Abercrombie & Fitch 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

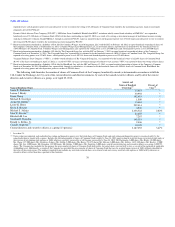

(ii) the Lead Independent Director who receives $30,000 for serving in that capacity. In each case, the retainers are paid quarterly in arrears; and

• an annual grant of 3,000 restricted stock units.

The annual restricted stock unit grant is subject to the following provisions:

• restricted stock units are to be granted annually on the date of the annual meeting of stockholders;

• the maximum market value of the underlying shares of Common Stock on the date of grant is to be $300,000 (i.e., should the price of the Company's

Common Stock on the grant date exceed $100 per share, the number of restricted stock units granted will be automatically reduced to provide a

maximum grant date market value of $300,000);

• the minimum market value of the underlying shares of Common Stock on the date of grant is to be $120,000 (i.e., should the price of the Company's

Common Stock on the grant date be lower than $40 per share, the number of restricted stock units granted will be automatically increased to provide

a minimum grant date market value of $120,000); and

• restricted stock units will vest on the later of (i) the first anniversary of the grant date or (ii) the first "open window" trading date following the first

anniversary of the grant date, subject to earlier vesting in the event of a director's death or total disability or upon a change of control of the

Company.

Directors who are elected after the beginning of the fiscal year receive pro-rated retainers and grants of restricted stock units based on the time to be

served during the fiscal year.

Non-associate directors are also reimbursed for their expenses for attending Board and committee meetings and receive the discount on purchases of the

Company's merchandise extended to all Company associates.

The Company has maintained the Directors' Deferred Compensation Plan since October 1, 1998. The Directors' Deferred Compensation Plan was split

into two plans (Plan I and Plan II) as of January 1, 2005 to comply with Internal Revenue Code Section 409A. The terms of Plan I govern "amounts deferred"

(within the meaning of Section 409A) in taxable years beginning before January 1, 2005 and any earnings thereon. The terms of Plan II govern "amounts

deferred" in taxable years beginning on or after January 1, 2005 and any earnings thereon. Voluntary participation in the Directors' Deferred Compensation

Plan enables a non-associate director of the Company to defer all or a part of his or her retainers, meeting fees (which are no longer paid) and stock-based

incentives (including stock options, restricted shares of Common Stock and restricted stock units relating to shares of Common Stock). The deferred

compensation is credited to a bookkeeping account where it is converted into a share equivalent. Stock-based incentives deferred pursuant to the Directors'

Deferred Compensation Plan are credited as shares of Common Stock. Amounts otherwise payable in cash are converted into a share equivalent based on the

fair market value of the Company's Common Stock on the date the amount is credited to a non-associate director's bookkeeping account. Dividend equivalents

will be credited on the shares of Common Stock credited to a non-associate director's bookkeeping account (at the same rate as cash dividends are paid in

respect of outstanding shares of Common Stock) and converted into a share equivalent. Each non-associate director's only right with respect to his or her

bookkeeping account (and the amounts allocated thereto) will be to receive distribution of the amount in the account in accordance with the terms of the

Directors' Deferred Compensation Plan. Distribution of the deferred amount is made in the form of a single lump-sum transfer of the whole shares of

Common Stock represented by the share equivalents in the non-associate director's bookkeeping account (plus cash representing the value of fractional shares)

or annual installments in accordance with the election made by the non-associate director. Shares of Common Stock will be distributed under the 2005 LTIP

in respect of deferred compensation allocated to non-associate directors' bookkeeping accounts on or after August 1, 2005, under the 2003 Stock Plan for

Non-Associate Directors in respect of deferred compensation allocated to non-associate directors' bookkeeping accounts between May 22, 2003 and July 31,

2005 and under the 1998 Restatement of the 1996 Stock Plan for Non-Associate Directors in respect of deferred compensation allocated to non-associate

directors' bookkeeping accounts prior to May 22, 2003.

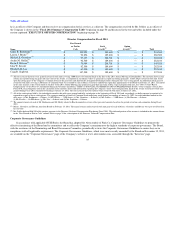

The following table summarizes the compensation paid to, awarded to or earned by, the non-associate directors for Fiscal 2011. The Company's

Chairman and CEO Michael S. Jeffries is not included in this table as

34