Abercrombie & Fitch 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

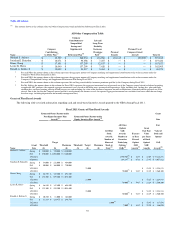

Table of Contents

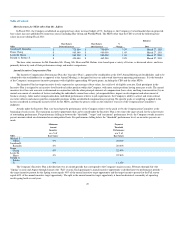

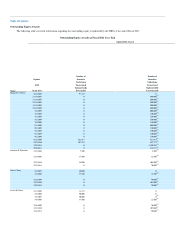

(4) The amounts shown in this column reflect All Other Compensation which included the following for Fiscal 2011:

All Other Compensation Table

Name

Company

Contributions

to 401(k) Plan(a)

Company

Contributions to

Nonqualified

Savings and

Supplemental

Retirement Plan(b)

Life and

Long-Term

Disability

Insurance

Premiums

Paid(c)

Personal

Security

Personal Use of

Company-Owned

Aircraft Total ($)

Michael S. Jeffries $ 23,707 $ 260,254 $ 116,906 $ 118,315 $ 200,000(d) $ 719,182

Jonathan E. Ramsden $ 18,071 $ 94,088 $ 7,267 $ — $ — $ 119,426

Diane Chang $ 17,891 $ 137,299 $ 12,637 $ — $ — $ 167,827

Leslee K. Herro $ 18,040 $ 137,299 $ 7,626 $ — $ — $ 162,965

Ronald A. Robins Jr. $ 10,099 $ 24,517 $ 5,463 $ — $ — $ 40,079

a. For each NEO, the amount shown in this column represents the aggregate amount of Company matching and supplemental contributions to his or her accounts under the

Company's 401(k) Plan during Fiscal 2011.

b. For each NEO, the amount shown in this column represents the aggregate amount of Company matching and supplemental contributions to his or her accounts under the

Company's Nonqualified Savings and Supplemental Retirement Plan during Fiscal 2011.

c. For each NEO, the amount shown in this column represents life and long-term disability insurance premiums paid for by the Company during Fiscal 2011.

d. For Mr. Jeffries, the amount shown in this column for Fiscal 2011 represents the aggregate incremental cost of personal use of the Company-owned aircraft calculated according

to applicable SEC guidance (the reported aggregate incremental cost is based on the direct costs associated with operating a flight, including fuel, landing fees, pilot and flight

attendant fees, on-board catering and trip-related hangar costs and excluding the value of the disallowed corporate income tax deductions associated with the personal use of the

aircraft. Due to the fact that the Company-owned aircraft is used primarily for business travel, the reported aggregate incremental cost excludes fixed costs which do not change

based on usage, including depreciation and monthly management fees).

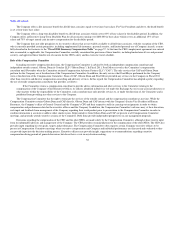

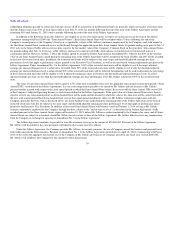

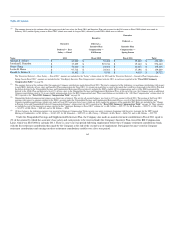

Grants of Plan-Based Awards

The following table sets forth information regarding cash and stock-based incentive awards granted to the NEOs during Fiscal 2011.

Fiscal 2011 Grants of Plan-Based Awards

Grant

Date

Estimated Future Payouts under

Non-Equity Incentive Plan

Awards(1)

Estimated Future Payouts under

Equity Incentive Plan Awards(2)

All Other

Stock

Awards:

Number of

Shares of

Stock or

Units(3)

All Other

Option/

SAR

Awards:

Number of

Securities

Underlying

Options/

SARs(4)

Exercise

or Base

Price of

Option/

SAR

Awards(5)

Grant

Date Fair

Value

per Share

of Stock

Option/

SAR

Awards

Grant

Date

Fair

Value of

Stock and

Option/

SAR

Awards(6)

Name

Threshold

($)

Target

($)

Maximum

($)

Threshold

($)

Target

($)

Maximum

($)

Michael S. Jeffries Spring $ 180,000 $ 720,000 $ 1,440,000

Fall $ 270,000 $ 1,080,000 $ 2,160,000

3/22/2011 1,590,908(7) $ 54.87 $ 22.09 $ 35,144,271

9/20/2011 288,287(7) $ 67.83 $ 27.95 $ 8,057,622

Jonathan E. Ramsden Spring $ 58,000 $ 232,000 $ 464,000

Fall $ 90,000 $ 360,000 $ 720,000

3/22/2011 23,000 $ 53.25 $ 1,224,833

3/22/2011 70,000(7) $ 54.87 $ 22.29 $ 1,560,300

Diane Chang Spring $ 86,850 $ 347,400 $ 694,800

Fall $ 132,300 $ 529,200 $ 1,058,400

3/22/2011 23,000 $ 53.25 $ 1,224,833

3/22/2011 70,000(7) $ 54.87 $ 22.29 $ 1,560,300

Leslee K. Herro Spring $ 86,850 $ 347,400 $ 694,800

Fall $ 132,300 $ 529,200 $ 1,058,400

3/22/2011 23,000 $ 53.25 $ 1,224,833

3/22/2011 70,000(7) $ 54.87 $ 22.29 $ 1,560,300

Ronald A. Robins Jr. Spring $ 20,250 $ 81,000 $ 162,000

Fall $ 31,219 $ 124,875 $ 249,750

3/22/2011 6,000(8) $ 52.95 $ 317,676

3/22/2011 7,000(7) $ 54.87 $ 22.29 $ 156,030

57