Abercrombie & Fitch 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

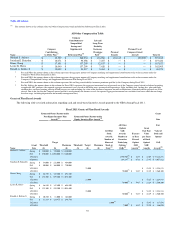

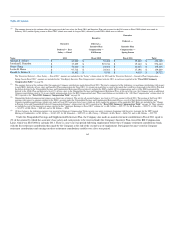

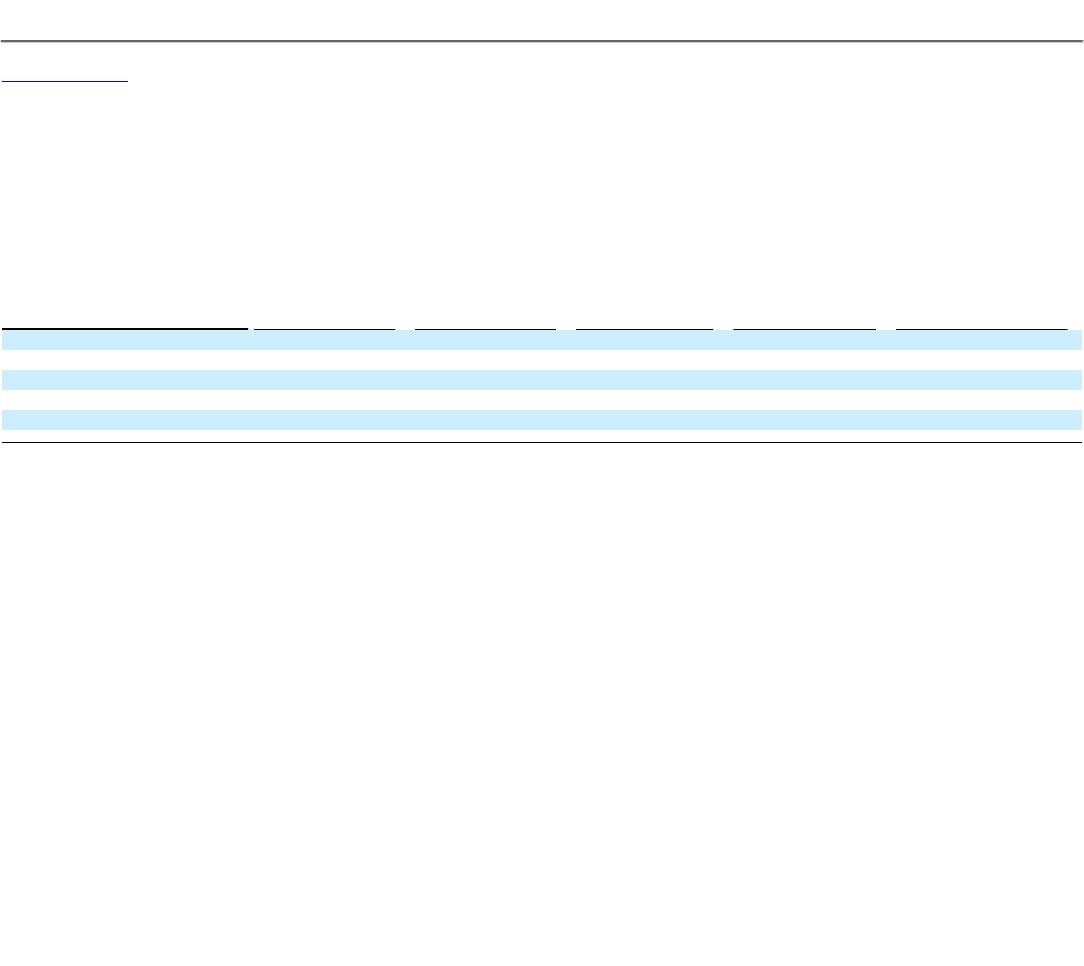

The following table provides information concerning the participation by the NEOs in the portion of the Nonqualified Savings and Supplemental

Retirement Plan providing for Company retirement contributions, for Fiscal 2011.

