Abercrombie & Fitch 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

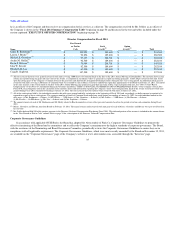

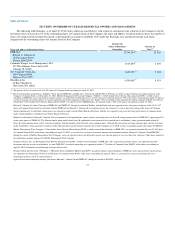

September 30, 1996 — January 31, 2012

Total Stockholder Return

ANF vs. S&P 500 vs. S&P Retail

Chart Data Source: S&P Research Insight

Compensation Program for the CEO

Mr. Jeffries, the Company's current Chairman and CEO, is effectively the "founder" of the modern day Abercrombie & Fitch due to his unique role and

contributions during his more than 20-year tenure. In addition to his role as Chairman and CEO, he also functions as the brand visionary and chief creative

talent for the Company. Under his leadership, the Company reinvented the Abercrombie & Fitch brand, created the Hollister, abercrombie kids and Gilly

Hicks brands and launched aggressive long-term international expansion. During Mr. Jeffries' tenure, the Company's market value has increased by

approximately $4 billion since 1996 and has significantly outperformed the S&P 500 (as shown on the chart above).

The Company's compensation arrangement with the CEO reflects his unique "founder" status and the extraordinary contributions he continues to

deliver. To ensure the continuation of Mr. Jeffries' service with the Company, the Board entered into a new five-year employment agreement in December

2008, when his previous agreement expired.

Under his employment agreement, the CEO is eligible to earn semi-annual performance-based equity grants based on a formula that ties the size of

semi-annual grants to increases in the Company's total stockholder return. The CEO does not earn a performance-based equity grant unless the Company's

total stockholder return for each semi-annual measurement period increases above all previous high-water marks since the beginning of the contract, adjusted

for cash dividends, and then only to the extent that the value created exceeds any cash compensation paid to or earned by the CEO and any increase in the

CEO's pension benefits accrued with respect to the semi-annual period to which the grant relates. Moreover, pursuant to a recent amendment to the CEO's

employment agreement, 80% of the total fair value any semi-annual equity grants earned during the remaining term of his employment agreement will be

awarded in the form of SARs and 20% will be awarded in the form of restricted stock units. The restricted stock units will be subject to the same target and

threshold adjusted earnings per share performance levels that apply to performance shares granted to our Executive Vice Presidents, as well as the time-based

vesting requirements specified in the CEO's employment agreement. Under this amendment to the CEO's employment agreement, 100% of the restricted stock

units will be eligible to vest if the target adjusted earnings per share performance level is achieved or exceeded. Only 50% of the restricted stock units will be

eligible to vest if the threshold adjusted earnings per share performance level is achieved and 50% of the restricted stock units will be forfeited. Interpolation

will be used to determine the percentage of the restricted

42