Abercrombie & Fitch 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

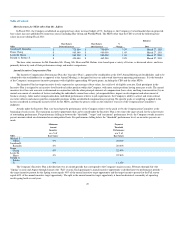

EXECUTIVE OFFICER COMPENSATION

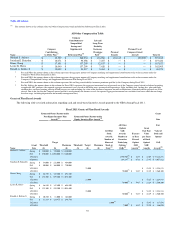

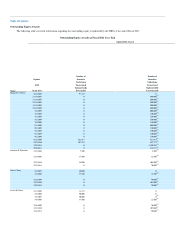

Summary Compensation Table

The following table summarizes the compensation paid to, awarded to or earned by the NEOs for Fiscal 2011, Fiscal 2010 and Fiscal 2009 in

accordance with the rules promulgated by the SEC effective as of February 28, 2010.

Fiscal 2011 Summary Compensation Table

Name and Principal Position

During Fiscal 2011

Fiscal

Year

Salary

($)

Bonus

($)

Stock

Awards

($)(1)

Option/SAR

Awards

($)(1)

Non-Equity

Incentive Plan

Compensation

($)(2)

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings ($)(3)

All Other

Compensation

($)(4)

Total

($)

Michael S. Jeffries 2011 $ 1,500,000 $ — $ — $ 43,201,893 $ 1,188,000 $ 1,460,398 $ 719,182 $ 48,069,473

Chairman and Chief 2010 $ 1,500,000 $ — $ — $ 14,071,661 $ 2,329,200 $ 734,122 $ 4,609,925 $ 23,244,908

Executive Officer 2009 $ 1,500,000 $ — $ — $ 33,293,108 $ — $ 15,545 $ 1,526,991 $ 36,335,644

Jonathan E. Ramsden 2011 $ 745,192 $ — $ 1,224,833 $ 1,560,300 $ 382,800 $ 10,616 $ 119,426 $ 4,043,167

Executive Vice President 2010 $ 717,308 $ — $ — $ 2,378,600 $ 697,913 $ 2 $ 55,729 $ 3,849,552

and Chief Financial Officer 2009 $ 700,000 $ — $ — $ — $ — $ — $ 43,859 $ 743,859

Diane Chang 2011 $ 977,116 $ — $ 1,224,833 $ 1,560,300 $ 573,210 $ 38,751 $ 167,827 $ 4,542,037

Executive Vice President — 2010 $ 955,246 $ — $ — $ 2,378,600 $ 1,053,212 $ 779 $ 109,635 $ 4,497,472

Sourcing 2009 $ 923,446 $ — $ — $ 1,408,400 $ — $ 3,805 $ 198,959 $ 2,534,610

Leslee K. Herro 2011 $ 977,116 $ — $ 1,224,833 $ 1,560,300 $ 573,210 $ 57,166 $ 162,965 $ 4,555,590

Executive Vice President — 2010 $ 955,246 $ — $ — $ 2,378,600 $ 1,053,212 $ 1,187 $ 109,008 $ 4,497,253

Planning and Allocation 2009 $ 923,446 $ — $ — $ 1,408,400 $ — $ 5,757 $ 197,103 $ 2,534,706

Ronald A. Robins, Jr. 2011 $ 460,096 $ — $ 317,676 $ 156,030 $ 133,650 $ 992 $ 40,079 $ 1,108,523

Senior Vice President, 2010 $ 429,077 $ — $ — $ — $ 216,048 $ 1 $ 22,620 $ 667,746

General Counsel and Secretary 2009 $ — $ — $ — $ — $ — $ — $ — $ —

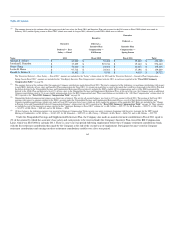

(1) The amounts included in the "Stock Awards" and "Option/SAR Awards" columns represent the grant date fair value related to restricted stock unit awards and SAR grants to the NEOs,

computed in accordance with U.S. generally accepted accounting principles. The SARs that were granted to the NEOs will only deliver monetary value if the price of the Company's

Common Stock increases beyond the grant price after the awards vest. For a discussion of valuation assumptions, see "Note 4. Share-Based Compensation" of the Notes to Consolidated

Financial Statements included in "ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA" of the Company's Fiscal 2011 Form 10-K. The actual number of equity

awards granted in Fiscal 2011 is shown in the "Fiscal 2011 Grants of Plan-Based Awards" table beginning on page 57. Pursuant to applicable SEC Rules, the amounts shown exclude

the impact of estimated forfeitures related to service-based vesting conditions. In addition, in accordance with U.S. generally accepted accounting principles, the fair value of a stock

option, a SAR or a restricted stock unit granted to a retirement-eligible associate will be expensed earlier than a stock option, a SAR or a restricted stock unit granted to an associate who

is not retirement eligible. These amounts do not necessarily reflect the actual value received or to be received by the NEOs.

(2) Represents the aggregate of the performance-based incentive cash compensation for Spring and Fall selling seasons for each individual.

(3) For all NEOs other than Mr. Jeffries, the amounts shown in this column for Fiscal 2011, Fiscal 2010 and Fiscal 2009 represent the above-market earnings on their respective Nonqualified

Savings and Supplemental Retirement Plan balances. Above market-earnings is defined as earnings in excess of 120% of the monthly applicable federal long-term rate (AFR). The AFR

for January 2012 was 3.11%.

For Mr. Jeffries, (i) the amount shown in this column for Fiscal 2011 represents above-market earnings of $147,088 on his Nonqualified Savings and Supplemental Retirement Plan

balance plus the increase in actuarial present value of $1,313,310 in respect of Mr. Jeffries' accumulated benefit under the Chief Executive Officer Supplemental Executive Retirement

Plan; (ii) the amount shown in this column for Fiscal 2010 represents above-market earnings of $3,137 on his Nonqualified Savings and Supplemental Retirement Plan balance plus the

increase in actuarial present value of $730,985 in respect of his accumulated benefit under the Chief Executive Officer Supplemental Executive Retirement Plan; and (iii) the amount

shown in this column for Fiscal 2009 represents above-market earnings of $15,545 on his Nonqualified Savings and Supplemental Retirement Plan balance but does not include the

decrease in actuarial present value of $2,634,611 in respect of his accumulated benefit under the Chief Executive Officer Supplemental Executive Retirement Plan (which decrease was

primarily due to a decrease in the preceding 36-month average compensation, partially offset by a decrease in the discount rate used in the calculation to determine such benefit).

56