Nonqualified Deferred Compensation for Fiscal 2011 — Company Supplemental

Annual Retirement Contribution

Name

Executive

Contributions

in Fiscal 2011

($)

Company

Contributions

in Fiscal 2011

($)(1)

Aggregate

Earnings

in Fiscal 2011

($)(2)

Aggregate

Withdrawals /

Distributions

($)

Aggregate

Balance as of

January 28, 2012

($)(3)

Michael S. Jeffries $ — $ 72,088 $ 198,538 $ — $ 4,543,359

Jonathan E. Ramsden $ — $ 25,199 $ 790 $ — $ 25,990

Diane Chang $ — $ 37,959 $ 47,844 $ — $ 1,101,397

Leslee K. Herro $ — $ 37,959 $ 54,399 $ — $ 1,250,639

Ronald A. Robins Jr. $ — $ 618 $ 19 $ — $ 637

(1) The amounts shown in this column reflect the Company's retirement contributions made during Fiscal 2011. These retirement contributions are included in the "All Other Compensation"

column totals for 2011 reported in the "Fiscal 2011 Summary Compensation Table" on page 56.

(2) The amounts included in the "Change in Pension Value and Nonqualified Deferred Compensation Earnings" column totals for 2011 reported in the "Fiscal 2011 Summary

Compensation Table" on page 56 represent earnings in Fiscal 2011 with respect to amounts credited to the NEOs' accounts under the Nonqualified Savings and Supplemental

Retirement Plan as a result of retirement contributions (which were made in Fiscal 2011 and prior fiscal years) which are above-market for purposes of the applicable SEC Rules. These

amounts are included as part of the aggregate earnings reported in the "Aggregate Earnings in Fiscal 2011" column for: (a) Mr. Jeffries — $61,328; (b) Mr. Ramsden — $244;

(c) Ms. Chang — $14,779; (d) Ms. Herro — $16,804; and (e) Mr. Robins — $6.

(3) Of these balances, the following amounts were reported in Summary Compensation Tables in prior-year proxy statements beginning with the proxy statement for the 2007 Annual

Meeting of Stockholders: (a) Mr. Jeffries — $1,530,106; (b) Mr. Ramsden — $25,443; (c) Ms. Chang — $588,597; (d) Ms. Herro — $604,874; and (e) Mr. Robins — $624.

Payouts under the Nonqualified Savings and Supplemental Retirement Plan are based on the participant's election at the time of deferral and may be

made in a single lump sum or in annual installments over a five-year or ten-year period. The annual installment election will only apply if at the time of the

separation from service, the participant is retirement eligible — that is, age 55 or older with at least five years of service. If there is no distribution election on

file, the payment will be made in ten annual installments. Regardless of the election on file, if the participant terminates before retirement, dies or becomes

disabled, the benefit will be paid in a single lump sum. However, if the participant dies while receiving annual installments, the beneficiary will continue to

receive the remaining installment payments. The committee which administers the Nonqualified Savings and Supplemental Retirement Plan may permit

hardship withdrawals from a participant's account under the Nonqualified Savings and Supplemental Retirement Plan in accordance with defined guidelines

including the IRS definition of a financial hardship.

Participants' rights to receive their account balances from the Company are not secured or guaranteed. However, during the third quarter of Fiscal 2006,

the Company established an irrevocable rabbi trust, the purpose of which is to be a source of funds to match respective funding obligations to participants in

the Nonqualified Savings and Supplemental Retirement Plan and the SERP.

In the event of a change in control of the Company, the payment of the aggregate balance of each participant's account will be accelerated and such

balance will be paid out as of the date of the change in control unless otherwise determined by the Board.

The Nonqualified Savings and Supplemental Retirement Plan is subject to requirements affecting deferred compensation under Section 409A of the

Internal Revenue Code and is being administered in compliance with the applicable regulations under Section 409A.

65