Abercrombie & Fitch 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• Clawback Policy — Each of the plans pursuant to which annual and long-term incentive compensation may be paid to the Company's executive

officers includes a stringent "clawback" provision, which allows the Company to seek repayment of any incentive amounts that were erroneously

paid, without any requirement of misconduct on the part of the plan participant.

• Derivatives and Hedging Policy — The Company prohibits associates (including the NEOs) and directors from engaging in hedging transactions

with respect to any equity securities of the Company held by them.

Compensation Objectives

The Company operates in the fast-paced and highly-competitive arena of specialty retail. To be successful, the Company must attract and retain key

creative and management talents who thrive in this environment. The Company sets high goals and expects superior performance from these individuals. The

Company's executive compensation structure is designed to support this culture. As such, the Company's executive compensation and benefit programs are

designed to:

• Drive high performance to achieve financial goals and create long-term stockholder value;

• Reflect the strong team-based culture of the Company;

• Provide compensation opportunities that are competitive with those offered by similar specialty retail organizations and other companies with which

the Company competes for high caliber executive talent;

• Be cost-efficient and fair to associates, management and stockholders; and

• Be effectively communicated to and understood by program participants.

Elements of Compensation Program

The Company's compensation program consists of the following elements:

• Base Salary — fixed pay that takes into account an individual's role and responsibilities, experience, expertise and individual performance;

• Annual Incentive Compensation Performance Plan — variable pay that is designed to reward the attainment of short-term business goals, with target

award opportunities expressed as a percentage of base salary;

• Long-Term Incentive Program — stock-based awards tied to retention and increases in stockholder value over longer periods of time, and intended

to align the interests of associates to those of stockholders; and

• Benefits — additional programs offered to attract and retain capable associates.

Fiscal 2011 Compensation Actions

Compensation for Fiscal 2011 related to Mr. Jeffries

Under the 2008 employment agreement, the CEO's compensation program is structured so that a large majority of his compensation depends on the

Company's ability to grow and sustain total stockholder return. The CEO only earns performance-based semi-annual equity awards if the market price of the

Company's Common Stock during each semi-annual measurement period increases beyond that during any previous semi-annual measurement period since

December 2008, adjusted for cash dividends, and then only to the extent that the value created exceeds any cash compensation paid to or earned by the CEO

and any increase in the CEO's pension benefits accrued with respect to the semi-annual period to which the grant relates.

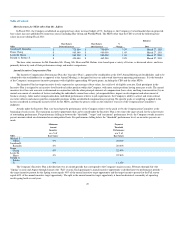

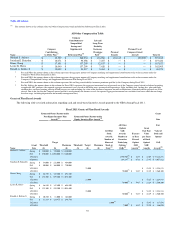

The "Fiscal 2011 Summary Compensation Table" on page 56 shows Fiscal 2011 total compensation for Mr. Jeffries of $48,069,473. Of this total,

$43,201,893 reflects the grant date fair value of the March and September semi-annual SAR grants discussed below. In order for Mr. Jeffries to realize this

amount, the price of the Company's Common Stock must appreciate substantially above the exercise prices of the SARs as shown in the chart on page 43.

47