Abercrombie & Fitch 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

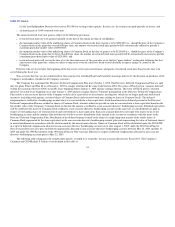

(2) The percent of class is based upon the sum of 84,841,792 shares of Common Stock outstanding on April 25, 2012 and the number of shares of Common Stock, if any, as to which the

named individual or group has the right to acquire beneficial ownership by June 24, 2012, either through the vesting of restricted shares or restricted stock units or upon the exercise of

stock options or SARs which are currently exercisable or will become exercisable by June 24, 2012.

(3) The "Amount and Nature of Beneficial Ownership" does not include the following number of shares of Common Stock credited to the bookkeeping accounts of the following directors

under the Directors' Deferred Compensation Plan: Mr. Griffin, 24,209 shares; Mr. Kessler, 5,536 shares; Mr. Stapleton, 3,539 shares; and all directors as a group, 33,284 shares. While the

directors have an economic interest in these shares, each director's only right with respect to his bookkeeping account (and the amounts allocated thereto) is to receive a distribution of the

whole shares of Common Stock represented by the share equivalent credited to his bookkeeping account (plus cash representing the value of fractional shares) in accordance with the terms

of the Directors' Deferred Compensation Plan.

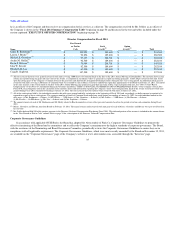

Stock Ownership Guidelines

The Board believes it is important that the executive officers and directors have, and are recognized both internally and externally as having, long-term

financial interests that are aligned with those of the Company's stockholders. Accordingly, the Board adopted stock ownership guidelines for all directors and

executive officers effective as of November 12, 2009. The Company's stock ownership guidelines are posted on the "Corporate Governance" page of the

Company's website at www.abercrombie.com, accessible through the "Investors" page.

The guidelines for the executive officers are five times annual base salary for the CEO and one times annual base salary for the other executive officers.

The guidelines are initially calculated using the executive officer's base salary as of the later of the date the guidelines were adopted and the date the

individual was first designated as an executive officer by the Board. The guidelines may be modified, at the discretion of the Nominating and Board

Governance Committee, when an executive officer changes pay grade and otherwise from time to time. Until the amount contemplated by the guidelines is

achieved, the executive officer is required to retain an amount equal to 50% of the shares received as a result of the exercise of stock options or stock-settled

SARs or the vesting of restricted stock or restricted stock units, in each case netted to pay any exercise price or withholding taxes; provided, that for a three-

year transition period ending November 12, 2012, executive officers are required to retain 33 1/3% of the net shares received if they are not above the

applicable guidelines. Failure to meet or, in unique circumstances, to show sustained progress toward meeting these stock ownership guidelines may be a

factor considered by the Compensation Committee in determining future long-term incentive equity grants and/or appropriate levels of incentive

compensation. All of the executive officers have complied with their obligations under the guidelines.

The guideline for the directors is three times the amount of the annual retainer paid to directors, calculated using the annual retainer as of the later of the

date the guidelines were adopted and the date the director is elected to the Board. It is anticipated that directors should be able to achieve the guideline within

three years of joining the Board, or, in the case of directors serving at the time the guidelines were adopted, within three years of the date of adoption of the

guidelines. All of the directors are in compliance with the guidelines.

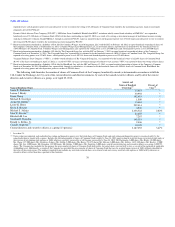

Section 16(a) Beneficial Ownership Reporting Compliance

To the Company's knowledge, based solely on a review of the forms furnished to the Company and written representations that no other forms were

required, during Fiscal 2011, all directors, officers and beneficial owners of greater than 10% of the outstanding shares of Common Stock timely filed the

reports required by Section 16(a) of the Exchange Act.

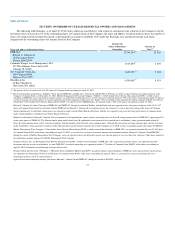

PROPOSAL 2 — ADVISORY VOTE ON EXECUTIVE COMPENSATION

We are asking stockholders to approve an advisory resolution on the Company's executive compensation as reported in this Proxy Statement. As

described below in the "COMPENSATION DISCUSSION AND ANALYSIS" section of this Proxy Statement beginning on page 41, the Compensation

Committee has structured the Company's executive compensation programs, among other things, to achieve the following key objectives:

• Align executive pay with the achievement of financial and operational objectives;

• Create and sustain long-term stockholder value; and

• Reflect the strong team-based culture of the Company.

39