Abercrombie & Fitch 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

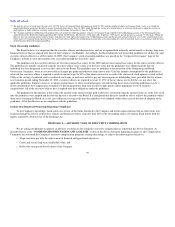

Table of Contents

at the time of the filing of this Proxy Statement, management and the Compensation Committee have concluded that there are no risks arising from the

Company's compensation policies and practices that are reasonably likely to have a material adverse effect on the Company. This assessment was overseen by

the Compensation Committee, in consultation with its independent counsel and independent compensation consultant.

We reviewed the compensation policies and practices in effect for our executive officers, senior management and associates and assessed the features

we have built into the compensation programs to discourage excessive risk-taking. These features include, among other things, a balance between different

elements of compensation, use of different time periods and performance metrics for different elements of compensation, use of consistent Company-wide

programs, and stock ownership guidelines for senior management. The Company has also included clawback provisions in its incentive plans which are

applicable to all participating associates.

Base Compensation

All associates (including executive officers and senior management) participate in a common base pay program. Each job below the Senior Vice

President level is assessed against the competitive market, and a range of base pay (within an overall salary grade structure) is assigned to each job. These

ranges have inherent limits on base pay for any given job, and mitigate any possible risk. Individual merit pay decisions are constrained by a grid which

relates the size of a pay increase to a given level of performance, subject to aggregate caps (i.e., merit pools).

At the Senior Vice President level and above, the Company "custom-fit" job comparisons with market data and all pay decisions are reviewed and

approved by the Compensation Committee. Increases are also subject to the same merit grids and merit pool controls as apply to other associates.

Incentive Compensation

All incentive compensation-eligible associates (including executive officers and senior management) participate in a common incentive compensation

program — the Incentive Compensation Performance Plan. Individual payments are strictly determined by overall Company performance (rather than

divisional and/or individual performance) and are capped at twice target levels, regardless of Company performance.

The Incentive Compensation Performance Plan does have two design elements which may create a theoretical risk: semi-annual payments and the use

of operating income as a measure of performance. Although seasonal payments provide good alignment between short-term business results and associate

rewards, they create a theoretical risk of misalignment between short-term and long-term goals. Use of operating income as the sole measure of corporate

performance could also be seen as introducing a theoretical risk (i.e., use of a single metric). However, counterbalancing these theoretical risks are the

following elements:

• The ability for a single individual to affect overall corporate operating income is limited to a handful of individuals, and given our delegation of

authority, is mostly vested in the CEO. Total delivered compensation ("TDC") to these key associates is composed of three elements: base pay,

annual cash incentives and long-term (equity) awards. All of these key associates have compensation packages which provide the majority of their

TDC in the form of long-term equity compensation, the value of which is directly tied to the long-term performance of the Company. This

compensation structure mitigates the risk of providing incentives to take short-term actions which could harm the long-term prospects of the

Company.

• Operating income is a measure of revenues over expenses and, therefore, it incorporates sales, cost of goods sold, stores and distribution expense,

marketing, general and administrative expense and other expenses. As such, it reflects the overall results of the business, and considers top-line and

bottom-line elements.

• Individual awards are capped for every associate, and are subject to Compensation Committee approval and, if necessary, the Compensation

Committee's negative discretion.

32