Abercrombie & Fitch 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

significantly for the past few years. The advantage of fixed share guidelines is that it allows the Company to control share usage and dilution more closely

than target grant value guidelines, particularly given the volatility of the Company's stock price. Fixing the number of shares has meant that the grant value of

these long-term incentive awards has changed significantly from year to year and automatically aligns with changes in total stockholder value — being

relatively higher when the Company's stock price is higher at the time of grant and lower when the stock price is relatively lower.

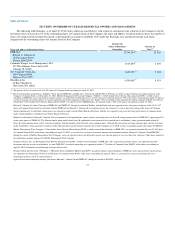

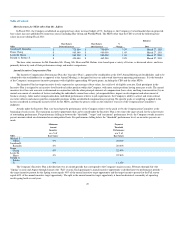

The grant date fair value of long-term incentives granted to our Executive Vice Presidents in Fiscal 2011 and Fiscal 2012 are shown below. Note that

we increased the long-term incentive target values in Fiscal 2012 to reflect the introduction of performance share awards ("PSAs").

Level

2011 2012

SARs (#) Performance-

based RSUs (#) Fair Value

($000) SARs (#) Performance-

based RSUs (#)

Performance

Shares (# at

Target) Fair Value

($000)

EVPs 70,000 23,000 $2,785 67,500 21,500 5,000 $2,953

For Fiscal 2012, we have also implemented objective criteria used to adjust the number of SARs and performance-based restricted stock units that

would be granted under our fixed share guidelines. A range of 80% to 120% of the target number of SARs and restricted stock units may be awarded by the

Committee depending on Company and individual performance criteria. These criteria include an assessment by the Compensation Committee of the

Company's prior year's performance on earnings per share growth and total sales growth against long-term targets and against the performance of peer retail

companies. In addition, the CEO's assessment of the individual performance of each executive is considered by the Committee. No weightings apply to the

factors considered in setting the target long-term incentive award level for each associate, and thus the process relies on the subjective exercise of the

Compensation Committee's judgment.

Best Practices

The following compensation decisions and practices demonstrate how the Company's executive compensation program reflects best practices and

reinforces the Company's culture and values:

• Emphasis on At-Risk Pay — For NEOs, the majority of their total compensation is contingent upon Company financial performance and appreciation

in the market price of the Company's Common Stock.

• CEO Pay for Performance Arrangements — The CEO receives a significant majority of his annual compensation in the form of long-term incentive

awards. Pursuant to his employment agreement, he is only entitled to receive additional performance-based semi-annual equity awards if the market

price of the Company's Common Stock during each semi-annual measurement period increases beyond that of all previous high-water marks since

December 2008.

• CEO Holding Requirements — The CEO is subject to mandatory holding periods beyond the completion of his employment agreement with respect

to a substantial portion of the long-term incentive awards he has received under his employment agreement.

• No Excise Tax Gross-Up Payments — On January 28, 2011, the CEO's employment agreement was amended, without payment of any additional

consideration, to provide that the CEO will no longer be entitled to any gross-up payments in the event that any payments or benefits provided to

him by the Company are subject to the golden parachute excise tax under Sections 280G and 4999 of the Internal Revenue Code. Similarly, no other

NEO is eligible for such payments.

• Stock Ownership Guidelines — The Board believes it is important that the executive officers and directors have, and are recognized both internally

and externally as having, long-term financial interests that are aligned with those of the Company's stockholders. Accordingly, the Board adopted

stock ownership guidelines for all directors and executive officers effective as of November 12, 2009.

46