Abercrombie & Fitch 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

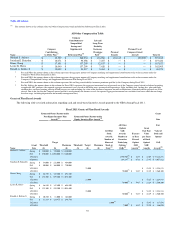

Table of Contents

months ended January 28, 2012. Due to the structure of the SERP, years of service credited are not applicable. Further, Mr. Jeffries received no payments

from the SERP during Fiscal 2011. As a result, columns for years of service credited and payments in Fiscal 2011 are not included in the following table.

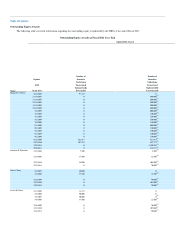

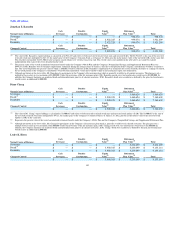

Pension Benefits at End of Fiscal 2011

Name Plan Name

Present Value of

Accumulated Benefit(1)

Michael S. Jeffries Supplemental Executive Retirement Plan $ 14,583,619

(1) The present value of Mr. Jeffries' accumulated benefit under the SERP as of the end of Fiscal 2011 was $14,583,619. The present value of this accumulated benefit was determined based

upon benefits earned as of January 28, 2012, using a discount rate of 4.34% and the 1994 Group Annuity Mortality Table for males. In Fiscal 2011, the Company recorded an expense of

$1,313,310 in conjunction with the SERP due to an increase in Mr. Jeffries' preceding 36-month average compensation, and a decrease in the discount rate used in the calculation. More

information on the SERP can be found in "Note 18, Retirement Benefits" of the Notes to Consolidated Financial Statements included in "ITEM 8. FINANCIAL STATEMENTS AND

SUPPLEMENTARY DATA" of the Company's Fiscal 2011 Form 10-K.

Nonqualified Deferred Compensation

The Company maintains the Nonqualified Savings and Supplemental Retirement Plan for associates, with participants generally at management levels

and above, including the NEOs. The Nonqualified Savings and Supplemental Retirement Plan allows a participant to defer up to 75% of base salary each year

and up to 100% of cash payouts to be received by the participant under the Company's Incentive Plan. The Company will match the first 3% that the

participant defers on a dollar-for-dollar basis plus make an additional matching contribution equal to 3% of the amount by which the participant's base salary

and cash payouts to be received under the Company's Incentive Plan (after reduction by the participant's deferral) exceed the annual maximum compensation

limits imposed on the Company's 401(k) Plan (the "IRS Compensation Limit"), which was $245,000 in calendar 2011. The Nonqualified Savings and

Supplemental Retirement Plan allows for a variable earnings rate on participant account balances as determined by the committee which administers the

Nonqualified Savings and Supplemental Retirement Plan. The earnings rate for all account balances was fixed at 4.5% per annum for Fiscal 2011. Participants

are 100% vested in their deferred contributions, and earnings on those contributions at all times. Participants become vested in Company bi-weekly matching

contributions and earnings on those matching contributions ratably over a five-year period from date of hire.

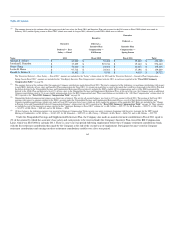

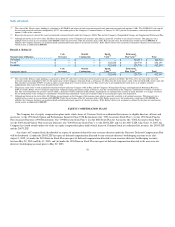

The following table provides information regarding the participation by the NEOs in the portion of the Nonqualified Savings and Supplemental

Retirement Plan providing for participant deferral contributions and Company matching contributions, for Fiscal 2011.

Nonqualified Deferred Compensation for Fiscal 2011 — Executive Contributions and Company Matching Contributions

Name

Executive

Contributions

in Fiscal 2011

($)(1)

Company

Contributions

in Fiscal 2011

($)(2)

Aggregate Earnings

in Fiscal 2011

($)(3)

Aggregate

Withdrawals/

Distributions

($)

Aggregate

Balance as of

January 28,

2012(4)

Michael S. Jeffries $ 134,100 $ 188,166 $ 277,629 $ — $ 6,452,492

Jonathan E. Ramsden $ 576,140 $ 68,889 $ 33,577 $ — $ 903,044

Diane Chang $ 135,146 $ 99,340 $ 77,609 $ — $ 1,879,571

Leslee K. Herro $ 139,269 $ 99,340 $ 130,670 $ — $ 3,087,878

Ronald A. Robins Jr. $ 26,722 $ 23,900 $ 3,191 $ — $ 96,326

63