, financial position or results of operations. Furthermore, the awards may not be deductible pursuant to Internal Revenue Code

Section 162(m). In addition, under applicable accounting rules, if the price of our Common Stock increases to a point where, as of any measurement date, we

would be unable to settle outstanding equity-based awards in shares of Common Stock from our existing plans, we would be required to classify and account

for a portion of the equity-based awards as liabilities. This could further adversely impact our results of operations.

While the Company and the Compensation Committee do not believe that equity-based compensation expense is a risk that arises from the Company's

compensation policies and practices that is reasonably likely to have a material adverse effect on the Company, the Company has sought to mitigate the risks

of (i) cash settlement of all or a portion of the equity-based awards and (ii) expense associated with accounting for all or a portion of the equity-based awards

as liabilities, due to an insufficiency of shares available to settle outstanding equity-based awards, through the approval by the Company's stockholders at last

year's annual meeting of stockholders of the addition of 3,000,000 shares to those available for awards under the 2007 LTIP.

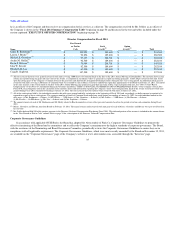

Compensation of Directors

Any officer who is also a director receives no additional compensation for services rendered as a director. Directors who are not associates of the

Company or its subsidiaries ("non-associate directors") receive:

• an annual retainer of $55,000 (paid quarterly in arrears);

• an annual retainer for each standing committee Chair and member of $25,000 and $12,500, respectively, other than (i) the Chair and members of the

Audit Committee who receive $40,000 and $25,000, respectively, and

33