Abercrombie & Fitch 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• Providing greater transparency to the Compensation Committee's decision-making process, including additional information about the performance

criteria used to determine the size of other equity grants that include only time-based vesting requirements;

• Revising our compensation peer group to put the Company closer to the median of the group in terms of sales and to implement other changes based

on size, business focus and location;

• Reconstituting the Compensation Committee, which is now comprised entirely of directors who were not on the Board in December 2008, when the

Company entered into the current CEO employment agreement; and

• Hiring a new independent compensation consultant who reports directly to the Compensation Committee, as did the prior consultant.

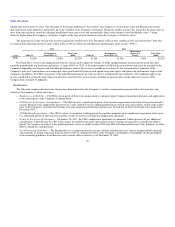

What's New for Fiscal 2012

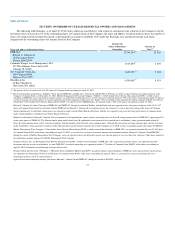

Since the 2011 Annual Meeting of Stockholders, the Compensation Committee has responded to our dialogue with investors and evolving

compensation practices and changed its approach to long-term incentives. During Fiscal 2011, as noted above and described in the "Fiscal 2011 Grants of

Plan-Based Awards" table on page 57, the Company granted Executive Vice Presidents time-vested SARs and performance-based restricted stock units that

will vest over time, but only if the Company's adjusted non-GAAP net income is positive. In Fiscal 2012, the Company has added performance shares as a

third component to the long-term incentive program. Over time, the Compensation Committee expects the proportion of performance shares to increase

relative to the total long-term incentive opportunity of NEOs.

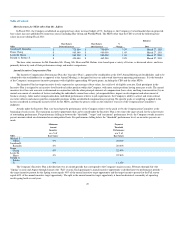

Set forth below is a summary of the vesting requirements for the three components of the long-term incentive program:

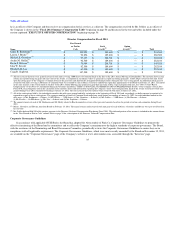

Component Performance Criteria Time Vesting

Performance Shares

Fiscal 2012 adjusted diluted EPS growth of 5% to 20% and positive adjusted non-GAAP net

income in Fiscal 2013 and Fiscal 2014

33% per year beginning on the

first anniversary of grant

SARs

Stock price appreciation above the exercise price

25% per year beginning on the

first anniversary of grant

Performance-based

Restricted Stock Units

("RSUs") Positive adjusted non-GAAP net income over the four-year vesting period

25% per year beginning on the

first anniversary of grant

In addition to adding performance shares, the Company previously had committed to stockholders to provide greater transparency to the Committee's

decision-making process, including additional information about the criteria used to determine the size of NEO equity grants. Accordingly, set forth below is

enhanced disclosure about the decision-making process for NEO equity grants.

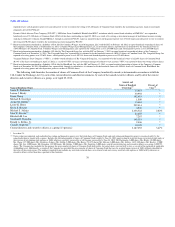

Target long-term incentive award levels are set by position level based on the Company's assessment of what is required to attract and retain critical

talent as well as information on compensation levels paid for comparable positions within the compensation peer group identified on page 53 and industry

survey data. The target long-term incentive award levels are expressed in terms of fixed numbers of shares that have not changed

45